Beginning Ranchers Might Consider Leasing Cows

(Click the image below to view a high-resolution image that can be downloaded)

Declining numbers of farmers and ranchers and the increasing age of those who remain in the business are fueling the call to bring in and train young farmers and ranchers.

That has resulted in the development of programs to facilitate and promote arrangements between retiring and aspiring young farmers. But even with such programs, including government-backed loans to new farmers, this is problematic because the competition from expanding farms for land can be fierce.

“Finding opportunities for new players amid the consolidation into much larger but fewer farms driven by recent profitability, new technology and risk protection policies is challenging,” says John Dhuyvetter, area Extension livestock specialist at North Dakota State University’s North Central Research Extension Center near Minot. “The reality is that getting started is as difficult as ever, with the exception of the next generation of families currently established with large, successful operations.”

With soaring land prices, the high cost of equipment and breeding stock, and escalating operating costs, startup operations will have a limited opportunity to own high-capital-cost assets. When ownership isn’t possible, leasing will be more likely. Leasing agricultural land is common, and for most farmers and ranchers, the majority of acreage they operate is leased. However, most cattle assets traditionally are owned or lender-financed.

Leasing cattle may be an option. Leasing allows a rancher to gain a herd of stock cows and generate income when investing and borrowing to buy cows may not be feasible or desired. A cow owner who leases cows to someone else eliminates the responsibility for caring for the herd while retaining an income-earning asset.

“With high-cost breeding stock and larger herd sizes, interest in leasing cows is being explored,” Dhuyvetter says. “The cattle industry is smaller than in the past and smaller than it probably should be. Widespread drought has been a major driver of this trend, coupled with higher feed prices and profitability in the farming sector. Older existing ranchers may be less inclined to rebuild or expand, creating opportunities for young ranchers as forage conditions improve.”

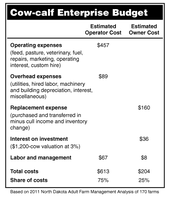

Historically, most cow leases were on a share basis. Financial experts recommend an equitable split of calves that is in proportion to contributed costs. For example, the owner contributes cow ownership costs (interest on investment, normal death loss, depreciation) and the operator provides all the operating costs (feed, yardage, care and health). A budgeting spreadsheet is available through the NDSU Extension Service at http://www.ag.ndsu.edu/livestockeconomics/Budgets. This spreadsheet can help document costs and calculate contributions.

More recently, cow owners seem to be using cash cow leases. Under these leases, the operator agrees to pay the owner an annual cash payment per cow for a set period (usually one to three years). The operator is expected to provide all care and inputs, and he or she earns the calves produced to market them in a way that returns the best profit possible.

“The possibilities for a win-win situation exist,” Dhuyvetter says. “The young rancher gets started in the business using someone else’s cows while conserving his borrowing ability for other needs. Provided costs can be controlled and the income of cattle great enough, sufficient revenue is generated to leave a return to his labor and management. The retiring or absentee cow owner earns a retirement income, continues to have some involvement and creates alternatives to phaseout.”

However, such leases can turn into a lose-lose situation because of factors such as improper cow management, poor production, high death loss, excessive costs and low market prices, he warns. Other problems can include inequitable leases in which the operator or owner feels unfairly treated.

“Communication of expectations is critical,” Dhuyvetter says. “For the most part, the devil is in the details, and to be successful, the lease should address cow care, animal identification, death loss, culling, replacement, marketing, etc., in addition to terms and rates.”

While a cow lease may be whatever two parties agree on and will be unique to a particular situation, here are some suggestions for developing a successful lease agreement:

- Plan and budget to explore equitability and feasibility.

- Make sure the person you’re working with is a good fit.

- Put the terms of the lease, including termination date and procedure, in writing.

- Specify how animals will be identified (include brand) and annually inventoried.

- Leave bull ownership to the operator and keep breeding dates standard.

- Allow the operator to cull as needed up to a limit, with culling income as part of the owner’s return.

- Develop or purchase replacements externally from the lease.

- Create a separate contract for leased land, machinery or special services, as calf backgrouding.

- The owner accepts a normal death loss with compensation for excess.

- Provide for notification when issues arise and opportunities for inspection.

NDSU Agriculture Communication - Feb. 15, 2013

| Source: | John Dhuyvetter, (701) 857-7682, john.dhuyvetter@ndsu.edu |

|---|---|

| Editor: | Ellen Crawford, (701) 231-5391, ellen.crawford@ndsu.edu |