Renewable Accounts: Liquid Hydrocarbon Limbo

(Click the image below to view a high-resolution image that can be downloaded)

By David Ripplinger, Bioproducts and Bioenergy Economist and Assistant Professor

NDSU Department of Agribusiness and Applied Economics

I thought I had a great plan. I would start the year with an article about gasoline and Bison football, then dedicate this article to my expectations for the bioenergy industry in 2016. Then $28 oil happened.

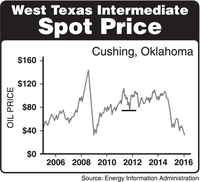

We haven’t seen oil this low in more than a decade, including the financial crisis.

What’s most troubling about the price of oil is not where it is, but where it might go.

Key to the current situation is the concept of support from the field of technical analysis. Technical analysts use past data, especially prices and volumes, to form expectations of the future. It’s the opposite of a common caveat. Technical analysts believe that past results can dictate future performance.

The concept of support is that at certain prices, buyers overpower sellers and disrupt or reverse a downtrend. This support is considered to be a floor. If prices again reach that level, buyers are expected to reappear in large numbers to stop or reverse the fall in price.

For example, West Texas Intermediate oil established a support level in October 2011 at $75 per barrel, got close to the price in June 2012, but didn’t fall through that support level until November 2014.

The current situation is troublesome because oil just blew past its last support level at about $30 per barrel. There are no other support levels below it. A new bottom may be at $28, $20 or even lower.

This liquid hydrocarbon limbo is troubling. There is no technical guidance on how low prices can go. Looking at fundamentals, that is supply and demand, there is little to signal a reduction in production outside the U.S. and demand looks weak.

I think back to my Econ 110 class and Tim Petry saying, “Low prices are the cure for low prices.” While generally true, the current situation, with many running for the door, makes me wonder, “What is the cure for uncertainty?” (Probably a put option.)

NDSU Agriculture Communication - Jan. 20, 2016

| Source: | David Ripplinger, (701) 231-5265, david.ripplinger@ndsu.edu |

|---|---|

| Editor: | Kelli Armbruster, (701) 231-6136, kelli.armbruster@ndsu.edu |