Kids and Money: Keeping Track of Your Money (FE1973, July 2020)

- iStock.com

A newsletter for young people

Keeping Track of Your Money

Money sometimes passes in and out of your hands so quickly that keeping track of it is hard. Keeping track of your money means knowing where it is and how much you have.

Stashing Cash

Where do you keep your money? Do you put it in a piggy bank on top of your dresser? Do you stash it in an envelope in your drawer or put it in a savings account in the bank?

Larger sums of money probably are the safest in a savings account, which will earn some interest to help your total grow. Smaller amounts of money still need to be kept safe in your home. Keep money out of sight. Keep money in something that doesn’t open easily to prevent it from spilling or getting lost.

Recording

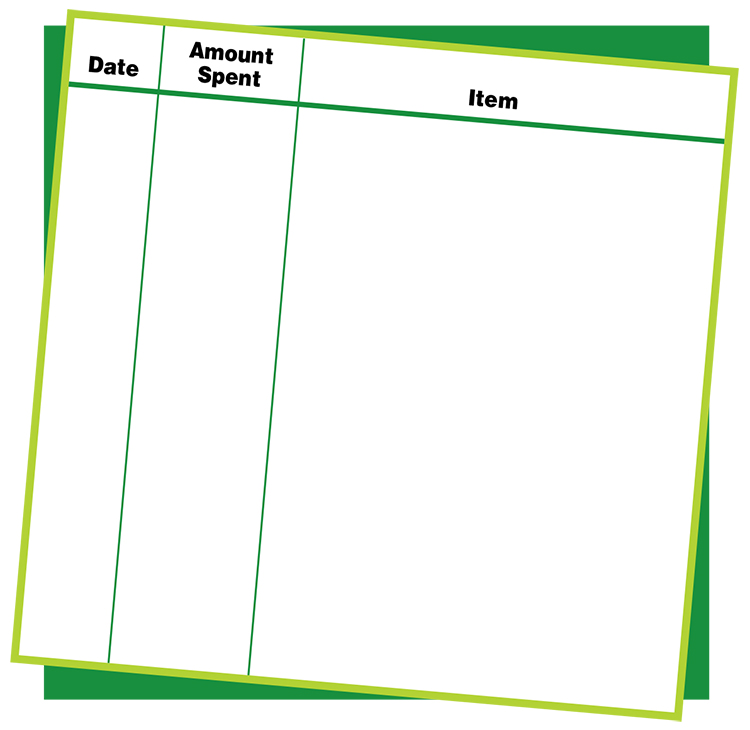

Even though your money may be in a safe place, you won’t know what you have unless you have some record of it. Use a notebook to write down your income and expenses. Under the income column, list the amount you received and where you got it. Under the expense column, list the item and its cost. Putting a date by each is a good idea.

Watching the dollars add up as you write down money under income is fun. It’s also a good way to keep saving for an item you really want. Writing down your expenses is just as important. Otherwise, you may have a lot less money than you thought.

Lending

Lending money to a brother, sister or friend is one way money can slip through your fingers. You will need to decide if you want to loan any of your money. Think about how you will feel if it doesn’t get paid back. Always keep a record of how much you loaned, and when and to whom you gave the money. Then you can cross of the debt when it is paid back.

Activity

1. Ask your parents how much they spend on you in two weeks. Be sure to write down all of the money spent on you, including the money you may spend yourself.

2. You can use this to compare with the family’s income and the household spending in the activity on the other side.

- iStock.com

A newsletter for parents

Keeping Track of Your Money

Spending Plan

A spending plan is another word for budget. It allows a person to plan for upcoming expenses and ensure that money is available to meet those expenses. Helping your child set up a simple plan now can lead the way to more detailed spending plans in the future.

Children learn most money management concepts by observing parents’ behavior. Your attitude toward recordkeeping or following a plan for saving and spending will have a strong influence on your child’s involvement in setting up a recordkeeping and spending plan.

Suggested Activity

Working with your child, estimate income and expenses for a two-week period. Adjust figures to balance the income and expenses. Next, allow your children to compare their spending from the activity on the other side with the household income and spending.

Remember that a fixed expense is something that you pay every month and the amount does not change. Add savings as a fixed expense and pay yourself first every month. A flexible expense is something that you buy every month, but the amount may change, such as groceries or the electric bill. Third, an occasional expense would be something that does not happen every month, such as birthday gifts or car insurance if it is not on a monthly plan.

![]()