N.D. Cropland Rents and Values Increase Modestly

(Click an image below to view a high-resolution image that can be downloaded)

Despite the recent commodity price rallies and ad hoc government payments to farmers across North Dakota, farmland values and rents have been reluctant to change.

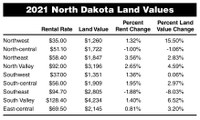

Relative to 2020, farmland values across the state are up a modest 1.74% while cropland cash rents are up 0.77%, according to data collected by the North Dakota Department of Trust Lands Survey found online at https://www.land.nd.gov/resources/north-dakota-county-rents-prices-annual-survey.

“This comes after 2020’s surveys showed statewide cropland rents had fallen 0.42% while land values went up slightly, 1.73%,” says Bryon Parman, North Dakota State University Extension agricultural finance specialist.

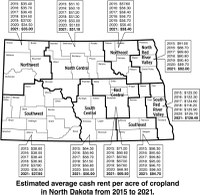

With respect to rents, NDSU county regional groupings showed surprising consistency across regions, he adds. Only two regions, the north-central and the southeast, showed any decline, at 1% and 1.88%, respectively.

“Although that is technically a decline, it is still not dramatically far off the state average of 0.77% growth and easily explained by data noise,” Parman says.

The two largest percentage changes of cash rents in any direction were in the northeast region, showing 3.56% growth, and the northern Red River Valley, showing 2.65% growth. Regions with a percentage growth between 1% and 2% were the northwest, at 1.32%, the southwest, at 1.36%, the south-central, at 1.95%, and the southern Red River Valley, at 1.4%. The east-central region data showed a slight increase of 0.81%.

Overall, rent data into 2021 indicated this was one of the more consistent years, lacking the wild swings shown between regions in previous years’ data. For instance, in 2019, data from the Trust Lands Survey grouped into NDSU regions had a decline in the north-central region of 2.5% and an increase in the northern Red River Valley of 11.86%.

Still, state average rental rates have shown a modest trend upward, with average dollar-per-acre rents increasing from $65.80 per acre in 2018 to $69.10 in 2021. However, the high-water mark for the statewide average cash rental rate occurred six years ago in 2015, with an average of $70.40 per acre.

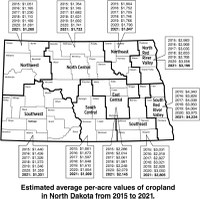

Land value data grouped into NDSU regions did not display the consistency that rental data did across the state. The northwest region data showed an increase of 15.5% while the southeast region showed a decline of 8.03%. Other than the north-central region, which also showed a decline of 1.06%, the remainder of the regional data showed small to moderate increases.

The southwest showed almost no change, at an increase of 0.06%, while the northeast and south-central increased nearly 3%. The east-central increased 3.2% while the northern Red River Valley increased 4.59%. Next to the northwest region, the southern Red River Valley data showed the next highest increase at 6.52%.

Since 2018, land values have inched upward at 1.6%, 1.73% and 1.74% in 2019, 2020 and 2021, respectively. While regional swings in land values may occur as a result of data noise and challenges in getting representative samples in certain counties, the statewide average data have been much more consistent.

Since 2015, the largest statewide average movement was a decline in 2016 of 3.95%. Otherwise, the changes are less than 2% in any direction.

The highest statewide land value achieved for North Dakota cropland was in 2014, with an average of $2,313 per acre. Following 2014, statewide cropland values dipped to $2,146 per acre in 2018 and have steadily increased since, although modestly. The 2021 data show a statewide average cropland value of $2,274 per acre, which is below the highest year posted in 2014 and about at the same levels as 2013 and 2015.

When looking at the six- or seven-year trends, land values and cash rents have remained mostly static. Some yearly dips and increases have occurred in both, and some wild swings from region to region (explained at least somewhat by data noise) have occurred, but when viewed on a longer time horizon, things have mostly moved sideways.

“This is especially important for land values because land purchases are typically a much longer-term commitment than a cash rental agreement,” Parman says. “An implication here is that those who purchased farmland from 2014 to 2016 on average have realized little or no capital gain on those purchases.”

NDSU Agriculture Communication - April 14, 2021

Source: Bryon Parman, 701-231-8248, bryon.parman@ndsu.edu

Editor: Ellen Crawford, 701-231-5391, ellen.crawford@ndsu.edu