Wall Street Problems Will Have Minimal Impact on 2009 N.D. Agricultural Credit

(Click an image below to view a high-resolution image that can be downloaded)

North Dakota agricultural credit will be available and reasonably priced in 2009 despite all the recent turmoil on Wall Street. That is the conclusion of a recent poll of 300 participants who attended North Dakota State University’s annual agricultural lenders conferences in Grand Forks, Minot, Bismarck and Fargo.

During the conference, Cole Gustafson, NDSU Department of Agribusiness and Applied Economics professor, collected lenders’ anonymous reactions to several statements using a new audience response system.

“In many other sectors of the economy and geographic locations, credit markets have come to a standstill and financing is extremely difficult to obtain,” Gustafson says. “We were concerned that North Dakota farmers and ranchers may have difficulty financing their operations next year.”

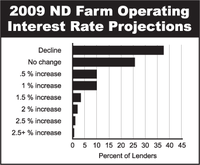

He asked lenders to specify how much 2009 interest rates on operating credit would change from 2008. Forty percent of the lenders expected rates at their financial institution to decrease from 2008 levels. Many lenders felt that agricultural interest rates would trend lower following the Federal Reserve’s recent efforts to ease monetary policy and lower interest rates across the economy. Twenty-nine percent of the lenders felt interest rates would remain steady. Only one-third of the lenders expect an increase, but the vast majority of that group felt rates would increase less than 1 percent (100 basis points).

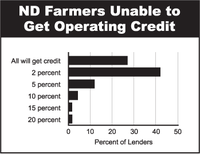

“Lenders were not quite so optimistic about credit availability,” Gustafson says. “About one-third of the lenders expected all of their 2008 customers to obtain credit next year. However, nearly half (46 percent) of the lenders expected to deny 2009 credit to about 2 percent of their customers who received financing in 2008. Sixteen percent of the lenders estimated that 5 percent of their previous customers would be unable to qualify for 2009 credit.”

There was considerable regional variation in lenders’ responses, especially from north to south. Northern lenders were more optimistic that existing customers would receive credit in 2009. Part of the explanation is new income from oil and wind lease arrangements. In the southern regions, recent layoffs in Gwinner and poor crops in the southwestern region were contributing factors.

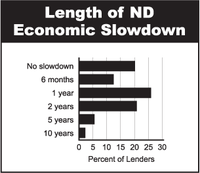

Lenders were asked to estimate how long North Dakota would take to recover from any slowdown. More than one-third of the lenders felt North Dakota’s economy wouldn’t slow down at all or, if it did, the state would recover in less than six months. More than half of the lenders estimated that the state’s economy would take one or two years to rebound. Only a few expected a long-term impact by saying economic troubles would last five years or more. Again, considerable variation existed regionally, with the northern lenders expecting a quicker recovery.

Gustafson says he is encouraged by these results. However, he urges all farmers and ranchers to contact their lender and initiate financial planning for the 2009 season.

NDSU Agriculture Communication

| Source: | Cole Gustafson, (701) 231-7096, cole.gustafson@ndsu.edu |

|---|---|

| Editor: | Rich Mattern, (701) 231-6136, richard.mattern@ndsu.edu |

Attachments

- PDF - 2009 ND Farm Operating Interest Rate Projections - (15.2900390625 kb)

- EPS - 2009 ND Farm Operating Interest Rate Projections - (243.046875 kb)

- PDF - ND Farmers Unable to Get Operating Credit - (14.5546875 kb)

- EPS - ND Farmers Unable to Get Operating Credit - (171.94921875 kb)

- PDF - Length of ND Economic Slowdown - (14.1689453125 kb)

- EPS - Length of ND Economic Slowdown - (148.470703125 kb)