N.D. Pastureland Values Up 7 Percent

(Click an image below to view a high-resolution image that can be downloaded)

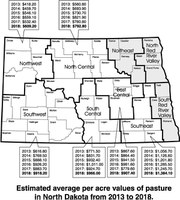

North Dakota pastureland values are up approximately 7 percent, and rents are up nearly 2 percent based on the 2018 County Rents and Prices Report funded by the North Dakota Department of Trust Lands.

“The survey, conducted in February and March of 2018, contains observations from 2017,” says Bryon Parman, North Dakota State University Extension agricultural finance specialist. He used the county averages to develop the NDSU crop budget regional averages.

Parman notes, “The northern Red River Valley, southern Red River Valley and northeastern counties of Nelson, Ramsey, Towner and Cavalier are not included in this report, nor are their responses included in the state average due to relatively few survey responses and pasture acres.”

In North Dakota, pastureland values have gained every year from 2013 to 2018, with the exception of 2017. Percentagewise, North Dakota pastureland increased double digits year to year from 2013 to 2015, appreciating 12.5 percent, 15 percent and 12.5 percent respectively.

“Despite a decline of nearly 7 percent in 2017, pastureland increased approximately 6 percent in 2016 and 6.75 percent heading into 2018,” says Parman. “The only year since 2013 where any regional average sales value declined (to varying degrees) was 2017, when all accounted-for regions declined in sales value. Overall, since 2012, North Dakota pastureland is up 54 percent from an average of $576 per acre in 2012 to $886 per acre in 2018.

“The pastureland movements regionally were all upwards, similar to state pastureland value movements; however, the magnitude of the movements from region to region differs,” he says.

The east-central, northwestern and southeastern regions saw double-digit appreciation of 16.5 percent to $907 per acre, 14.5 percent to $609 per acre and 11 percent to $1,384 per acre, respectively. The southwestern and north-central regions increased approximately 4 percent, up to $918 per acre in the southwest and $792 per acre in the north-central, while the south-central district increased 4.5 percent to $966 per acre.

“For the most part, the east-central, north-central, south-central and southwestern regions are valued relatively close to the state average in 2018, with none being much more than $100 per acre above or below the average for the state,” Parman says. “However, pastureland values in the southeastern region are nearly $500 per acre above the state average, while the northwestern region is almost $280 per acre below.”

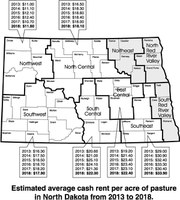

Cash Rents

Pasture rents across North Dakota have been less persistent regionally, while statewide average rents mostly have mirrored land values.

The state average pasture rent for North Dakota has held steady or moved upward every year since 2013, with the exception of 2017, when statewide average pasture rents dropped 6 percent. Moving into 2018, rents inched upward nearly 2 percent to $17.40 per acre.

The east-central and southwest were the only two regions to post declining pasture rental rates heading into 2018. The southwest declined 1.5 percent to $17.90 per acre, or $27.10 per animal unit month (AUM).

The east-central region reported a decline in rent of approximately 3 percent to $22.40 per acre or $31.50 per AUM. However, the last three years for these two regions have been fairly steady, moving less than $1 per acre in any direction.

The southeastern and northwestern regions showed the largest change in rental rates, with the southeastern region increasing 11 percent and the northwest increasing 8 percent. Pasture cash rent in the southeast moved from $30.40 per acre to $33.90 per acre, or $47.70 per AUM, in 2018. The northwestern region increased from $10.70 per acre in 2017 to $11.60 per acre in 2018, which gives an approximate cost of $17.60 per AUM.

Pasture rental rates in the southcentral region increased 3.6 percent in 2018, after declines of approximately 12 percent and 4 percent in 2017 and 2016, respectively, while the north-central region mostly held steady for the fourth year in a row.

The cash rent for the south-central region is reported at $22 per acre, yielding a cost of $33.40 per AUM.

Cash pasture rents for the north-central region have remained between $18.60 and $18 per acre since 2014, with the 2018 survey showing an average cash rent in the region of $18.10 per acre, or $25.40 per AUM.

Analysis

Lower beef cattle prices, following the record-setting year of 2014, have not diminished pastureland values across North Dakota.

Parman says, “Statewide, average pastureland values increased 12.5 percent in 2013, 15 percent in 2014 and 12.5 percent in 2015, and continue to climb. However, other states and regions have seen a slow decent, or at least a much more modest appreciation in the years since beef prices set nominal records.

“North Dakota pasture rents, on the other hand, have walked back a little from the statewide average high of $18.20 per acre from 2015 to 2016, down to $17.40 per acre in 2018,” Parman says. They do, however, remain higher than they were before the cattle market price spike in 2014, when statewide rents averaged $15.80 per acre.”

Parman concludes, “It is unlikely that lower cattle prices in the summer of 2018, with market prices around $110 per hundredweight (cwt) for live cattle and around $150 per cwt for feeder cattle, will impact pastureland values much as we move into 2019. The trend for pastureland values has been upward; it is likely that it will continue statewide next year, albeit possibly more gradually if current market prices hold.

“Rents, on the other hand, may react more quickly to lower market prices; however, drought activity across the state may play a bigger role,” he says. “If regional drought forces ranchers to sell cattle, fewer grazing animals’ means lower demand for rented acres.

“However, modest drought may find ranchers looking for more grass to support cattle that remain, driving rental contracts higher,” he adds. “Moderate to severe droughts can take multiple years to recover from, affecting multiyear contracts and rancher cattle-inventory decisions. Therefore, it would make sense that NDSU regions less affected by drought will see higher pasture rents moving into 2019, while moderate to severe drought-affected areas might see average rents begin falling.”

To learn more about ways to calculate pasture rental rates including renting by the AUM or renting by the acre, visit the NDSU Extension publication “Determining Pasture Rental Rates (R1810)” at http://bit.ly/PastureRentalRates.

NDSU Agriculture Communication – June 21, 2018

| Source: | Bryon Parman, 701-231-8248, bryon.parman@ndsu.edu |

|---|---|

| Editor: | Kelli Anderson, 701-231-6136, kelli.c.anderson@ndsu.edu |

Attachments

- PDF - Estimated average cash rent per acre of pasture in North Dakota from 2013 to 2018. - (401.041015625 kb)

- EPS - Estimated average cash rent per acre of pasture in North Dakota from 2013 to 2018. - (1023.9189453125 kb)

- PDF - Estimated average per acre values of pasture in North Dakota from 2013 to 2018. - (401.3037109375 kb)

- EPS - Estimated average per acre values of pasture in North Dakota from 2013 to 2018. - (1066.0380859375 kb)