Implications of U.S. and Canadian Beef Cow Inventories

The U.S. Department of Agriculture’s National Agricultural Statistics Service released the annual United States and Canadian Cattle inventory report on March 4, 2021.

Due to North Dakota’s proximity to Canada, comparing beef cow numbers between the two countries is interesting. Inventory numbers for both countries were reported as of Jan. 1, 2021.

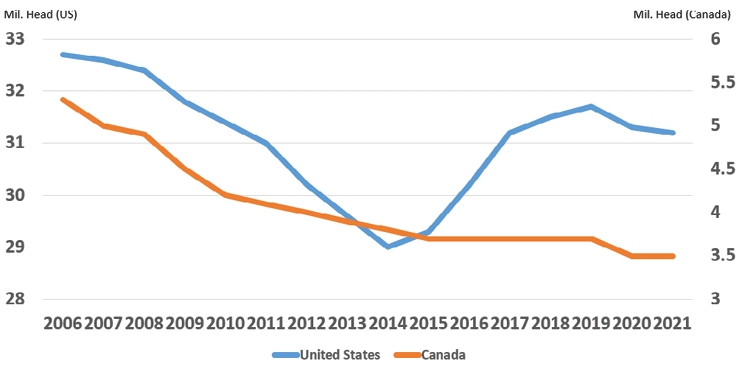

U.S. beef cows on Jan. 1, 2021, at 31.16 million head, were down 181,000 from the 31.34 million on Jan. 1, 2020. That was a cyclical decline of 533,100 head or 1.7% in the past two years, but it followed a 2.7 million head cyclical increase from Jan. 1, 2015 to 2019.

A number of factors led to the decline in U.S. beef cows during 2020. Drought spread into much of the western U.S., including North Dakota. Fewer U.S. beef replacement heifers entered the herd and beef cow slaughter was up 2.5%. Some reports of more than normal open cows and narrowing cow-calf profit margins contributed to the liquidation.

Canadian beef cows on Jan. 1 2021, at 3.53 million head, were down 13,200 head from the 3.54 million on Jan. 1, 2020. That was a decline of 154,700 or 4.2% in the last two years, and it followed the general decline since 2006 shown on the chart. The 2021 number was the lowest since the 3.48 million head in 1990.

Canadian beef cow numbers recorded a record high in 2005 at 5.28 million head. Numbers were high in 2004-2006 due to the discovery of bovine spongiform encephalopathy (BSE) in a Canadian cow in May 2003.

Beef Cow Inventory January 1, United States and Canada, Annual

Prior to BSE, many cull cows were shipped to the U.S. for slaughter. But the U.S. prohibited cow imports after BSE was discovered. That caused very low Canadian cow prices with only limited markets available. So, without a market, many cull cows remained on Canadian farms and ranches.

The V-shaped cyclical U.S. beef cow numbers are evident on the chart. The normal cyclical four-year liquidation from 2006 through 2009 should have ended with 31.7 million head on Jan. 1, 2010.

However, the severe drought in the southern Plains caused an additional four-year forced beef cow liquidation, ending with the Jan. 1, 2014, inventory at just under 29 million head.

Very low beef cow numbers were one reason for record high cattle prices in 2014. Normal rainfall returning to the southern Plains fueled a 2.7 million head cyclical increase back up to 2010 levels by 2019.

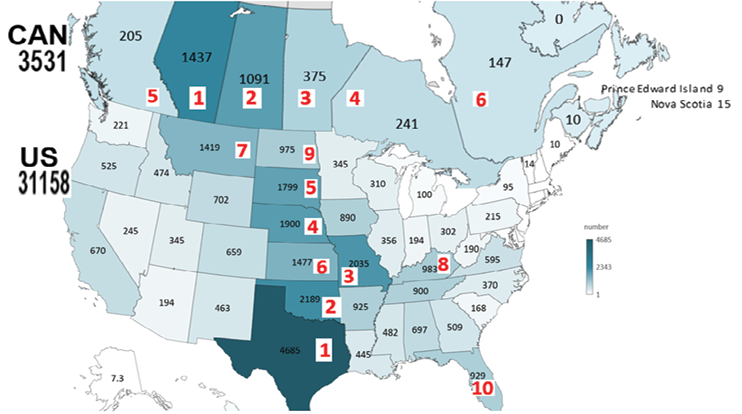

Canada’s beef cow herd is much smaller than in the U.S. For example, on Jan. 1, Texas, the largest beef cow state, had almost 4.7 million beef cows, compared with 3.5 million in Canada. North Dakota, the ninth largest beef cow state, reported 975,000 beef cows, compared with neighboring Manitoba at 375,000, Saskatchewan with 1,091,000 and Alberta, the largest beef cow province in Canada, totaling 1,437,000. Manitoba cow numbers declined about 25,000 head in the past year, with Saskatchewan increasing 17,000.

Beef Cows, January 1, 2021 — 1000 Head

U.S. and Canadian beef cow herds are expected to stabilize in 2021. Beef replacement heifers were up slightly in the U.S. and up 4% in Canada.

However, weather and summer pasture conditions are always the wild card affecting changes in beef cow numbers. Much of the western U.S. is experiencing drought, with about half the beef cow herd in areas with drought conditions. The entire state of North Dakota is in moderate to extreme drought.

Southern Manitoba, Saskatchewan and central Alberta also are experiencing drought conditions.

The Canadian beef cow herd decline and cyclically higher U.S. herd have implications for cattle and beef trade. In 2020, U.S. beef exports to Canada increased 6.7% while imports from Canada declined 2.7%.

To help maintain feedlot capacity in Canada, feeder cattle exports to the U.S. declined 30% in 2020. So far in 2021, Canadian feeder cattle exports are down more than 40%.

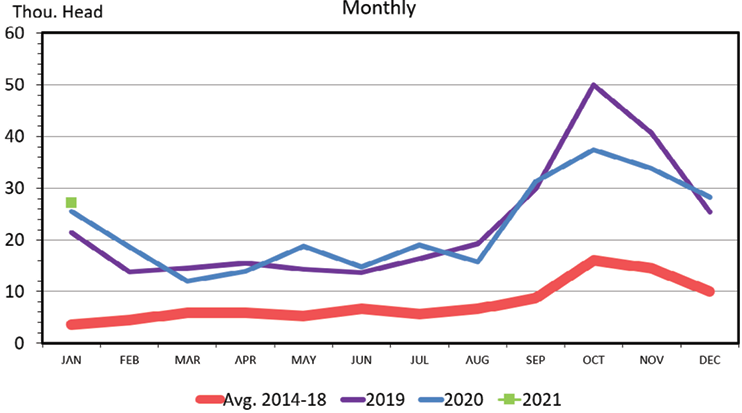

The chart above shows the historically strong U.S. feeder cattle exports to Canada the last several years, especially during the fall calf marketing season. Many of those calves originate in North Dakota, which is supportive to calf prices here. That trend is expected to continue.

-Tim Petry, Extension Livestock Economist