Historic Increase in N.D. Land Value Ends

(Click an image below to view a high-resolution image that can be downloaded)

Last year, it was apparent that the strongest sustained runup in North Dakota cropland values during the past 100 years was coming to an end, according to Andrew Swenson, North Dakota State University Extension Service farm management specialist.

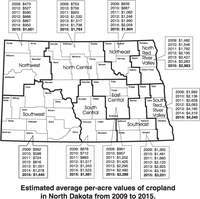

This was confirmed by a recent survey that indicates average cropland values dropped slightly (0.6 percent) during 2014. Swenson’s estimate is derived from the published results of a January 2015 county survey commissioned by the North Dakota Department of Trust Lands.

During an 11-year period (2003 through 2013), cropland values averaged annual increases of 15 percent. The strongest increase, 42 percent, occurred during 2012. The main causes were crop profitability, driven by very strong grain prices and good yields, and low interest rates.

Cropland values (January 2014 to January 2015) still were strong in western North Dakota but were weaker in the east. The largest increases in cropland values per acre were 13 percent (to $1,440) in the southwestern region, 11 percent (to $1,051) in the northwestern region and 9 percent (to $1,051) in the south-central region.

Cropland values per acre were essentially flat in the north-central region ($1,764) and the southern Red River Valley ($4,340). Cropland values declined by 5 percent (to $3,031) in the southeastern region and declined 7 to 9 percent in the northeastern region (to $1,904), east-central region (to $2,286) and northern Red River Valley (to $2,983).

The profitability of crop production had become precarious because of a doubling in per-acre production costs during the past decade. Lower grain prices in 2013 and 2014 pushed producers toward or below the cost of production.

The impact has been particularly evident on corn and sugar beet crops, which averaged negative returns on cash rented ground in 2013 and 2014, according to farms enrolled in the North Dakota Farm Business Management Education program. Returns to wheat declined dramatically but generally have stayed positive because of record yields the past two years. The average soybean profit dropped from more than $200 per acre in 2012 to almost $20 per acre in 2014 on cash-rented ground.

Last year, several factors helped keep land values strong in western North Dakota. There were good yields and prices for crops such as durum wheat and field peas. Also, crop producers in the western part of the state are more likely to be diversified with a beef cow-calf enterprise, which experienced record profits. Lastly, income associated with the region’s energy development have provided funds for investment.

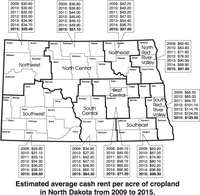

“Although the cropland value, on average, was flat, the survey indicated that cropland rents increased an average of 2.6 percent from January 2014 to January 2015,” Swenson says. “Land rents have typically lagged behind land values.”

The largest increases were 7 percent (to $64.30) in the south-central region and 6 percent (to $71.20) in the east-central region. Cropland rents increased about 2 percent in most regions, which include the northwestern region (to $35.40), north-central region (to $51.10), northeastern region (to $57.60), northern Red River Valley (to $91), and southeastern region (to $98.30). Cropland rents increased 1 percent (to $125.50) in the southern Red River Valley and were flat at $38.60 per acre in the southwestern region.

Will there will be a sharp drop in land values similar to what happened after 1981? That was the last time there was a sustained multiyear runup on cropland values.

“That is the major question going forward,” Swenson says. “So far, it has been a soft landing, which we may be able to sustain unless crop prices continue to decline and/or interest rates rise. Another risk is if we have mediocre to slightly poor yields.”

The impact of large-yield shortfalls would be mitigated by crop insurance. Also, the implementation of the 2014 farm bill should provide some assistance if crop revenue declines substantially. Projected crop budgets for 2015 are challenging and, although there always is interest in land, producers and their lenders have become cautious. Therefore, Swenson believes cropland rents will decline next year and cropland values could decline in the range of 3 to 8 percent.

Swenson cautions that the values and rents are averages for large multicounty regions. Prices can vary considerably within a region because of soil type, drainage and location.

NDSU Agriculture Communication – April 10, 2015

| Source: | Andrew Swenson, (701) 231-7379, andrew.swenson@ndsu.edu |

|---|---|

| Editor: | Rich Mattern, (701) 231-6136, richard.mattern@ndsu.edu |