Think Twice Before Cutting Input Costs

(Click an image below to view a high-resolution image that can be downloaded)

Is net profit per acre for crop production impacted more by yield, price or costs?

“When operating margins are strong, as was the situation for several years prior to 2013, this concern seldom came to mind,” says Dwight Aakre, North Dakota State University Extension Service farm management specialist. “There were adequate returns to cover rising costs and minor yield reductions because commodity prices were strong and still rising.”

Since grain prices peaked in 2012, the price for wheat and soybeans has declined by 40 percent and the price of corn has been cut in half. At the same time, costs have declined very little.

“Thus, most farm operators are struggling with the cost price squeeze and are looking for ways to deal with it,” Aakre says. “The typical first response is to cut costs. Cutting costs will be a necessary part of the strategy to survive this financial squeeze, yet producers need to be careful where they cut lest they make the cash flow situation worse.”

He adds, “We need to understand the differences in the costs incurred in producing a crop.”

One way to look at costs is to determine if a cost is fixed or variable. Fixed costs are difficult to alter in the short term without disrupting the business. Costs associated with ownership of assets, such as machinery, buildings and land, make up the majority of fixed costs on most farms.

Variable costs are items used up in the production of a crop within the crop year. Common variable costs include seed, fertilizer, pesticides, fuel, repairs, crop insurance, drying and operating interest. The easiest costs to reduce are variable costs.

Another way to look at costs is whether a cost contributes directly to yield, either enhancing yield or saving yield potential. The expenditures meeting this criteria are seed, fertilizer and pesticides. These are the costs that are the easiest to reduce, but cutting these costs often results in reduced yield potential, possibly making the cash flow situation worse.

What is the importance of yield, price and costs in determining net profit? Farm and Ranch Business Management Education record summaries for the Red River Valley from 2005 to 2014, were examined to shed some light on this question.

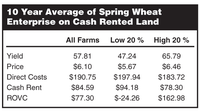

A spring wheat enterprise on cash-rented land was analyzed. The 10-year average yield, price, direct costs and land rent were summarized for all farms, including the 20 percent most profitable farms and 20 percent least profitable farms.

Return over variable costs (ROVC) is yield times price minus direct costs and cash rent. The average for all farms was $77.30 per acre per year, but the real story is in the difference between high-and-low profit groups.

The low-profit farms were $24.26 short of paying for direct costs and cash rent. This shortfall had to be made up from other farm enterprises, or nonfarm income or credit. The high-profit farms generated enough cash per acre to cover all direct costs and land rent, and still had $162.98 left to make principal and interest payments on machinery debt and provide for family living.

The records clearly show that yield, price, direct costs and cash rent all contributed to the difference in profitability between the low 20 percent and high 20 percent of farms enrolled in this educational program.

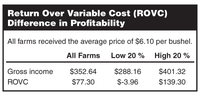

The next step was to look at the ROVC for the different groups if the average price received for all farms was applied to the high-profit and low-profit farms. This reduced the gross income and ROVC for the high-profit farms and raised the gross income and ROVC for the low-profit farms.

The results show the low-profit farms improved only slightly, still not covering direct costs and cash rent, and leaving nothing left to pay principal and interest payments on machinery debt and family living. On the other hand, while the high-profit farms would have received a reduction in income of nearly $24 per acre, they still had $139 per acre ROVC.

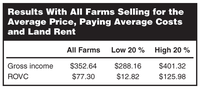

If all farms sold for the same price, spent the same for direct costs and paid the same for land rent, would there still be a significant difference in operating profit as measured by the ROVC?

Equalizing selling price, direct costs and land rent leaves only yield remaining to account for the difference in the ROVC. Yield alone accounted for a $113 per acre difference in the ROVC and therefore, net profit per acre between the farms in the lowest 20 percent and farms in the highest 20 percent.

“Yield will always be the primary determinant of profitability,” Aakre says. “Certainly direct costs, market price and land rent impact profitability as well, but this analysis suggests that all of these factors together do not equal the impact that yield has on the bottom line.

“The economic environment faced by farmers in 2016 makes it imperative that any plans to reduce costs must first be evaluated on whether or not they will impact yield,” Aakre says. “You cannot afford to lose yield in 2016. This year will be a cash flow challenge for many producers, but don’t make it worse by making short-sighted decisions on yield-enhancing inputs.”

Aakre adds, “Most difficult financial situations arise from taking on too much term debt on land and machinery. These obligations are incurred during good times and are feasible as long as those conditions last. But when markets turn down, there is considerably less cash flow to service this debt load.”

NDSU Agriculture Communication - March 18, 2016

| Source: | Dwight Aakre, (701) 231-7378, dwight.aakre@ndsu.edu |

|---|---|

| Editor: | Kelli Armbruster, (701) 231-6136, kelli.armbruster@ndsu.edu |

Attachments

- PDF - 10 Year Average of Spring Wheat Enterprise on Cash Rented Land - (18.30859375 kb)

- EPS - 10 Year Average of Spring Wheat Enterprise on Cash Rented Land - (215.1025390625 kb)

- PDF - Return Over Variable Cost (ROVC) Difference in Profitability - (18.7880859375 kb)

- EPS - Return Over Variable Cost (ROVC) Difference in Profitability - (215.9208984375 kb)

- PDF - Results With All Farms Selling for the Average Price, Paying Average Costs and Land Rent - (17.9921875 kb)

- EPS - Results With All Farms Selling for the Average Price, Paying Average Costs and Land Rent - (213.0908203125 kb)