Corn Trade Report: Trend and Risk Analysis (EC1993, Dec. 2020)

Availability: Web only

Center for Agricultural Policy and Trade Studies

Agribusiness and Applied Economics

North Dakota State University

Fargo, N.D., 58108

Acknowledgments

The authors express their gratitude to the North Dakota Corn Utilization Council and North Dakota Corn Growers’ Association for their support, suggestions, comments and several days of discussion during the project. Thanks to Ellen Crawford for editorial changes, Deb Tanner for formatting and NDSU Extension publication team. All views expressed in this publication are those of the authors and do not reflect the opinions and interest of the supporting organizations or NDSU.

Glossary

Average/mean - This is the sum of a collection of numbers divided by the count of numbers in the collection.

For past historical data as in this report, this gives an idea of what the producer or decision maker should expect.

BWC - Corn bran, waste and cakes.

Coefficient of variation - This is also known as the relative standard deviation. It is a statistical measure of the dispersion of data points around the mean. While it performs a similar function to the standard deviation, it is advantageous because it can be used to compare dispersion of data between distinct series of data. Furthermore, it is a unitless measure. Generally, a decision maker seeks a lower value because it provides an optimal risk-to-reward ratio with low volatility but high returns.

Descriptive statistics - These are brief descriptive coefficients that summarize given data sets. These are classified into the measures of central tendency (mean/average) and measures of variability (minimum, variance/standard deviation and maximum variables).

Ex-ante - These are inferences based on forecasts.

Export - Goods or services that are sent out of a specific geographical location to another spatially demarcated jurisdiction. This is represented as nominal dollars.

Ex-post - These are inferences based on actual results.

GF - Glucose and fructose

GHS - Groats, hull and starch

Harmonized system code - Commonly represented as harmonized system (HS) code. This is a standardized numerical method of classifying traded products. Primarily, it is used by customs authorities around the world to identify products when assessing duties/taxes and for collecting data for statistical analysis.

Import - Goods or services that are brought into a specific geographical location from another spatially demarcated jurisdiction. This is represented as nominal dollars.

Net farm income - Net farm income refers to the return to farm operators for their labor, management and capital after all production expenses have been paid. This is the gross farm income minus production expenses.

Period - A period is defined as a five-year interval in this report.

Prices - Price is computed as the ratio of export value and quantity. This is represented as nominal dollars per metric ton ($/MT).

Production efficiency - Production efficiency is concerned with producing goods and services with the optimal combination of inputs to produce maximum output for the minimum cost.

Production - Quantity of commodity produced. This is measured as bushels for both commodities (corn and soybeans).

Productivity - Productivity is the measure of output from a production process per unit of input.

Risk - A risk is the possibility of loss or gain of an event with known probabilities.

Shares - Representative proportion of the total of a variable/indicator.

Standard deviation - This is a quantification of the amount of variation or dispersion of a set of data values. This is most often a complementary information to the mean. Given any mean, there are chances of gain or a loss. Hence, knowing the possible variation can allow the decision maker or producer to plan with bounds.

Trade - This is basically computed as the sum of imports and exports. However, in this report, trade is used generically to represent either imports or exports.

Trend - A general course or prevailing tendency to take a particular direction or move in some indicated direction. In this report, the trend defines the direction of growth of the respective variable.

Uncertainty - Uncertainty refers to the occurrence of an event for which probabilities cannot be assigned.

Executive Summary

This report presents organized and structured information on corn trade indicators across geographical space and through time. The indicators considered are exports, imports and prices. These also are presented at the byproduct level. The levels of aggregation are global, U.S. and North Dakota.

The information is presented in the form of trends and descriptive statistics. The former reveals the direction of the growth, while the latter reveals the magnitude of expectations. The descriptive statistics are represented by the mean, standard deviation, coefficient of variation and share contribution to the total.

The report is presented in six sections: (I) global temporal corn trade, (II) global spatial corn export, (III) global spatial corn import, (IV) U.S. temporal corn export, (V) U.S. spatial corn export and (VI) U.S. state level corn export. At the global level, the trends of the indicators are presented in addition to the descriptive statistics of the top 15 exporting and importing countries. The trends and descriptive statistics for the top 15 exporting states also are provided at the U.S. level.

This report is important because it serves as an informational guide on exports, our competitors for exports and potential markets for corn to our producers. In the current environment, the success (productivity and net farm income stability) of agricultural business depends on the accurate prediction of potential demand for corn and their products to help producers in making decisions for domestic or foreign markets. Hence, having a comprehensive and accurate database on exports and imports at the global, national and state levels will enable producers in decision-making with confidence.

To formulate trade policies related to the international market, the trends and the descriptive statistics are useful to producers in identifying variations in demand for corn and their products. For decision makers, this information is helpful in the development of risk management tools for potential export losses due to risky events such as politically driven tariffs and uncertain events such as COVID-19. Finally, in the years of decline, identifying sources of variation or risk in changing consumer preferences, genetically modified restrictive index, trade facilitation and prosperity indexes is important. The study reveals that:

Global Trade

- Despite having an increasing trend, the proportion of corn grain relative to processed products has decreased through time.

- Corn grain, ethyl alcohol, corn meals (bran, residues, waste and cake) are the major traded corn products.

- Brazil, Argentina, Uruguay and France are the major competitors of the U.S. in global corn markets.

- Japan, Mexico, South Korea, Egypt and Spain are the major destinations for corn grain.

- Global corn prices have been on the decline in recent years.

U.S. Trade

- Mexico, Japan, South Korea, Colombia and Peru are the major destinations for U.S. corn grains.

- Italy, Iran, Netherlands, Malaysia, Algeria and Germany are among the top 15 importers but not part of the top 15 U.S. export destinations.

U.S. State Trade

- The U.S, Department of Agriculture (USDA) Foreign Agricultural Service (FAS) under- and overestimates state exports because they are based on the location of the port.

- Our production-adjusted state exports estimates suggest the major exporters of corn are Illinois, Iowa, Minnesota, Indiana, Nebraska, Ohio, Missouri, South Dakota, North Dakota and Kansas.

North Dakota Trade

- North Dakota corn exports are underestimated by the USDA FAS.For instance, the production adjusted export value predicts a value of $652,594,412 in 2018, while the FAS method presents a value of $134,183,209. On the other hand, the ERS method predicted $337,701,587, which is two times less than the production adjusted estimate.

Future Research

Exports are particularly important for every economy. In the case of North Dakota, where production mostly exceeds domestic consumption, the need to explore foreign market potentials is essential. From this report, we can observe that the current trends of corn trade for North Dakota have been increasing. We must not only evaluate the determinants of North Dakota corn exports but also explore potential markets.

- The next stage of this research seeks to evaluate the efficiency of U.S. state agricultural exports and their determinants. Of particular interest are the impact of genetically modified restrictive index, tariffs and other transportation costs. The expected outcome of the estimation is to provide the requisite knowledge that will give North Dakota corn farmers a comparative advantage in the international markets, given that these variables have become very instrumental drivers of international trade in recent years.

- The second objective will be to examine the determinants of commodity price volatilities and their impact on North Dakota production and exports.

About the Center

Center for Agricultural Policy and Trade Studies

The vision of the Center for Agricultural Policy and Trade Studies (CAPTS) is to enhance the sustainability of the net farm income of North Dakota producers through in-depth trade and agricultural policy research. After carefully considering stakeholder inputs, interests, risks and uncertainties, the concept of efficiency, technology assessment and productivity growth1 also are embedded into the center’s research.

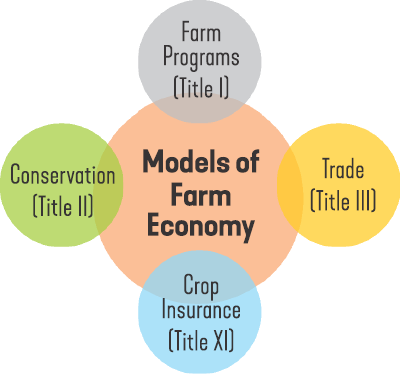

To address this vision, the center aims to develop a “model of farm economy” to conduct ex-post and ex-ante evaluations for North Dakota. The model will evaluate agricultural and trade policies with its implications on North Dakota producers’ net farm income. Additionally, the implications of policy on North Dakota producers’ efficiency, technology assessment and productivity growth also will be evaluated.

The model of farm economy based on multiple theoretical frameworks will not only evaluate the implications of existing agricultural and trade policies (Title I, II, III and XI) but also future policies to meet efficiency, productivity and net farm income sustainability goals of North Dakota producers. Our perception of the challenges and the choices made at this juncture in history will determine how to protect farmers in our state and secure our future. The center keeps detailed records of all activities and publishes the information that will be of value to the clientele, including commodity groups and decision makers of the state and region.

Center and Current Project

The center, in collaboration with North Dakota Soybean and Corn councils, is evaluating measures of improving net farm income sustainability for producers in the state. The project is in three dimensions; these are the production indicator report, trade report and policy report.

The phase 1 outcomes of the project include detailed and comprehensive development of databases and the presentation of trends and risks in the production indicator, trade and policy reports. These reports are useful to the producers, commodity groups and decision makers.

Also, this information will form the basis for the development of the “model of farm economy” to evaluate the implications of agricultural and trade policies on North Dakota producers’ net farm income. Additionally, the implications of technology and policies on North Dakota producers’ efficiency and productivity growth will be evaluated.

About the North Dakota Corn Utilization Council

The North Dakota Corn Utilization Council (NDCUC) was established in 1991 by the North Dakota Legislature to administer the state corn checkoff. The checkoff is one-fourth of 1% of the value of corn sold at elevators and processing facilities in North Dakota.

The NDCUC consists of a board of seven corn producers elected by their peers. North Dakota is divided into seven corn districts.

Each county within the district elects a county representative. County representatives elect a district representative to serve on the council. Council members are responsible for the investment of corn checkoff in programs to solve production problems, create new market opportunities, provide educational programming and promotion of the corn industry domestically and internationally.

Corn production in North Dakota has grown significantly since the late 1990s because genetic advancements have led to hybrids suitable for northern climates. Corn is one of the top three crops in North Dakota by acreage. Yield increases have made corn highly profitable during periods of price volatility.

Thanks to corn farmers’ investments in checkoff programming, production of renewable fuels has grown in North Dakota to create demand for approximately 50% of our bushels produced. Checkoff investments also are utilized to create market demand internationally. This has led to approximately 40% of the corn grown in North Dakota leaving the state by rail because it is destined to go to ports in the Pacific Northwest and shipped to buyers in Asia.

North Dakota’s corn processing facilities are a vital component of the state’s rural economy. Our five ethanol plants employ more than 230 workers in high-paying positions such as chemists, engineers, accountants and managers, as well as support staff. Each North Dakota ethanol plant is in a community with a population of less than 2,500 and contributes an average of 46 jobs to these rural communities.

The NDCUC works toward expanding new markets, invests in research to meet current and future needs of farmers, and works to ensure a profitable business climate for northern corn.

The NDCUC serves more than 6,000 corn farmers in North Dakota.

To learn more about the North Dakota Corn Utilization Council, please visit www.ndcorn.org or follow it on social media.

Trade Report

Rationale for This Report

In recent years, discussions on global trade have become a delicate topic among world leaders. Each country seems to seek out its interest at the expense of others.

However, a theoretically established fact is that international trade is a positive-sum game rather than a zero-sum game for partner countries involved. What also is well known is that governments are more likely to form free trade areas if the benefits outweigh the costs.

The U.S. has been at the center of many of these trade disputes in recent times. This can be primarily attributed to its efficiency of production. The U.S. agricultural sector consistently has produced more than its domestic needs. Hence, international trade and food aid supplies have been the two major outlets for excess agricultural produce of the U.S.

Considering this, the recent turn of geopolitical events has been unfavorable for farmers in the U.S. To remedy this issue, we have the need to understand the factors that hinder or promote U.S. agricultural exports.

Several studies have been conducted on the determinants of U.S. agricultural exports. Meanwhile, crop production is spatially specialized in the U.S. For instance, the Midwestern states are the major producers of U.S. grains.

To formulate policies concerning current trade events, the understanding of the determinants of U.S. agricultural exports alone may not be sufficient. A need exists to dissect the determinants of state-level agricultural exports.

However, research on U.S. state-level agricultural exports is limited. This can be attributed to the nature of available data on U.S. state-level agricultural exports. The current data on state-level exports do not reflect the major producing states. This is because of the dual problem of the absence of ports of exit in these states and the USDA Foreign Agricultural Services method of reporting state-level exports based on the ports of exit rather than state of origin.

As part of its commitment to help mitigate the effects of these challenges faced by producers in North Dakota on the international markets, the CAPTS frequently performs research. This report is the output of a collaboration between the CAPTS and NDCUC with the aim of overcoming challenges of corn trade in North Dakota.

To evaluate the possible effects of these challenges and propose plausible solutions, we have a need for accurate and up-to-date data at different levels of aggregation. The objective of this study is to develop a statistical-based method to estimate the corn exports by the individual states within the U.S.

Obtaining this estimate will be useful to examine the actual determinants of corn exports at the state level. Knowing this can help Congress formulate policies with emphasis on states that are major producers of corn.

This report, as the first of a series of research in line with the collaborative objective, presents data on corn trade indicators. This trade report presents data on the following variables through time (temporal) and across geographical space (spatial):

- Export value

- Import value

- Price

Why is This Report Important?

This report presents systematically aggregated trade information for corn producers. First, it is important because it contains details of exports and imports based on corn byproducts through time. This information reveals the shifting demand for these byproducts through time.

For U.S. corn producers, this information is relevant for them to identify major competitors and potential new markets. Identifying the competitors will aid in policy formulation to increase market dominance, while identifying new markets will help increase total market share (and subsequently revenue) through exploring these new destinations.

Secondly, the report presents information on corn prices during the period in addition to its statistical risk. The financial markets (prices) form the bedrock of profit maximization and income sustainability. These trends and statistical risks are important because they reveal the volatilities and possible losses or gains.

For North Dakota corn producers, this report presents a set of accurate state-level exports that eliminates the port bias problem. Typically, the demand for state production incentives can be boosted with higher historic exports.

However, under situations where the exports for certain states are underestimated due to the port bias problem, the representatives have difficulty in obtaining the necessary incentives for their producers. These accurate state-level exports can be used for negotiations by state representatives or commodity groups for incentives for corn producers in North Dakota.

Data and Methods

The U.S. national and state-level exports and imports from the world and individual countries are available from the Global Agricultural Trade System (GATS), U.S. Department of Agriculture, Foreign Agricultural Service (USDA FAS). These trade data are presented at bulk and byproduct levels identified by their harmonized system (HS) codes. The corn trade data were obtained from this website at the byproduct level. The groups (with their HS codes) obtained are:

- Corn and seeds (100510 and 100590)

- Corn ethyl alcohol (220710 and 220720)

- Corn bran, residues, waste and cake (230210, 230310, 230330, 230670 and 230690)

- Corn flour, groats, hulled and starch (110220, 110313, 110423 and110812)

- Corn sugars; glucose and fructose (170240 and 170260)

- Corn crude and refined oil (151521 and 151529)

To compute the production-adjusted state-level exports, production data was obtained from the USDA National Agricultural Statistical Services (NASS). The Statistical Analysis System (SAS) software was used in the generation of tables and graphs. These are presented at::

- World (aggregate and countries)

- U.S. (aggregate and states)

The empirical framework for this report includes annual trends, five-year changes and summary statistics (mean, risk/deviations and coefficient of variation) and intensity of trade (market share) among countries and states. The results presented at various levels would help the corn producers not only evaluate their options for the present but also develop strategies for the future based on the market trends and risks.

- Annual trends: The annual trends of global exports, imports and prices of corn are presented in the report. The export and import values also are presented by trends for the top 15 countries. At the U.S. level, the trends of these indicators are presented for the whole country and top 15 states. At the North Dakota level, the trends are presented and compared for our computed production-adjusted exports, USDA FAS exports and ERS exports. Presenting these trends in the report will provide a framework to gauge the changes through time across countries and states. Furthermore, it will help reveal the extent of bias accumulation attributed to the current USDA FAS method of computing state exports. Knowing these trends can serve as a basis for estimating the volatilities and their sources. This can help forecast future possibilities vs. desired horizons for advance decision making.

- Five-year changes: This report further presents histograms of the five-year sums of the trade indicators at the various levels of aggregation and product group level. Having the indicators in five-year periods in the report will provide a framework to evaluate the increase/decrease or shifts across periods.

- Summary statistics: The summary statistics are provided for the various levels of aggregation for all the trade indicators enumerated. This will provide a framework to evaluate the magnitude of the variables using totals, averages, risks, coefficient of variation and intensity of the trade variables in the form of market share.

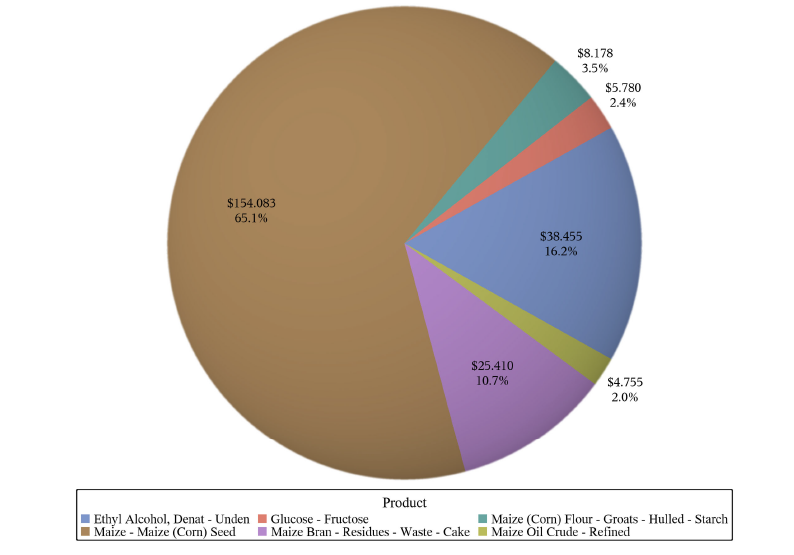

Key Findings

Global Trend and Risk

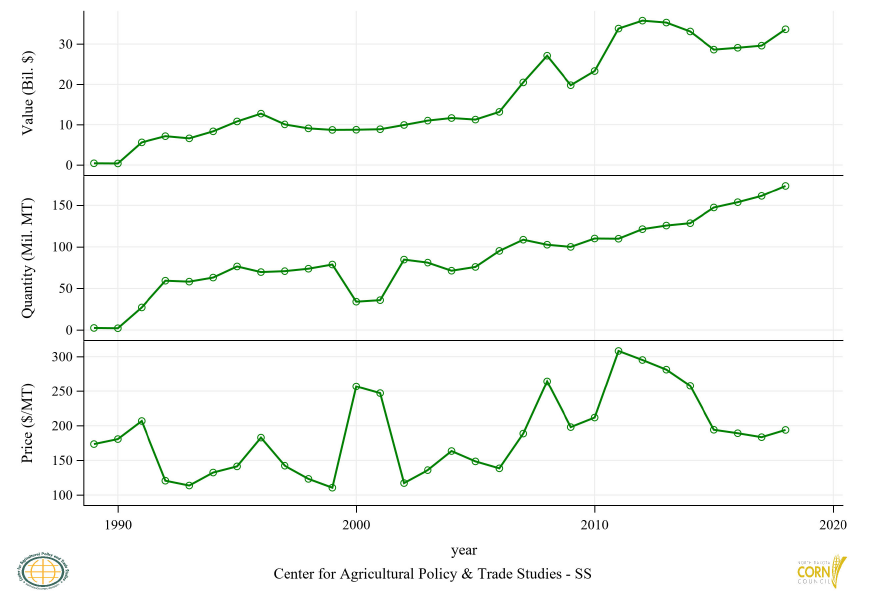

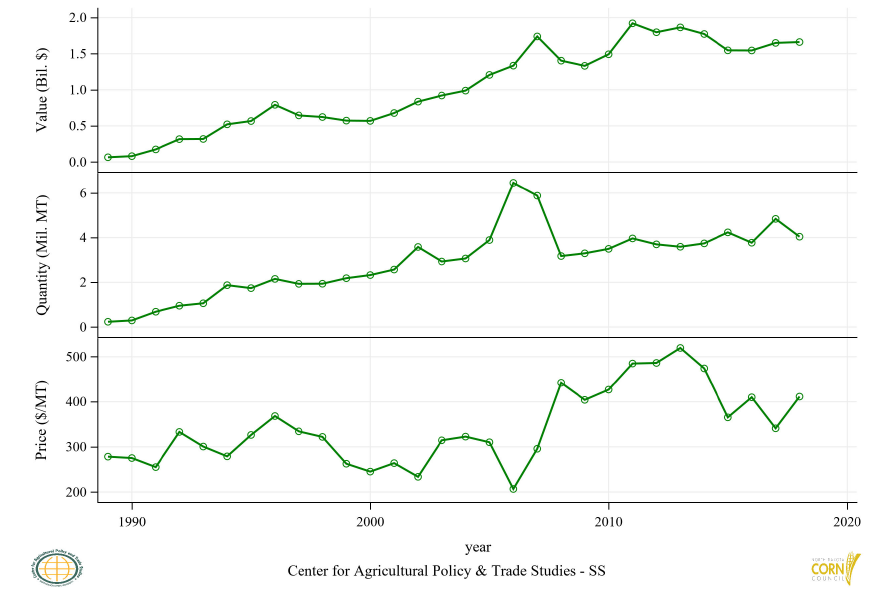

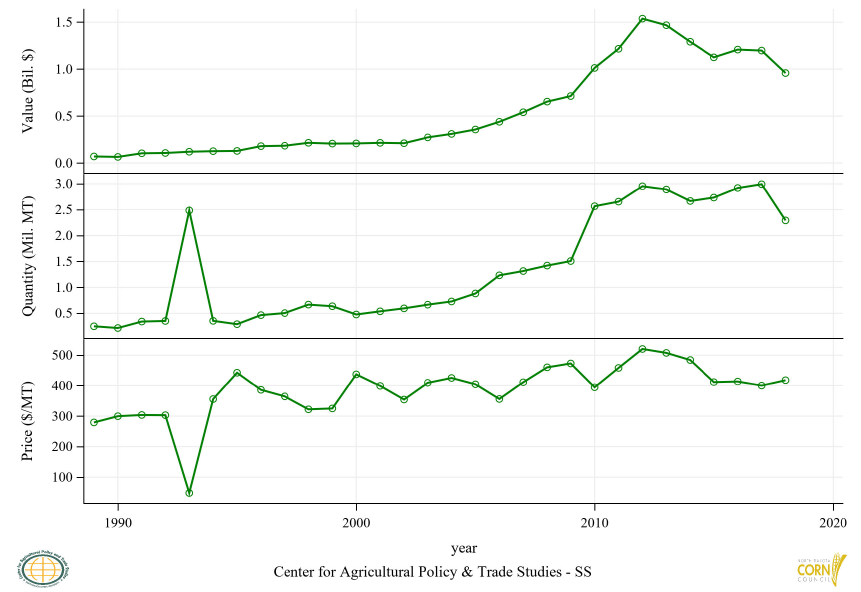

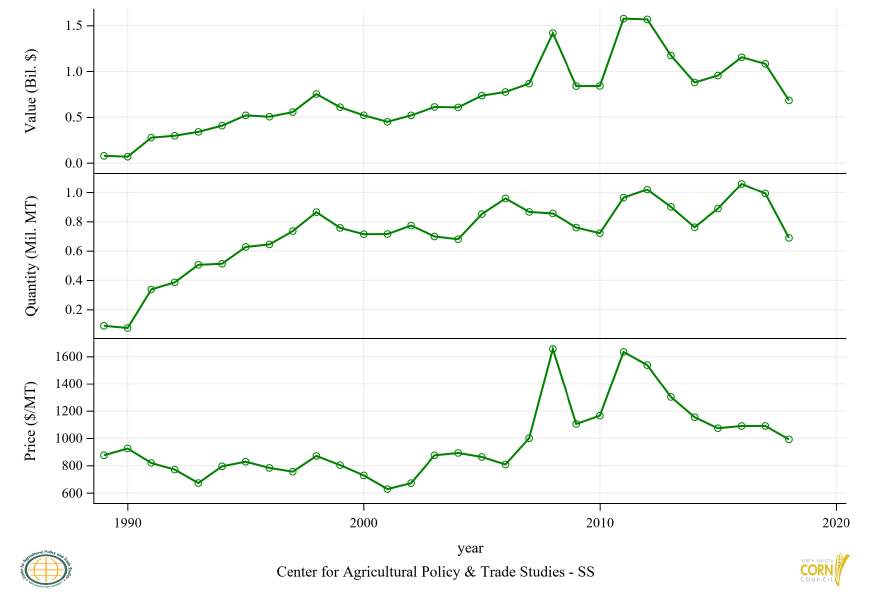

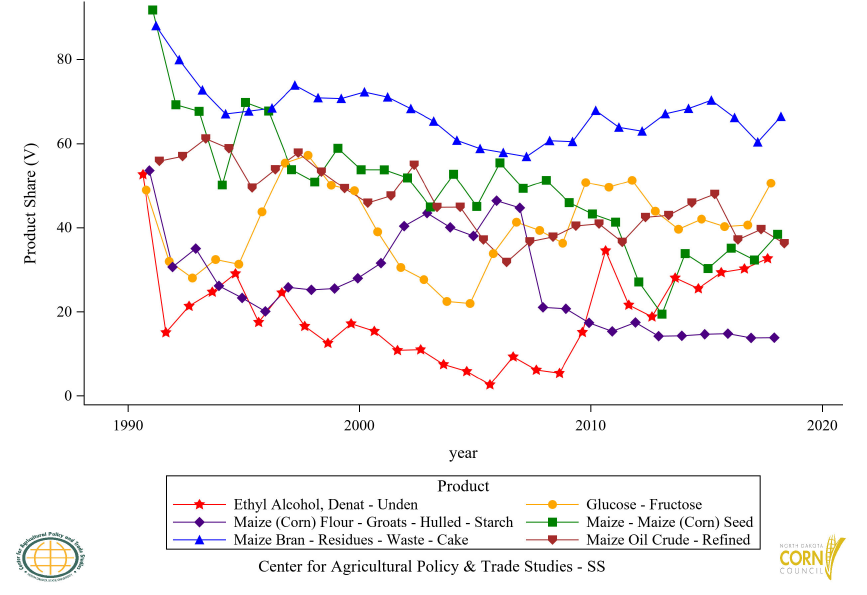

Global corn export quantity and value increased steadily during the period (Figure 1). Between 2014 and 2018, whole grain corn, including seeds, accounted for 65.1% of the global export share of corn products. Ethyl alcohol accounted for 16.2% of the total export share in this period, while corn bran, residues and cake accounted for 10.7%. Corn flour, groats and starched represented 3.5% of the total exports, followed by corn sugars (glucose and fructose) with 2.4%.

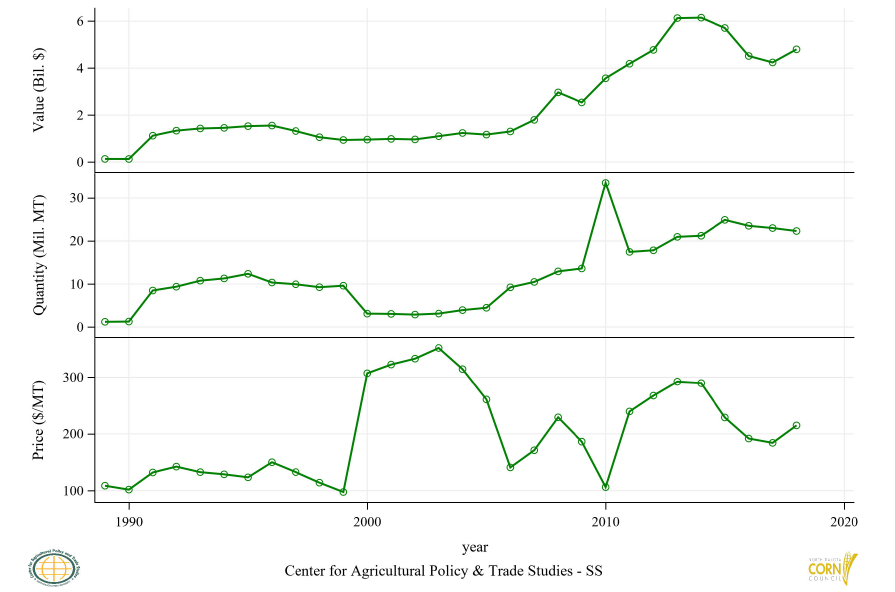

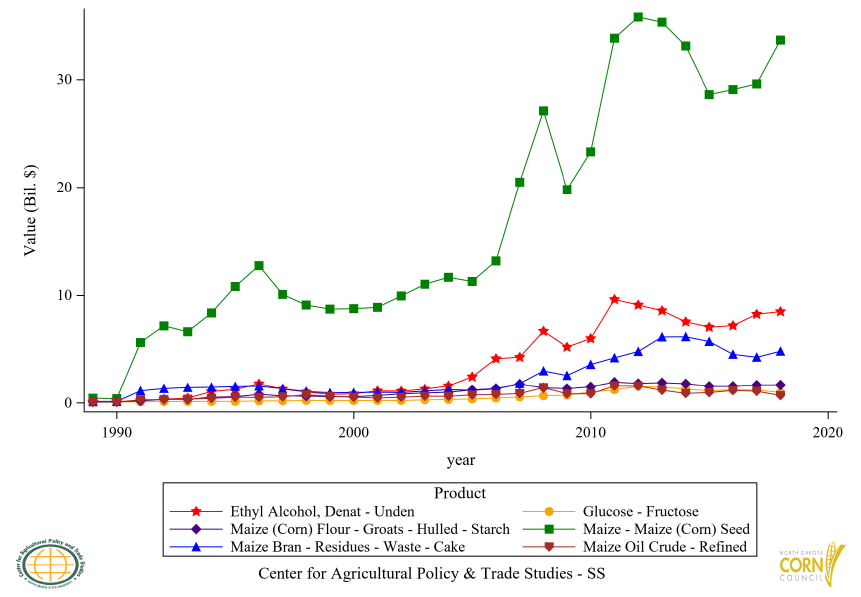

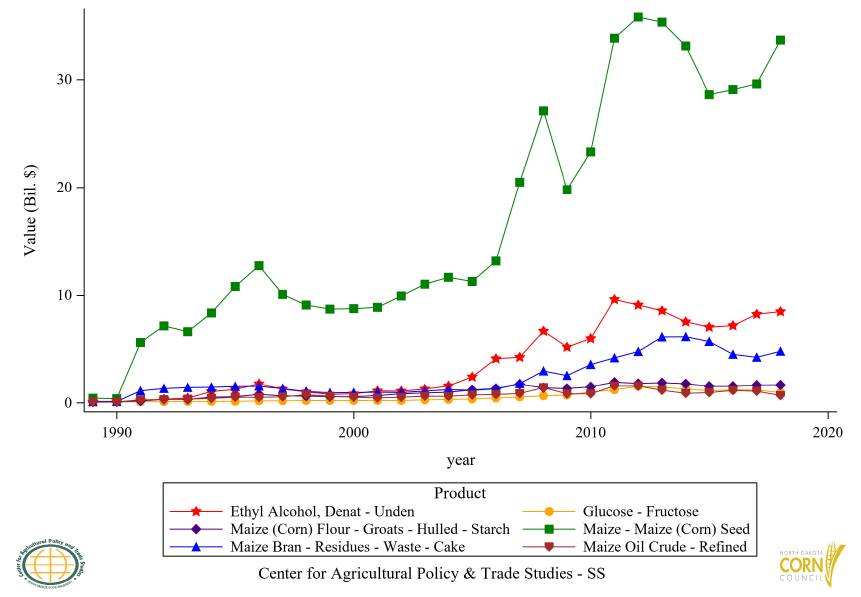

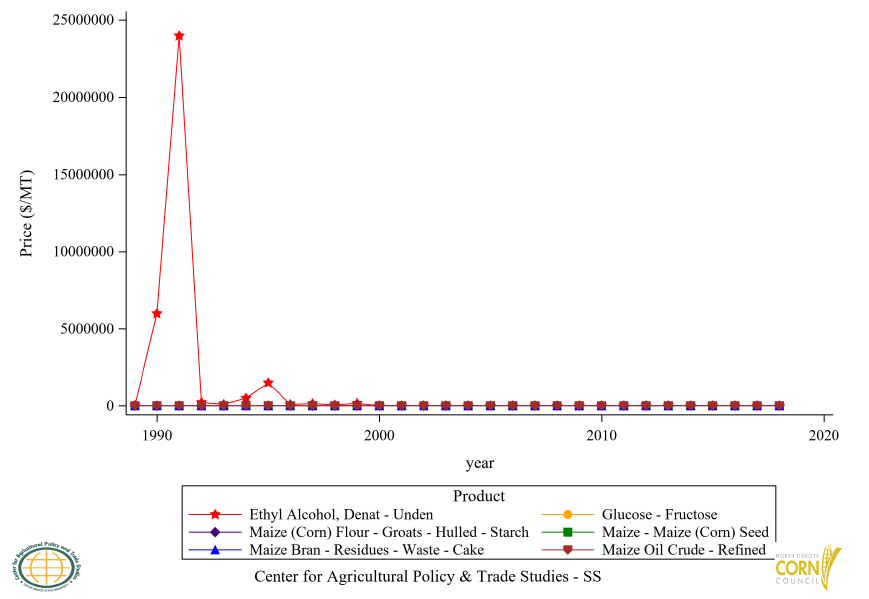

The least component of corn exports for this period is corn crude oil and residue, with 2%. Figure 7 presents the global export share of corn byproducts from 2014 to 2018. The trends of export value, quantity and price for the six groups of byproducts are presented in Figures 8, 9 and 10.

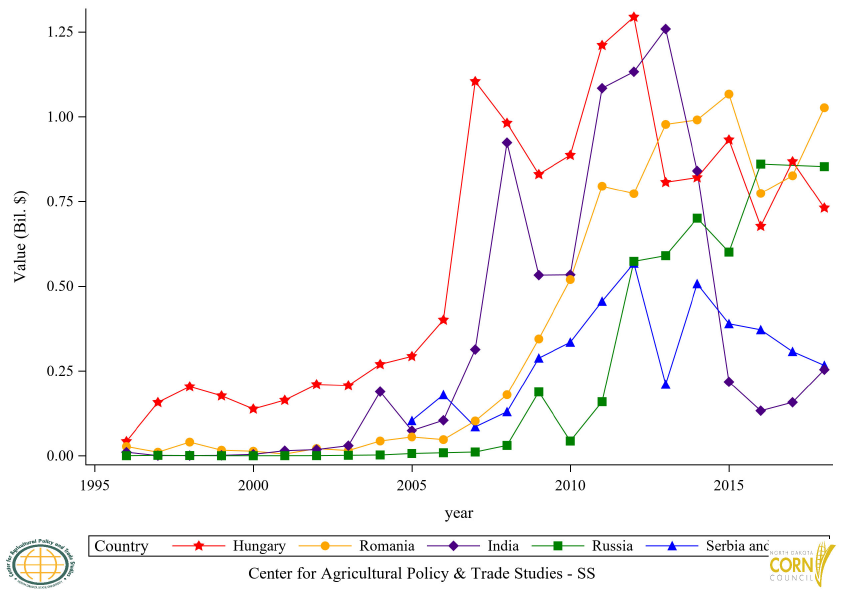

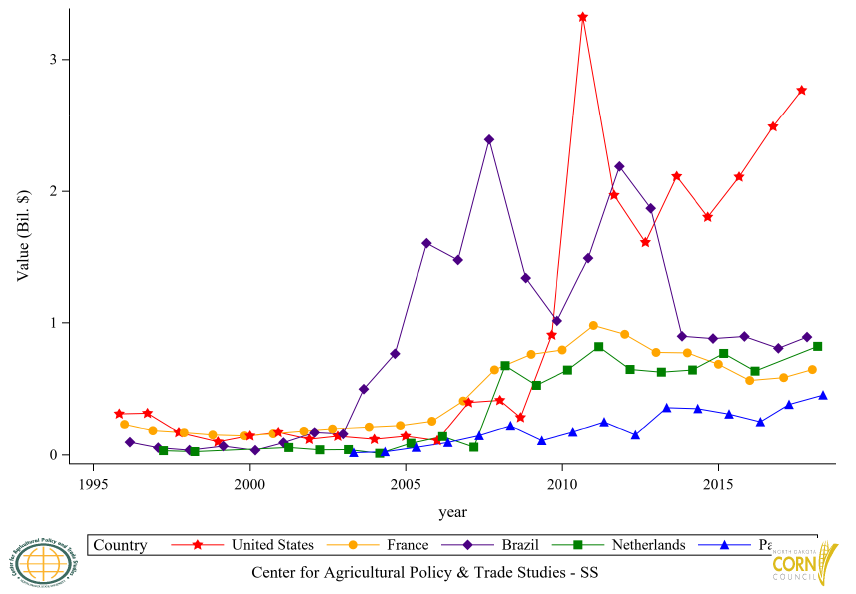

The top 15 exporters of corn and seeds (export value share) based on the period between 2014 and 2018 are:

- U.S. (35%)

- Brazil (14.3%)

- Argentina (12.6%)

- Ukraine (10.3%)

- France (5.89%)

- Romania (3.12%)

- Hungary (2.68%)

- Russia (2.01%)

- Serbia and Kosovo (1.23%)

- India (1.07%)

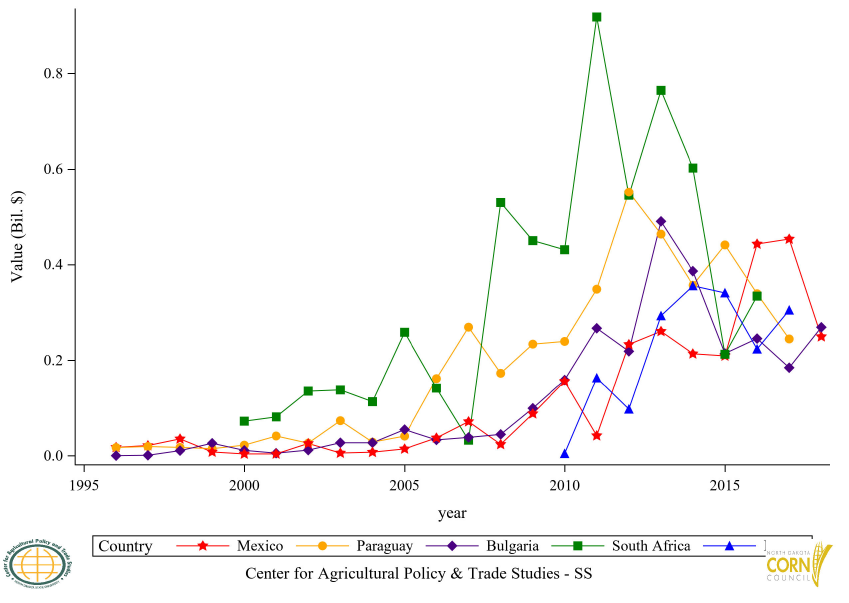

- Mexico (1.04%)

- Paraguay (0.92%)

- Bulgaria (0.87%)

- Burma (0.82%)

- South Africa (0.77%)

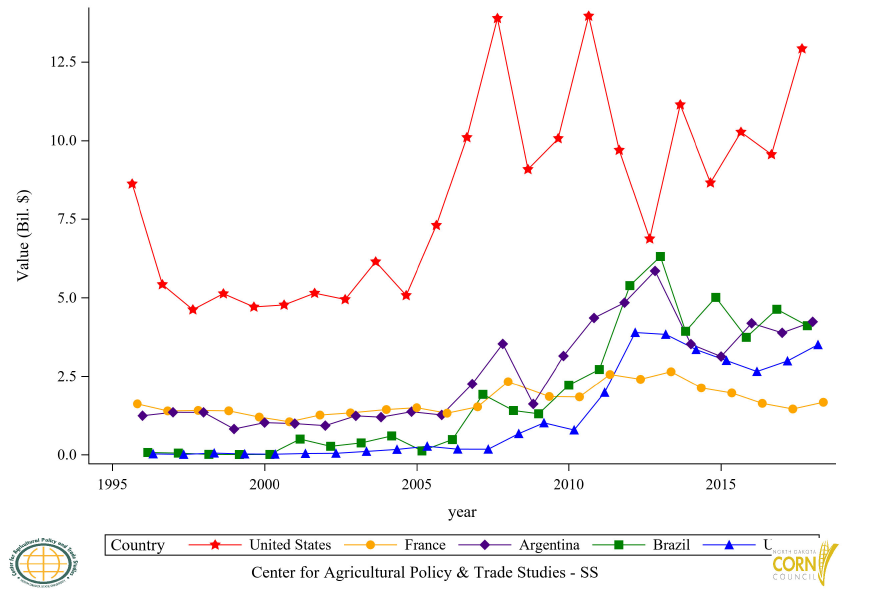

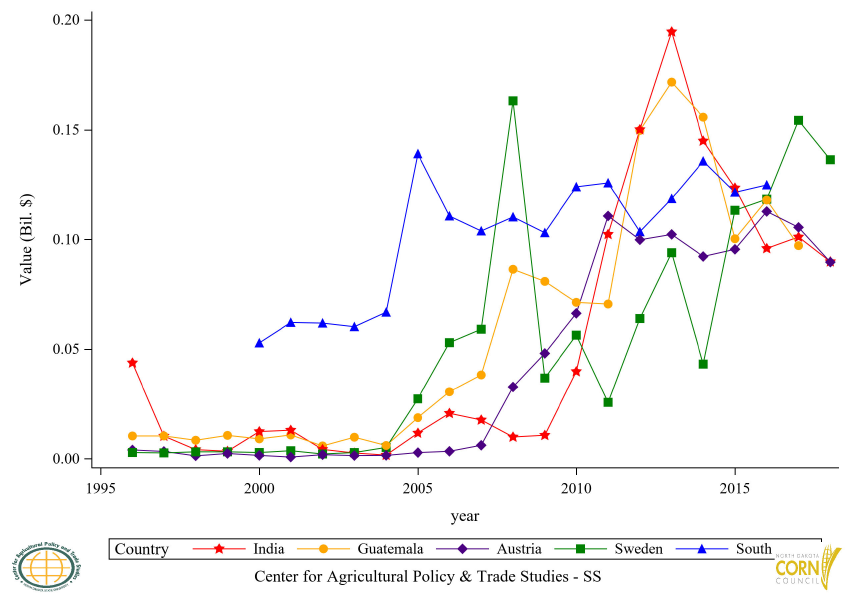

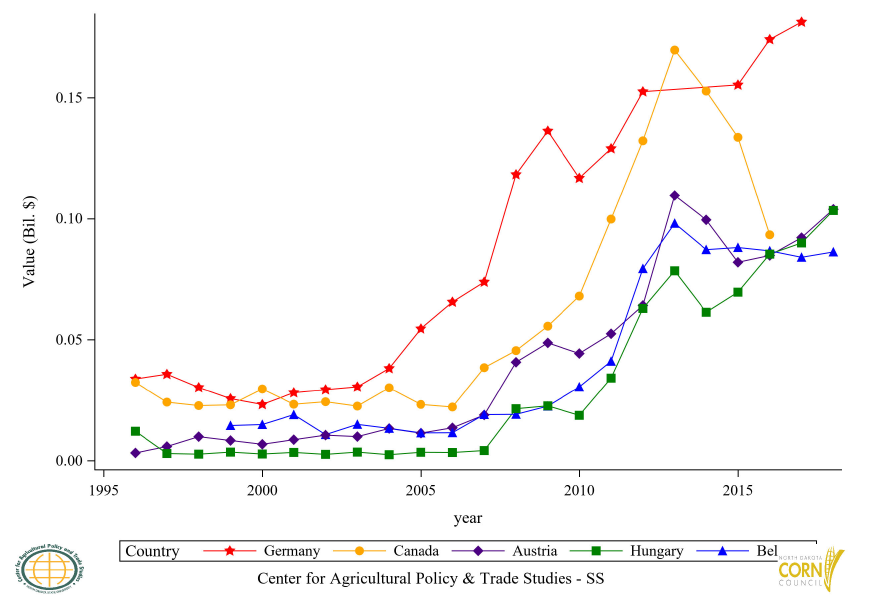

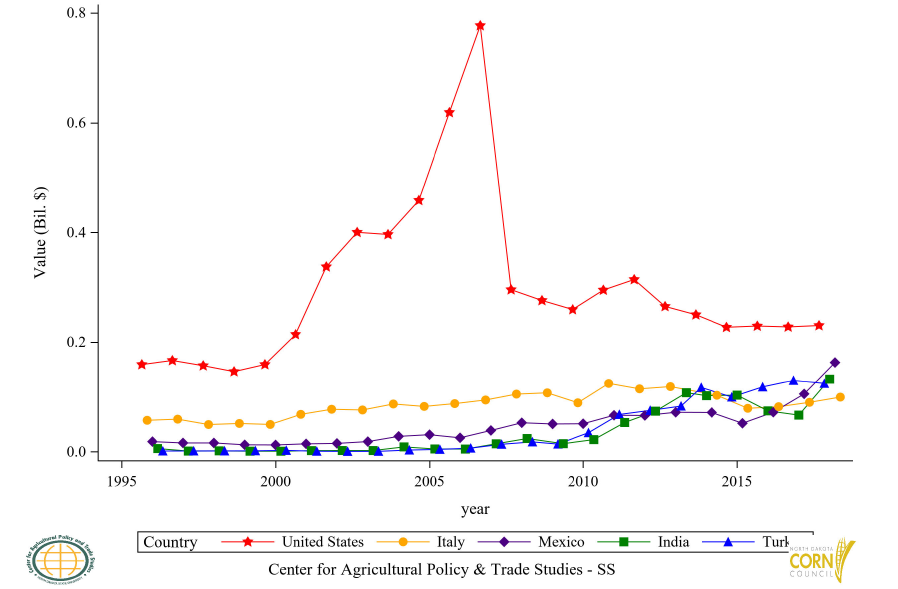

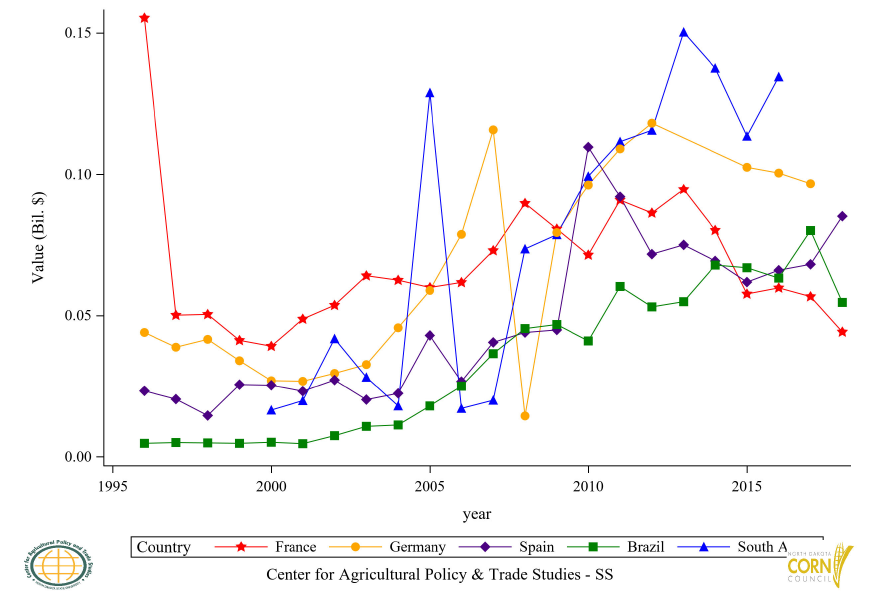

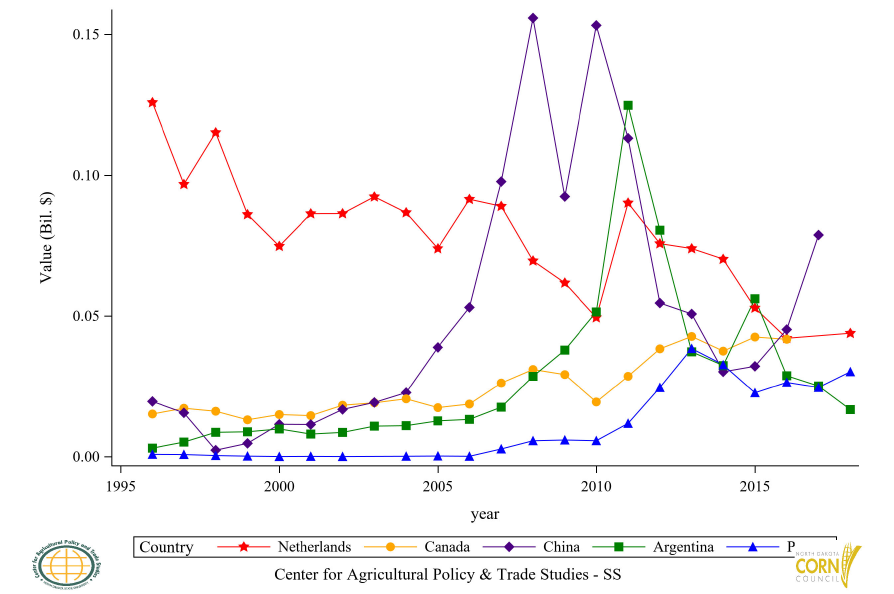

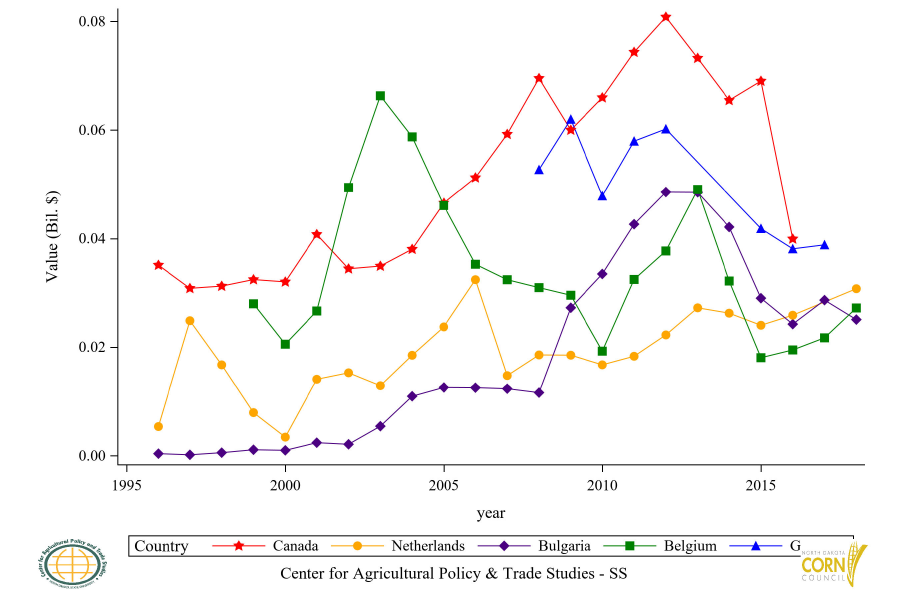

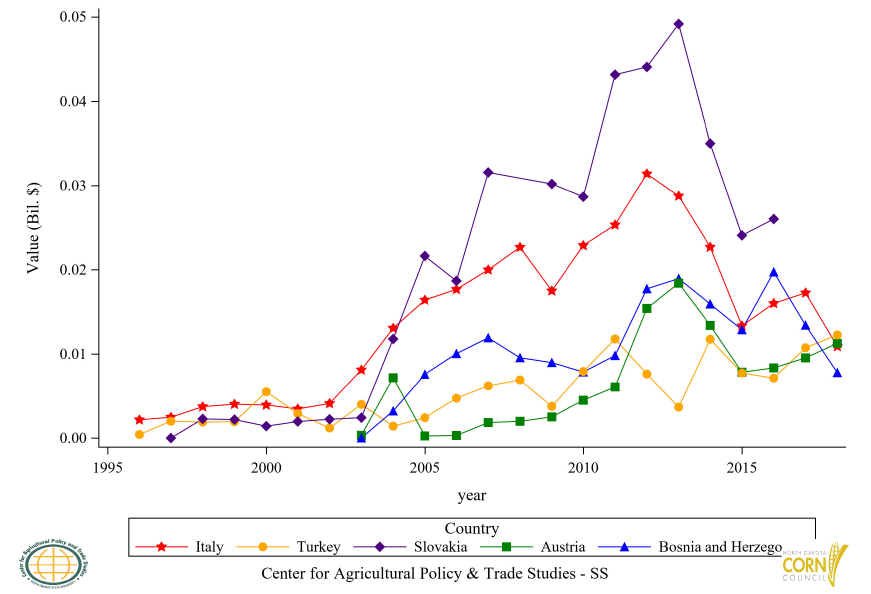

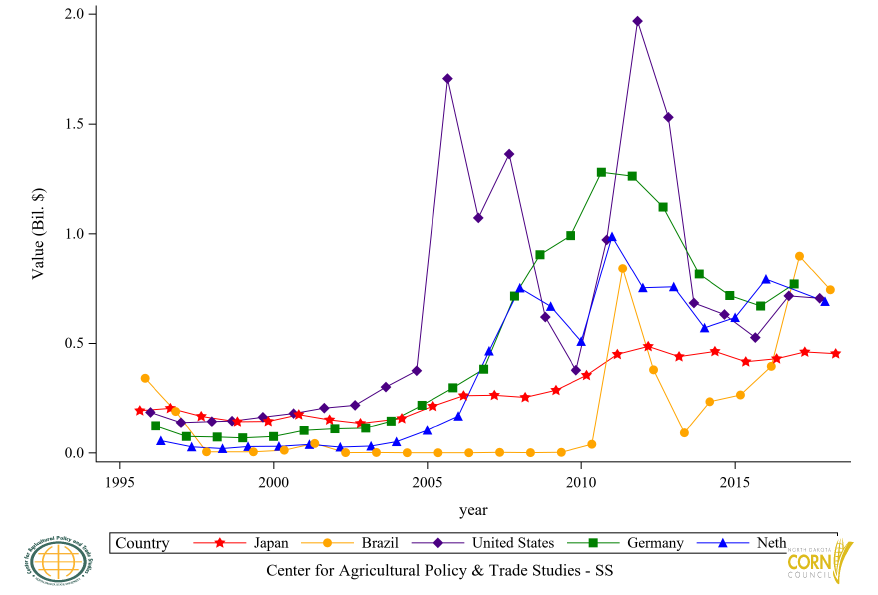

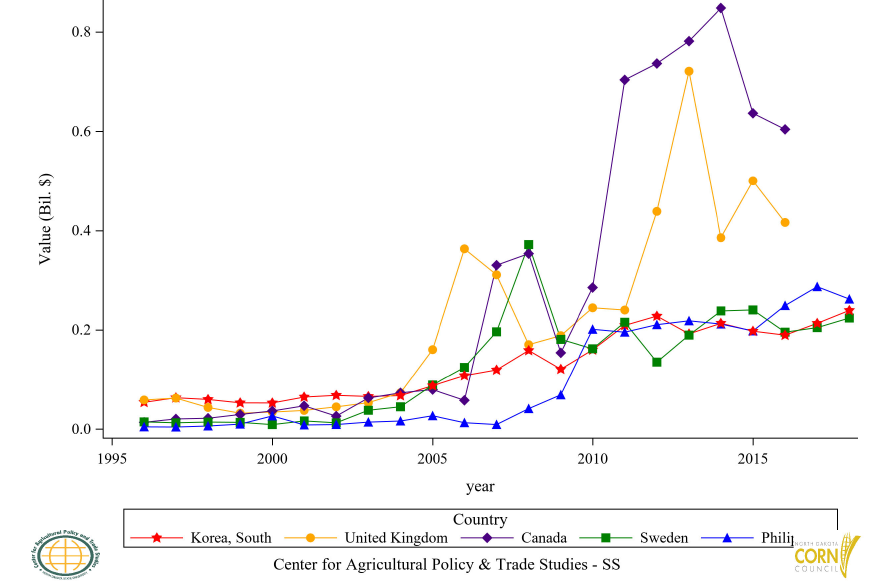

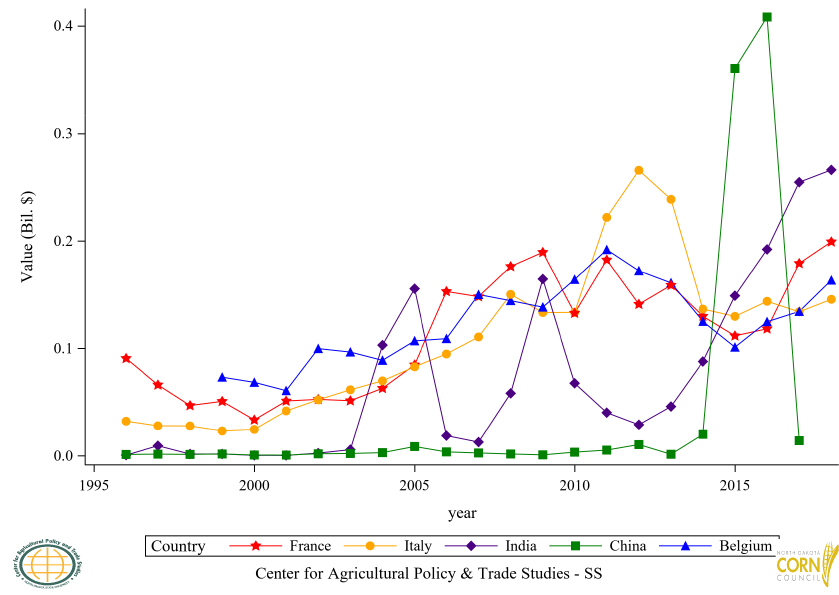

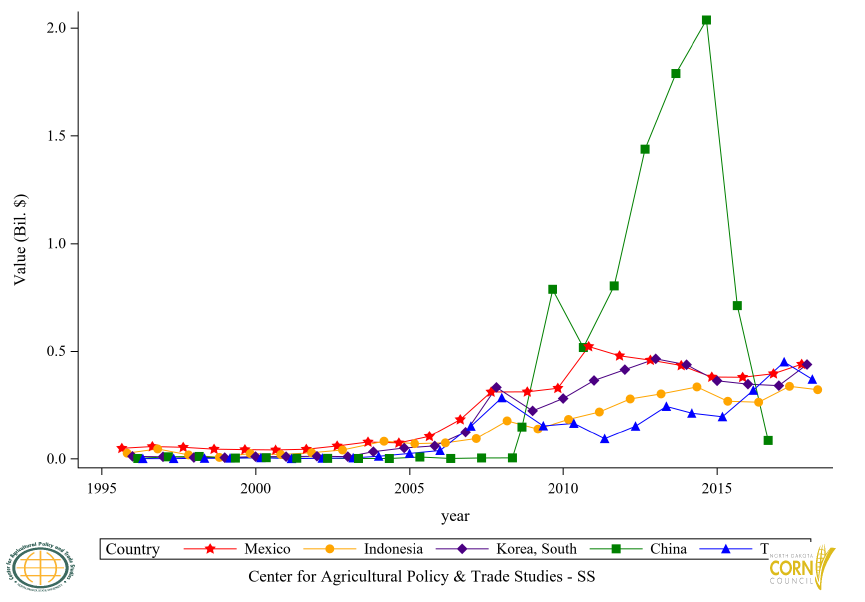

The trends of the export values for the top 15 countries are presented from Figure 11 to Figure 13. Figures 14 to 28 present trends for the top 15 exporters for the other byproducts. The details for the descriptive statistics can be found in the appendix.

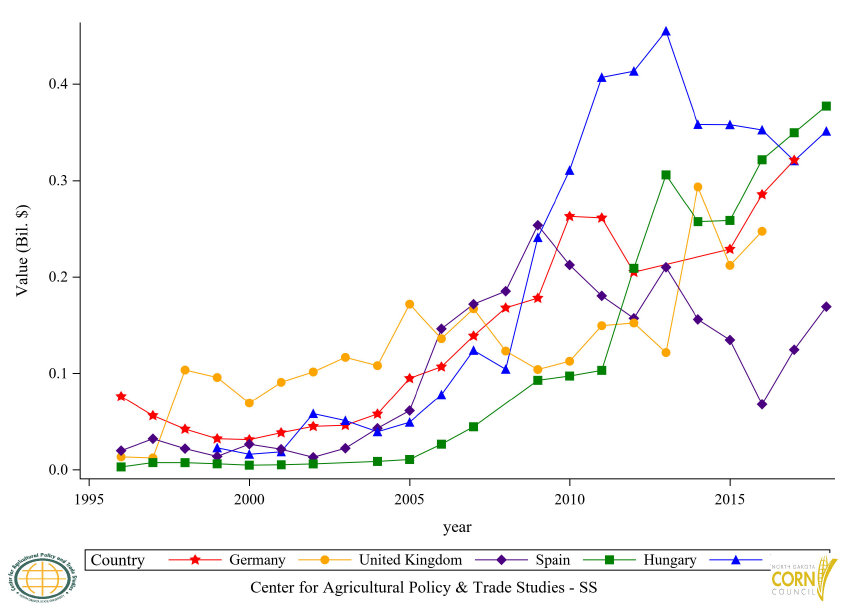

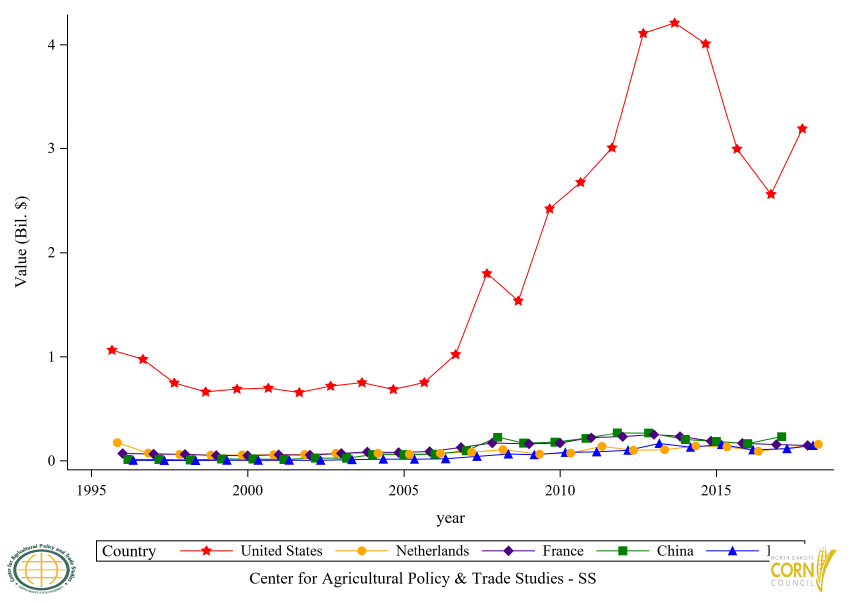

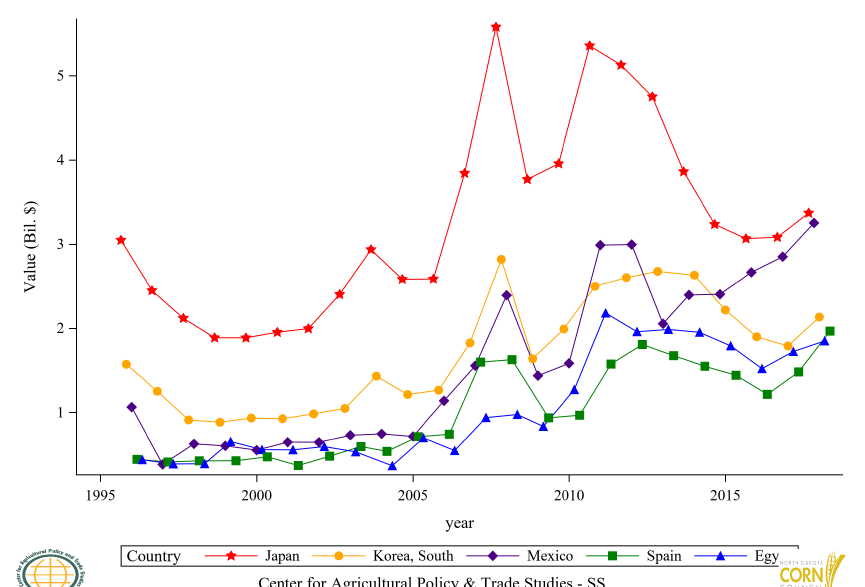

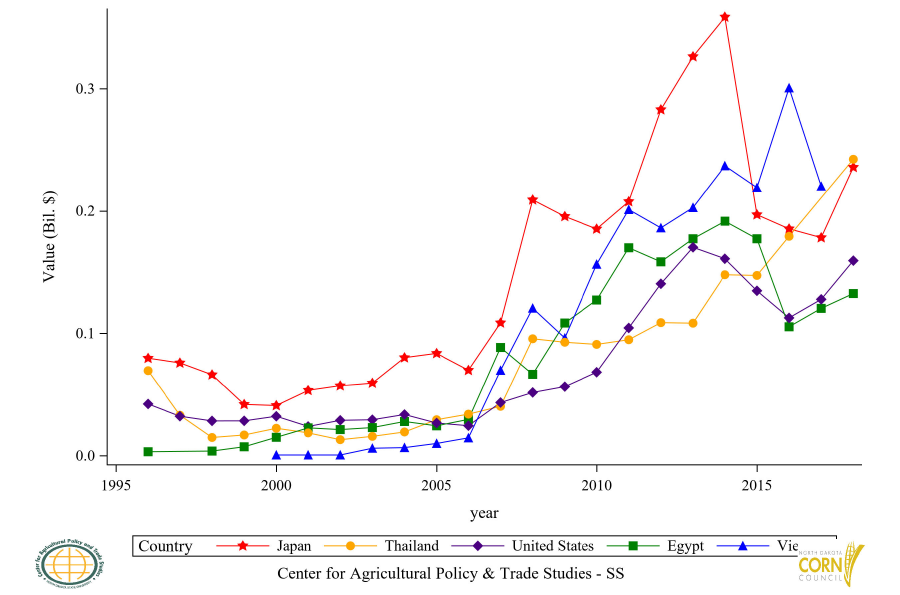

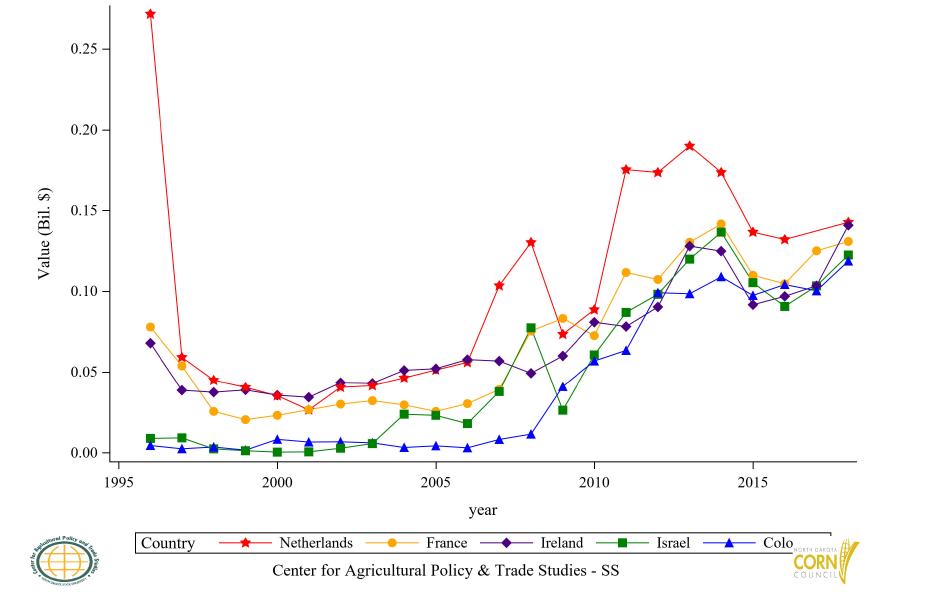

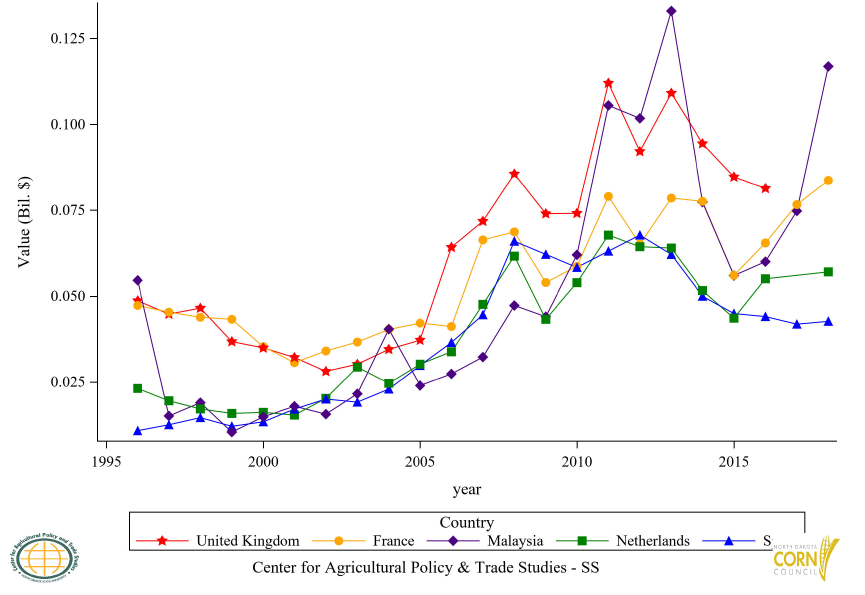

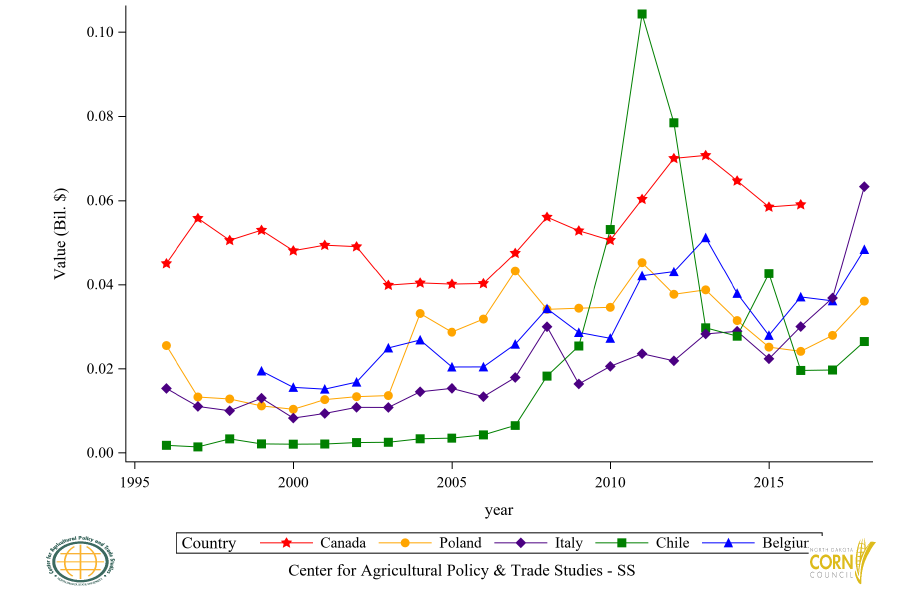

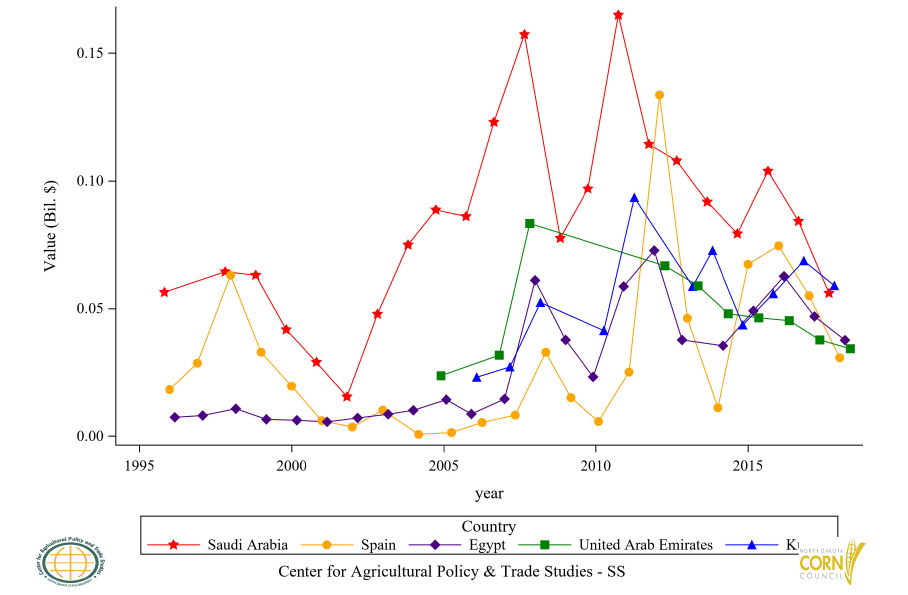

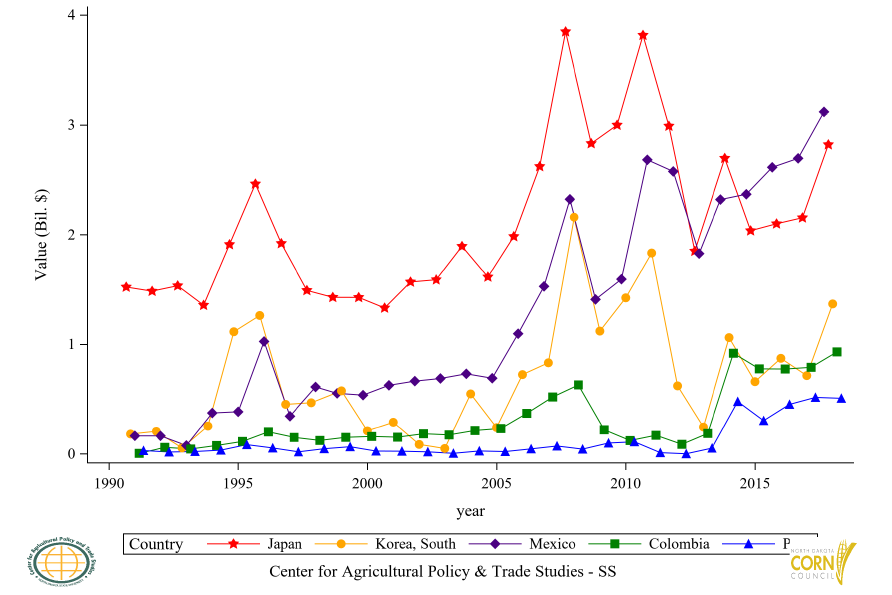

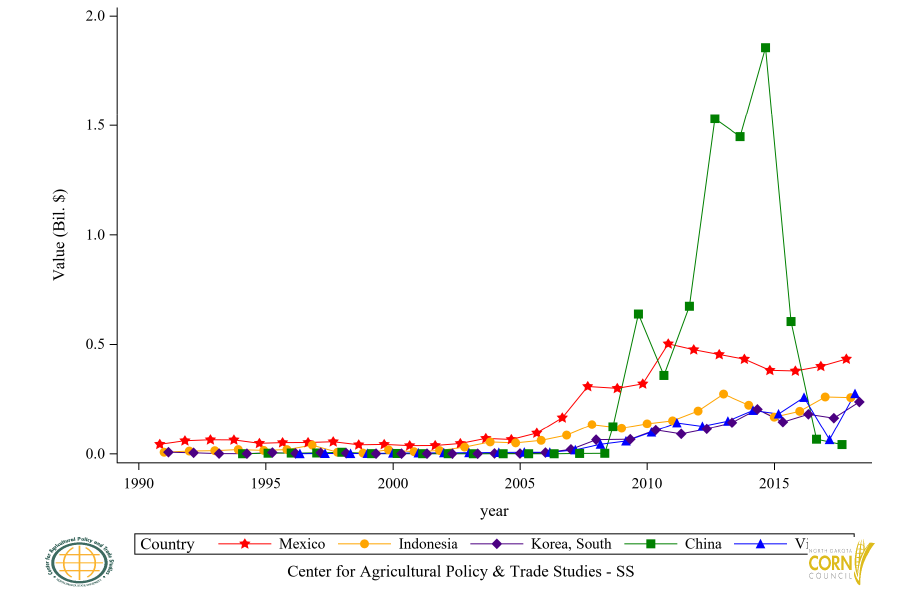

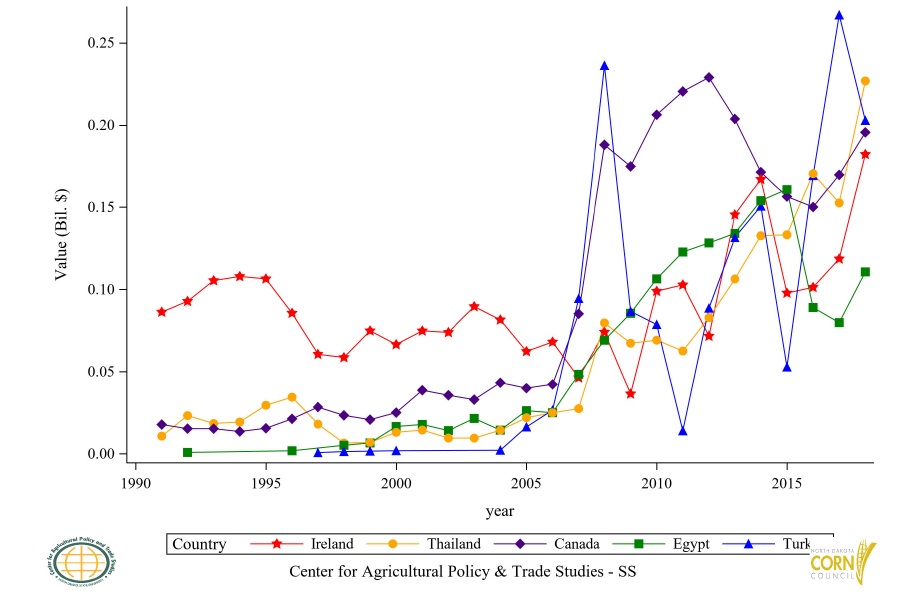

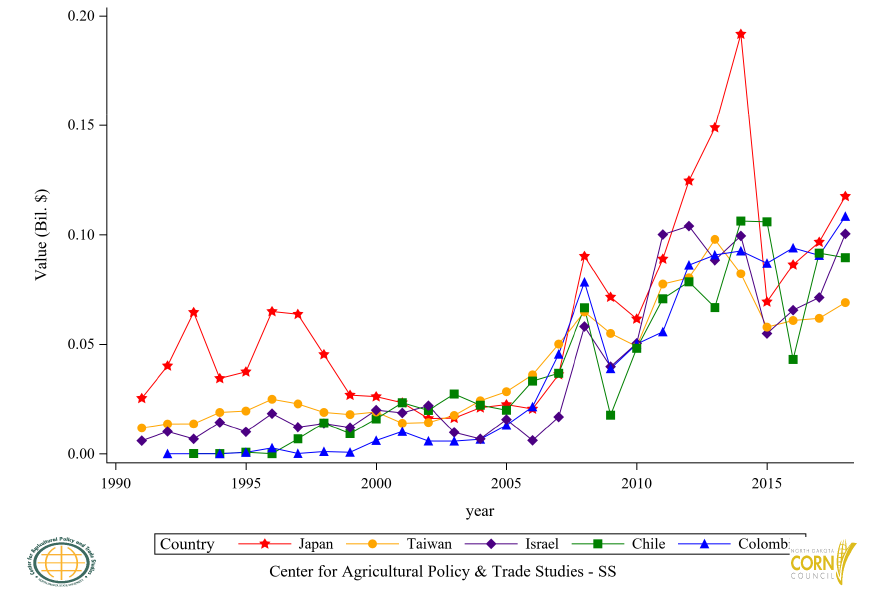

The top 15 importers of corn grain (import value share) based on the period between 2014 and 2018 are:

- Japan (11%)

- Mexico (8.97%)

- South Korea (7.05%)

- Egypt (5.84%)

- Spain (5.06%)

- Vietnam (3.99%)

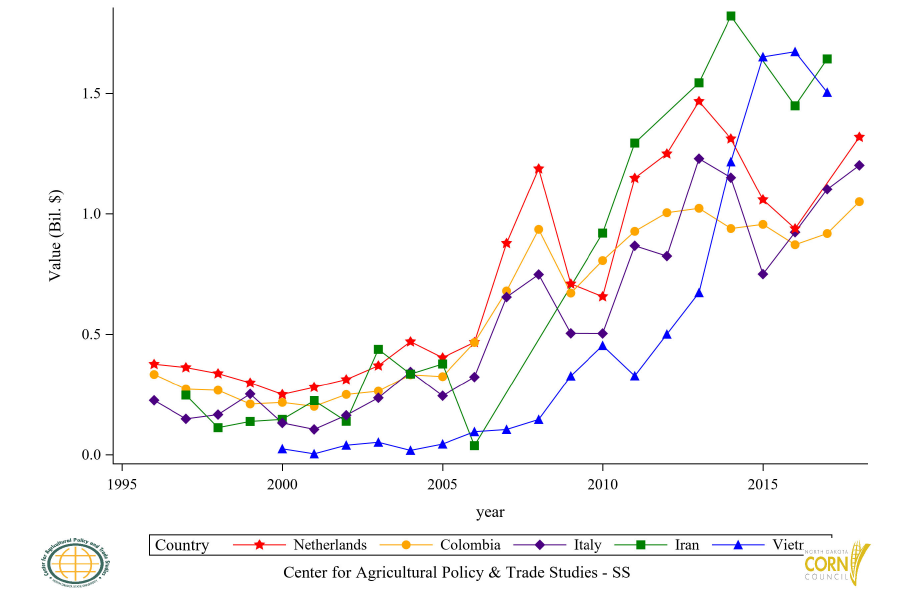

- Italy (3.39%)

- Iran (3.25%)

- Colombia (3.13%)

- Netherlands (3.06%)

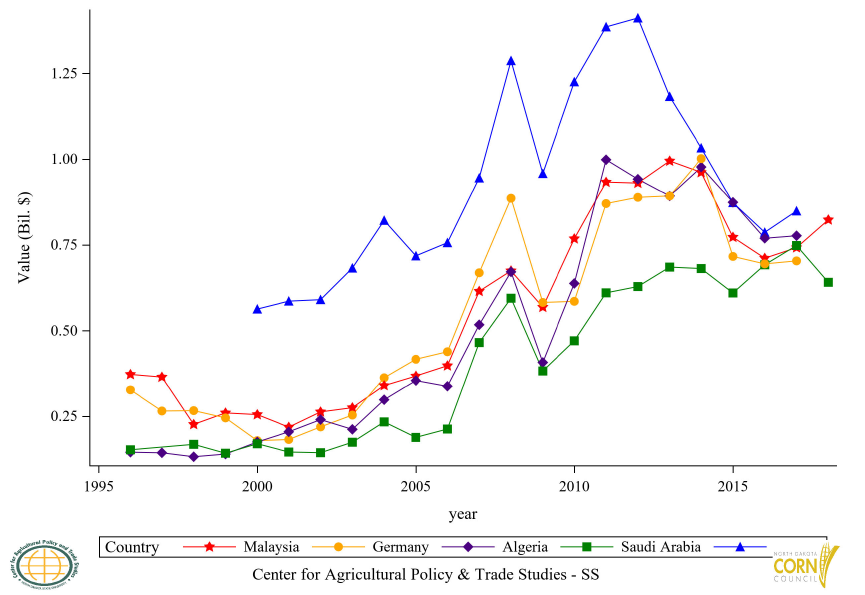

- Malaysia (2.65%)

- Taiwan (2.34%)

- Algeria (2.24%)

- Saudi Arabia (2.23%)

- Germany (2.06%)

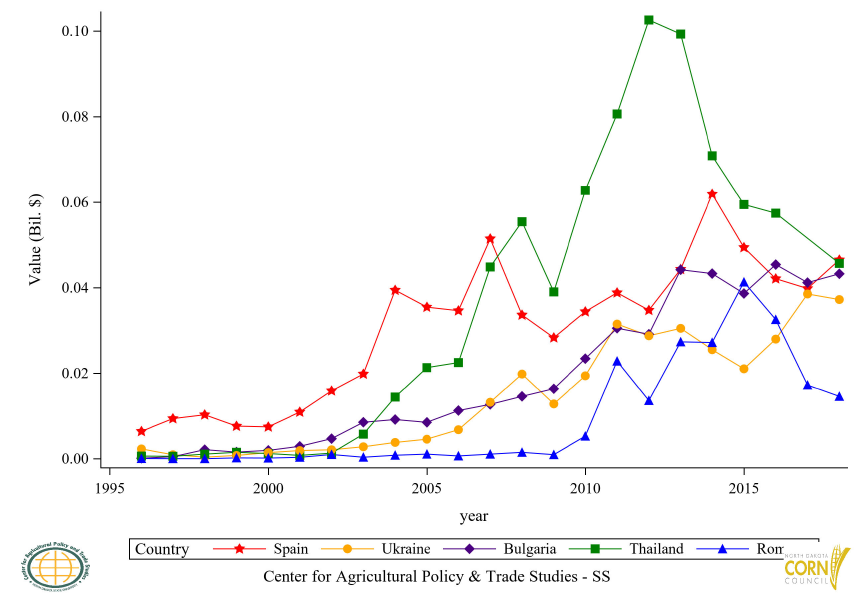

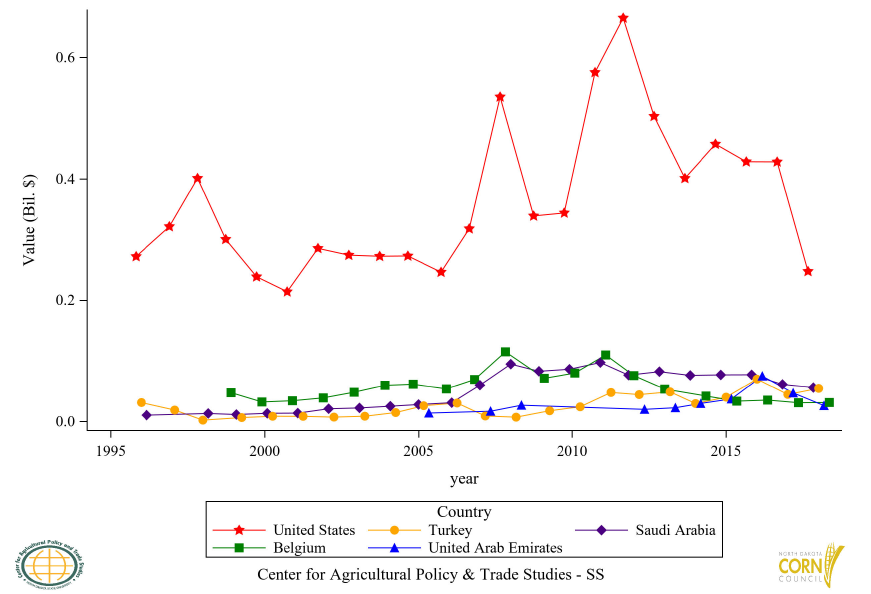

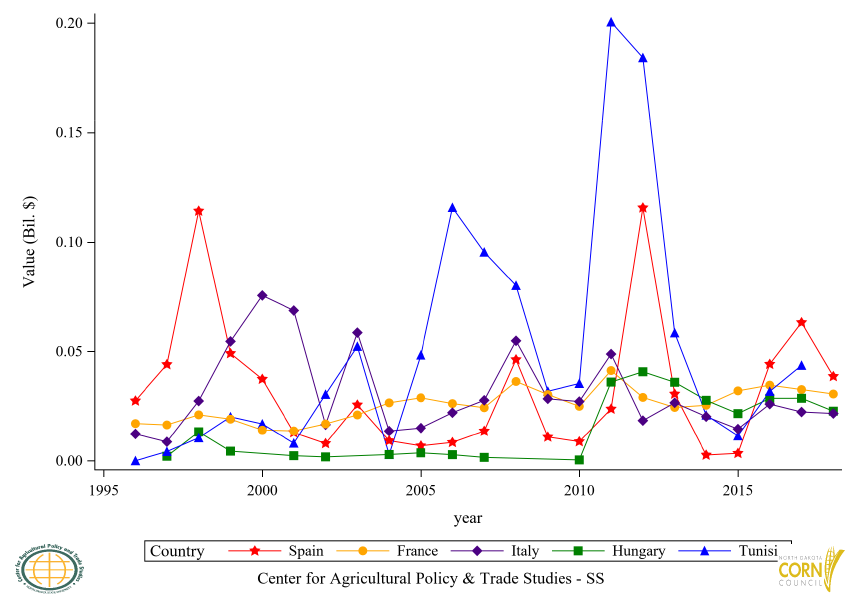

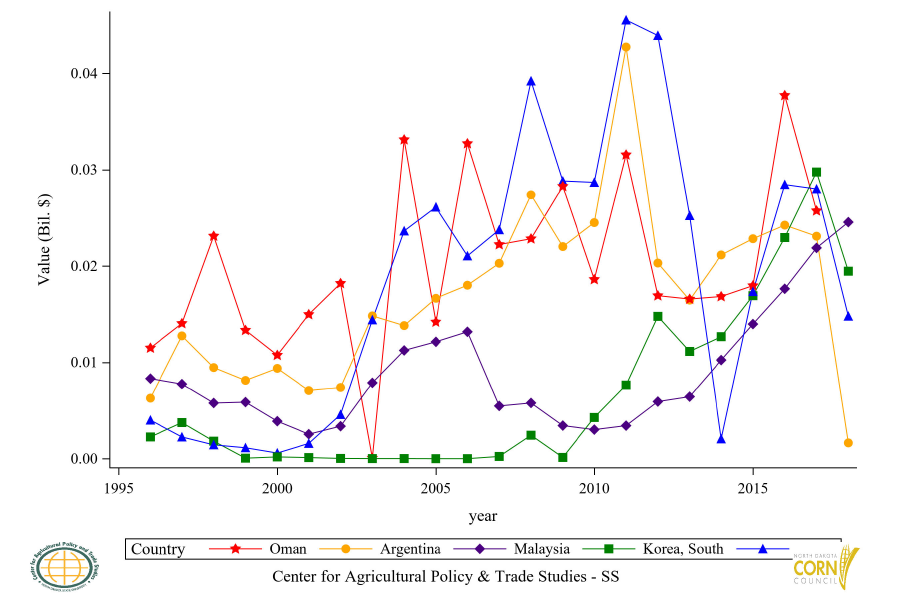

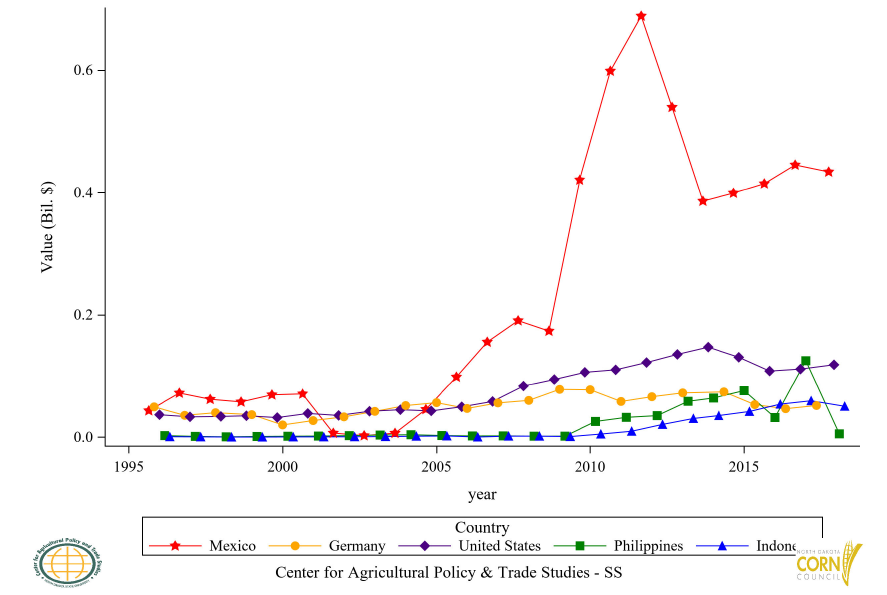

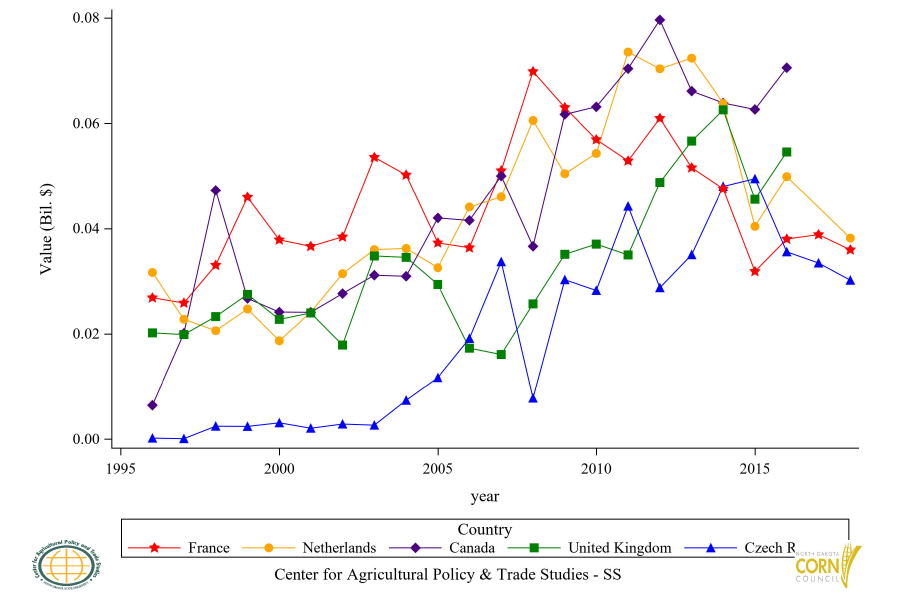

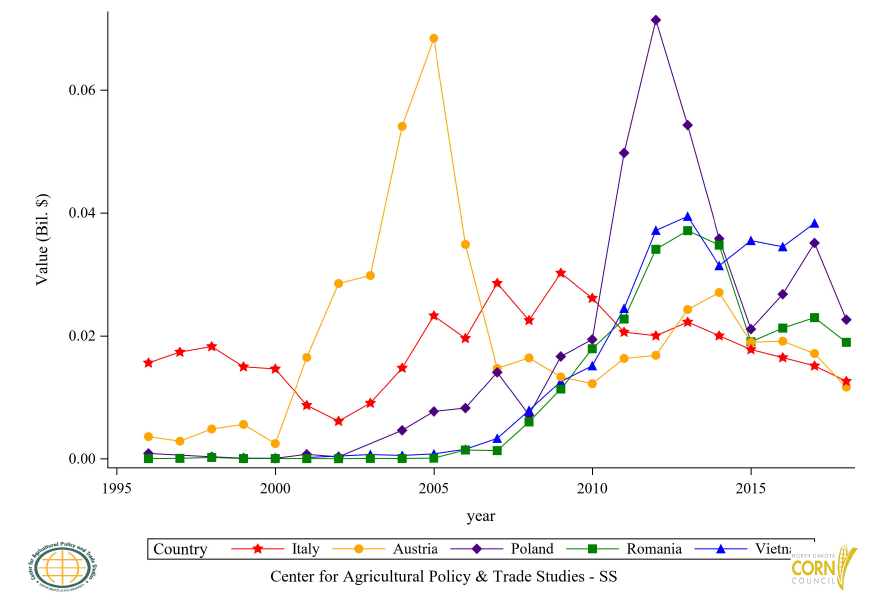

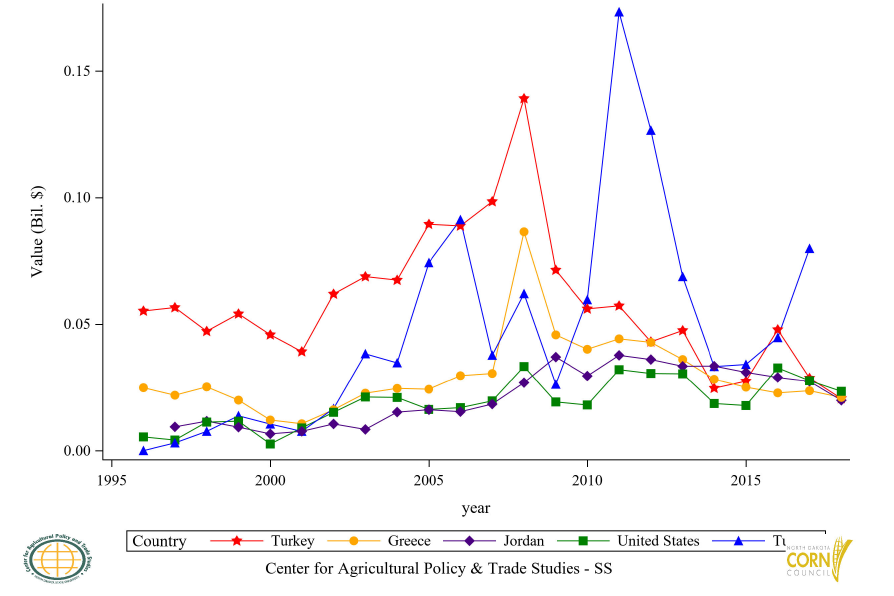

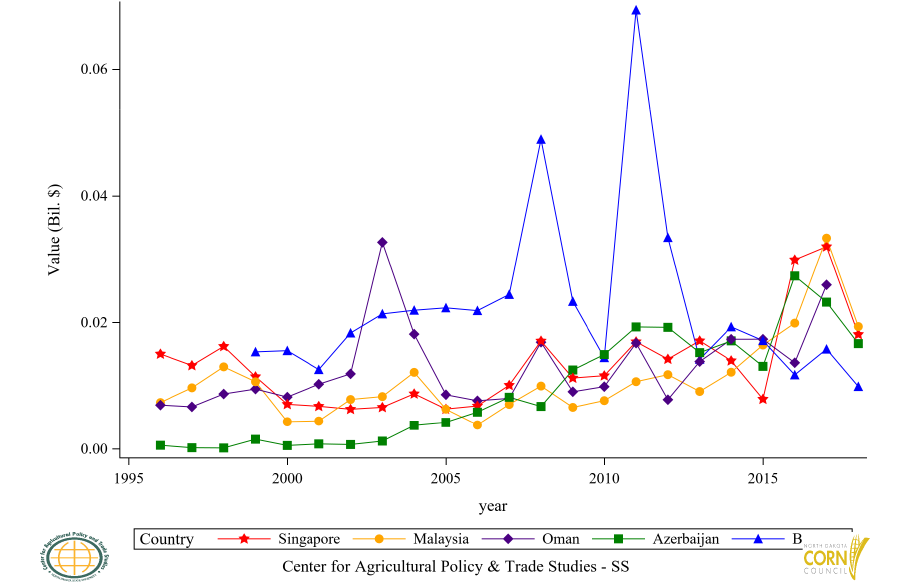

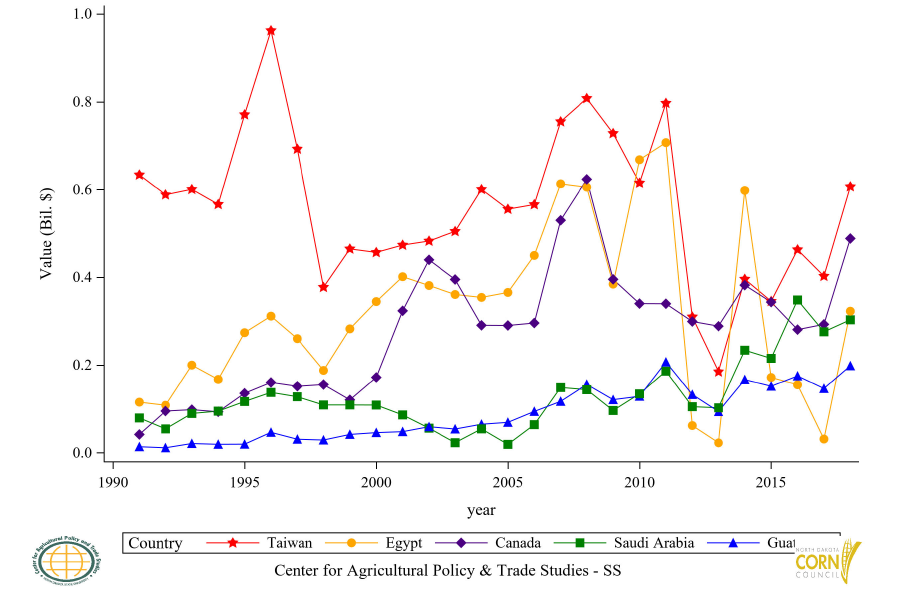

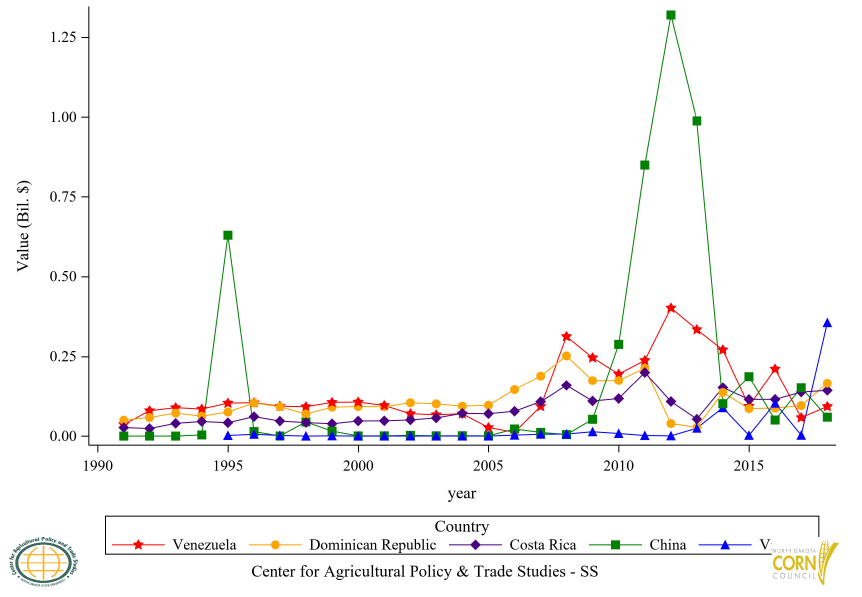

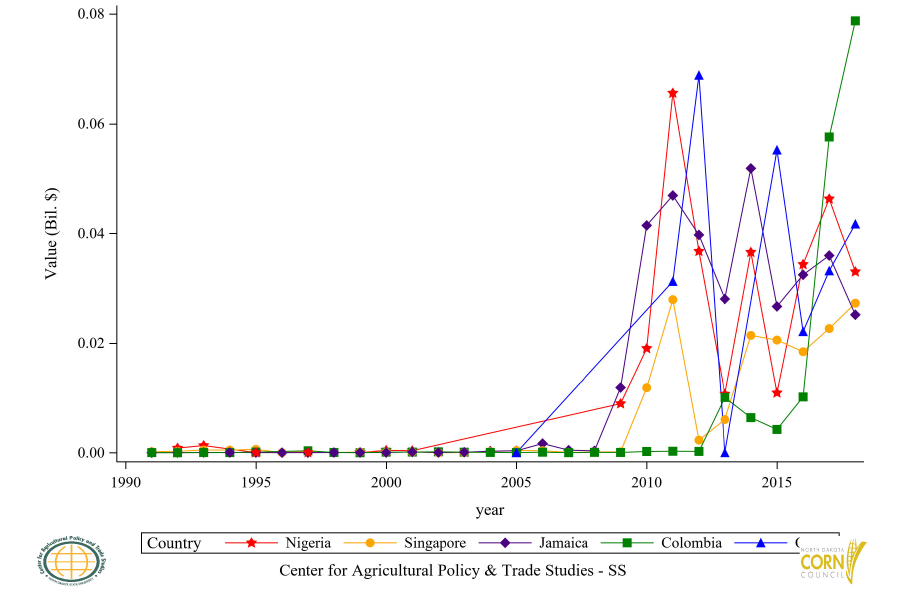

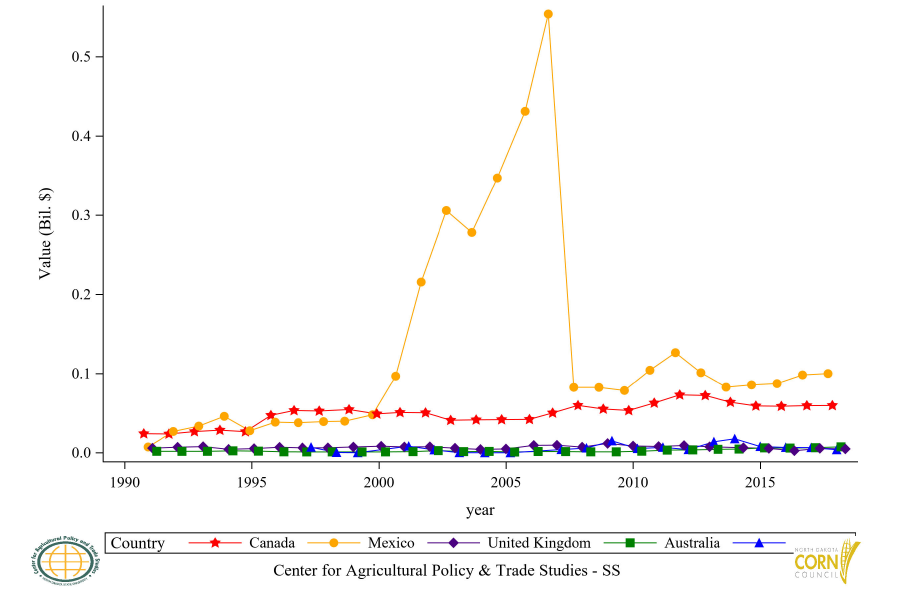

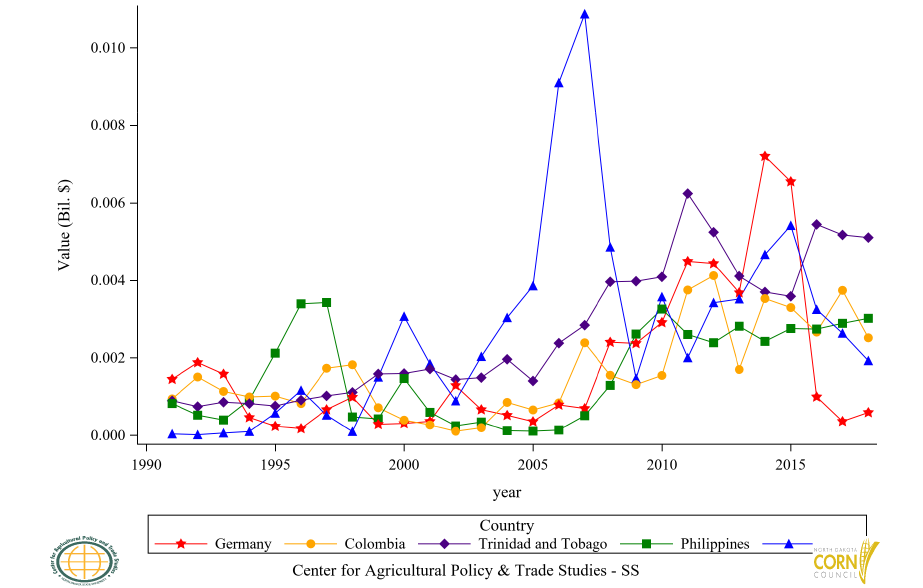

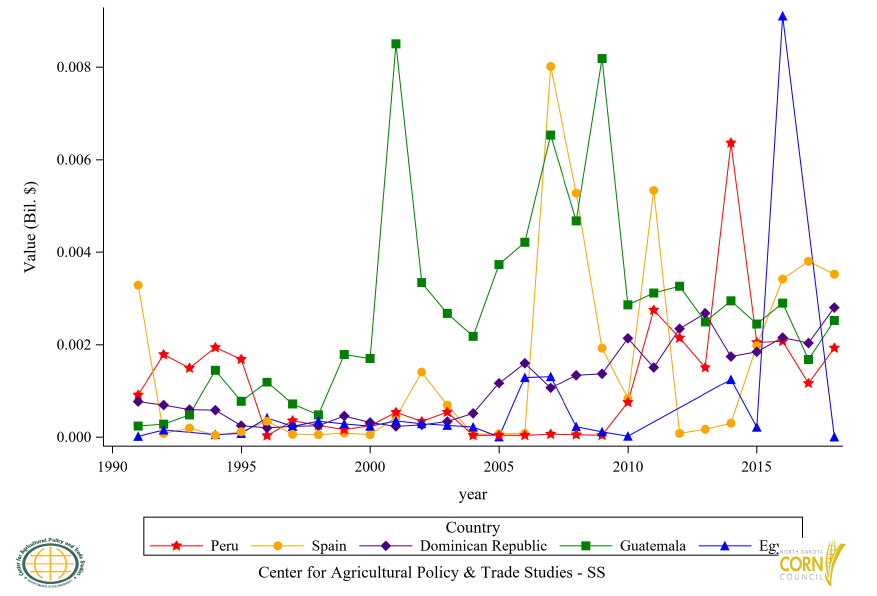

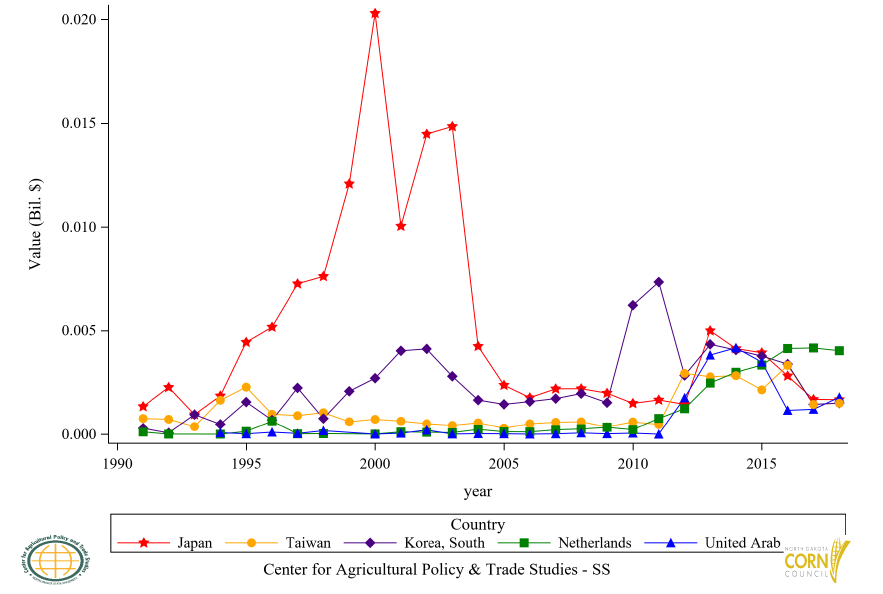

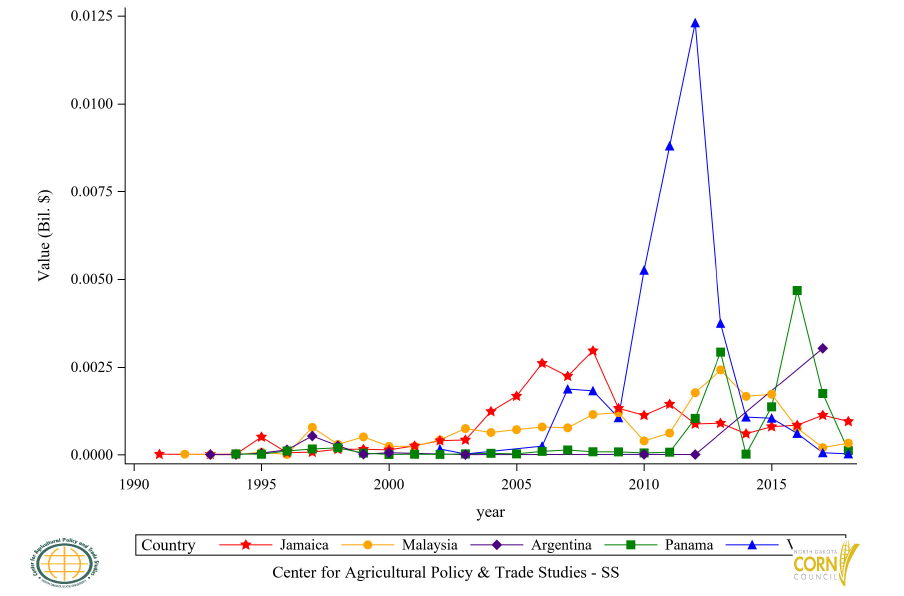

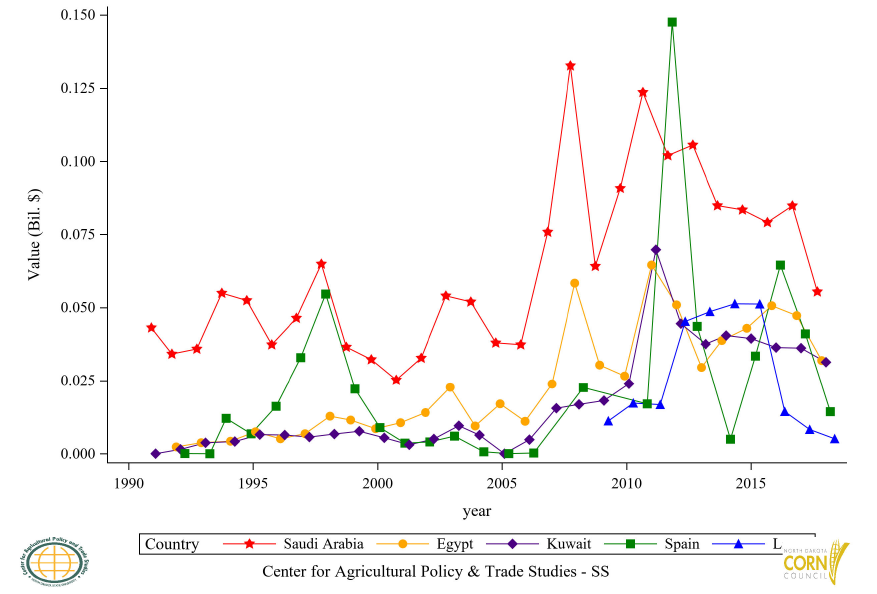

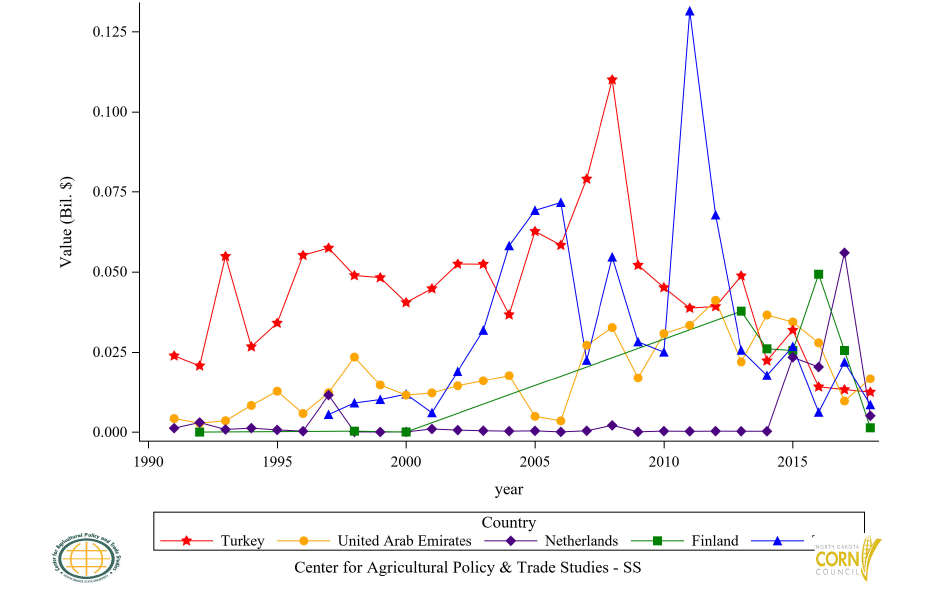

The trends of the import values for the top 15 countries are presented from Figure 29 to Figure 31. Figures 32 to 46 present trends for the top 15 importers for the other byproducts. The details for the descriptive statistics can be found in the appendix.

U.S. States Trend and Risk

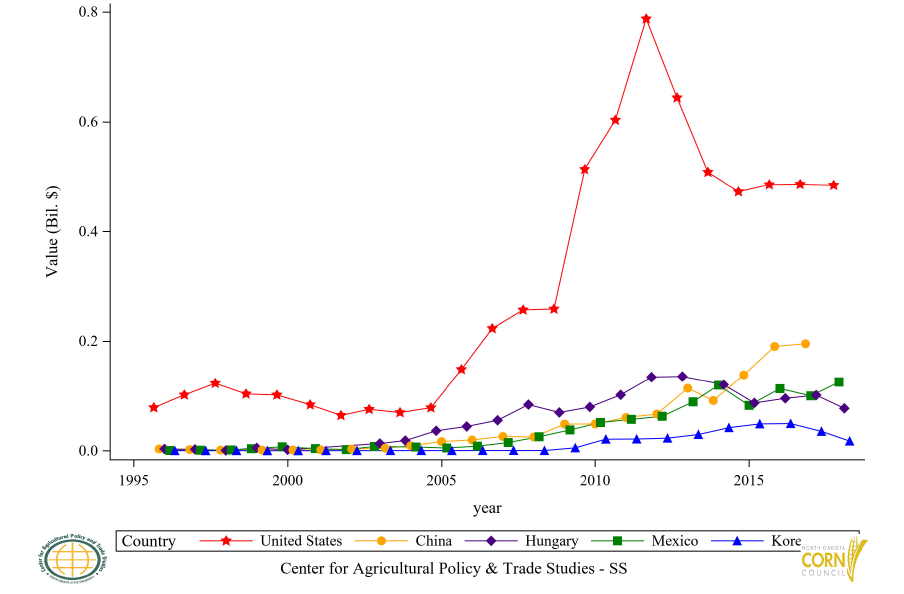

The trend of the share of U.S. corn exports relative to the world is presented in Figure 47. This figure shows that U.S. corn exports are diversified to include processed products. Important by products are corn residue, sugars and oils. The importance of ethyl alcohol continues to grow.

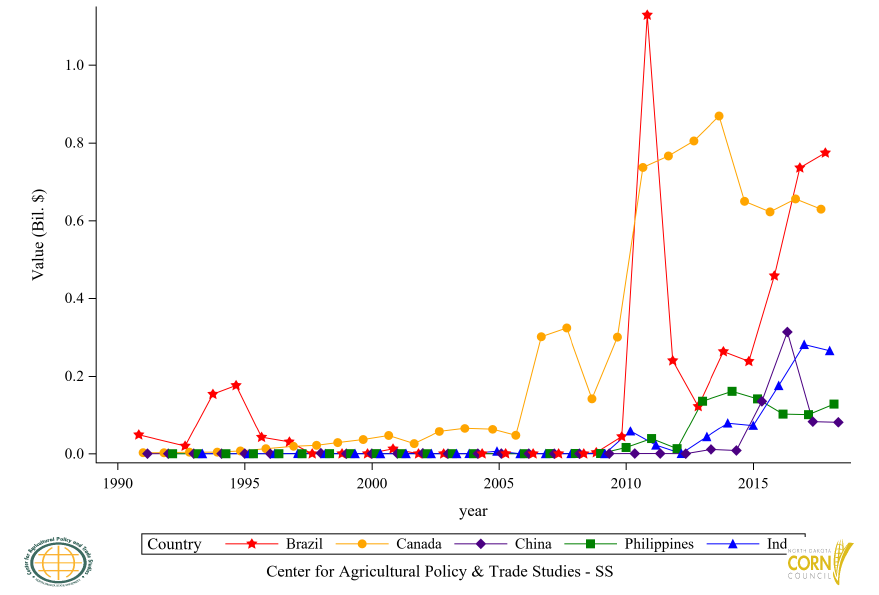

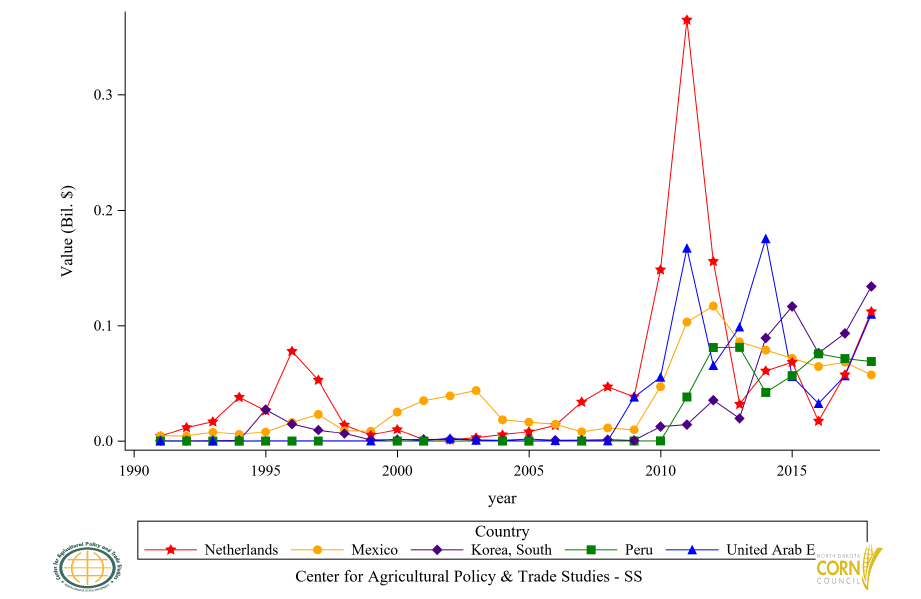

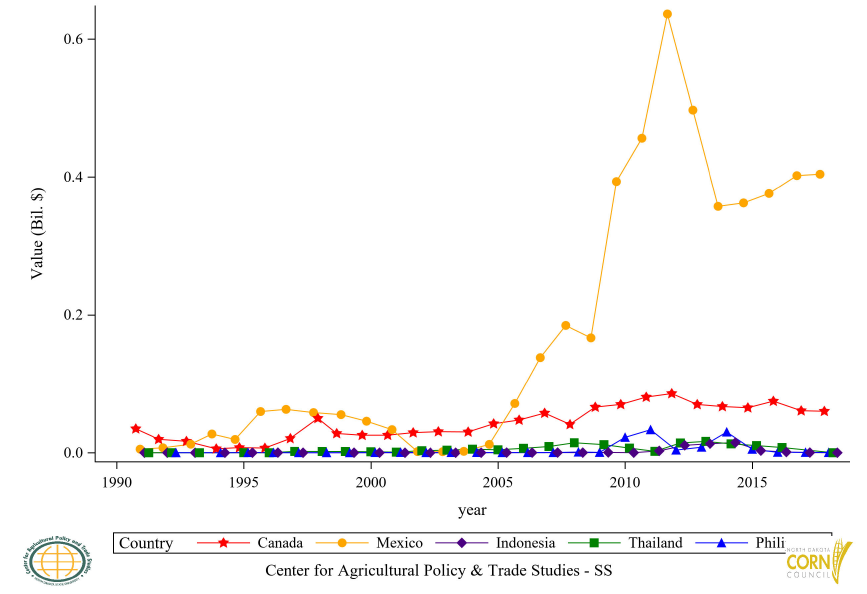

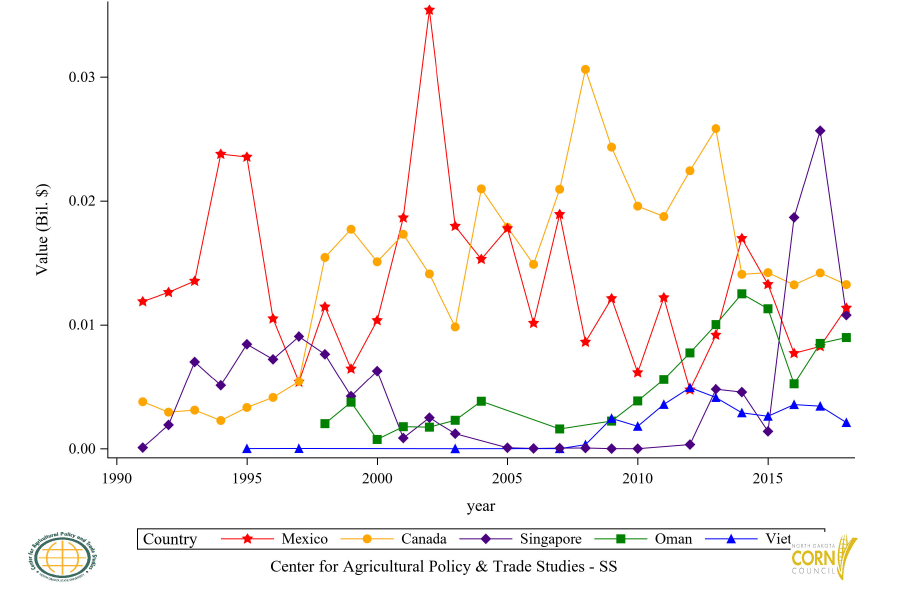

The top 15 U.S. export destinations are:

- Mexico (12.6%)

- Japan (11.3%)

- South Korea (4.37%)

- Colombia (4.02%)

- Peru (2.15%)

- Taiwan (2.10%)

- Canada (1.70%)

- Saudi Arabia (1.32%)

- Egypt (1.17%)

- Guatemala (0.80%)

- Venezuela (0.69%)

- Costa Rica (0.64%)

- Dominican Republic (0.54%)

- Vietnam (0.46%)

- China (0.56%)

The trends of the import values for the top 15 U.S. export destination countries are presented from Figure 48 to 50. Figures 51 to 65 present trends for the top 15 U.S. exporting destinations for the other byproducts. The details for the descriptive statistics can be found in the appendix.

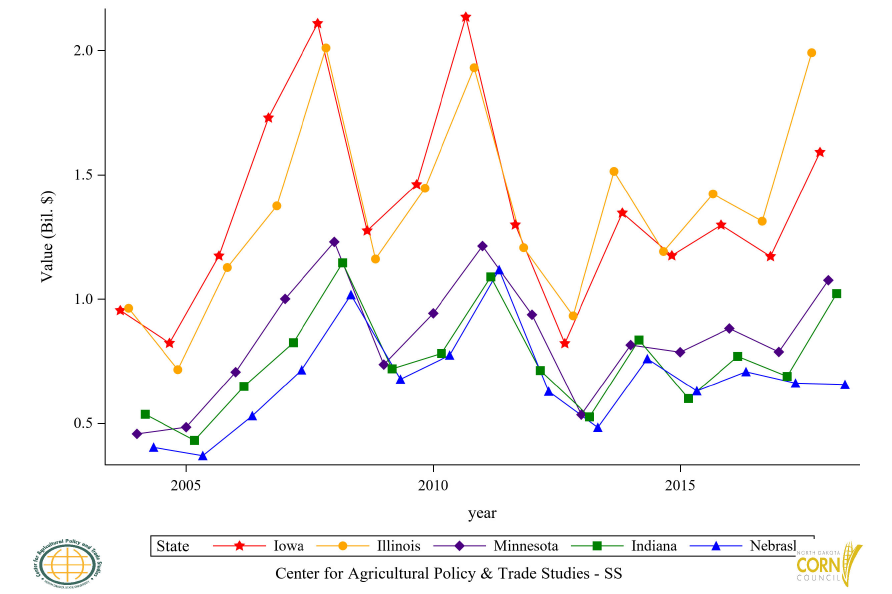

The production-adjusted export trends of the top 15 states are:

- Illinois (14.6%)

- Iowa (12.9%)

- Minnesota (8.54%)

- Indiana (7.70%)

- Nebraska (6.71%)

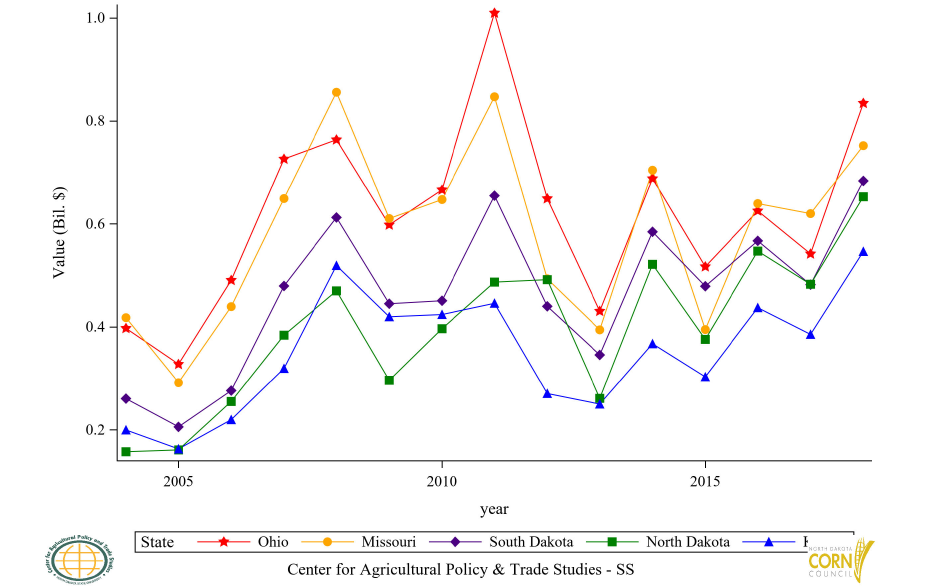

- Ohio (6.30%)

- Missouri (6.11%)

- South Dakota (5.49%)

- North Dakota (5.07%)

- Kansas (4.01%)

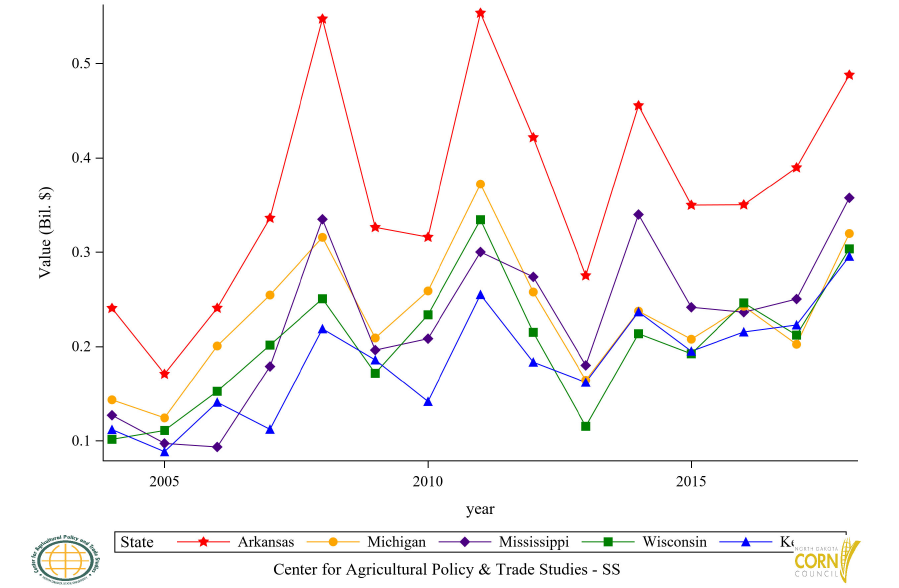

- Arkansas (4%)

- Mississippi (2.80%)

- Michigan (2.38%)

- Wisconsin (2.30%)

- Kentucky (2.29%)

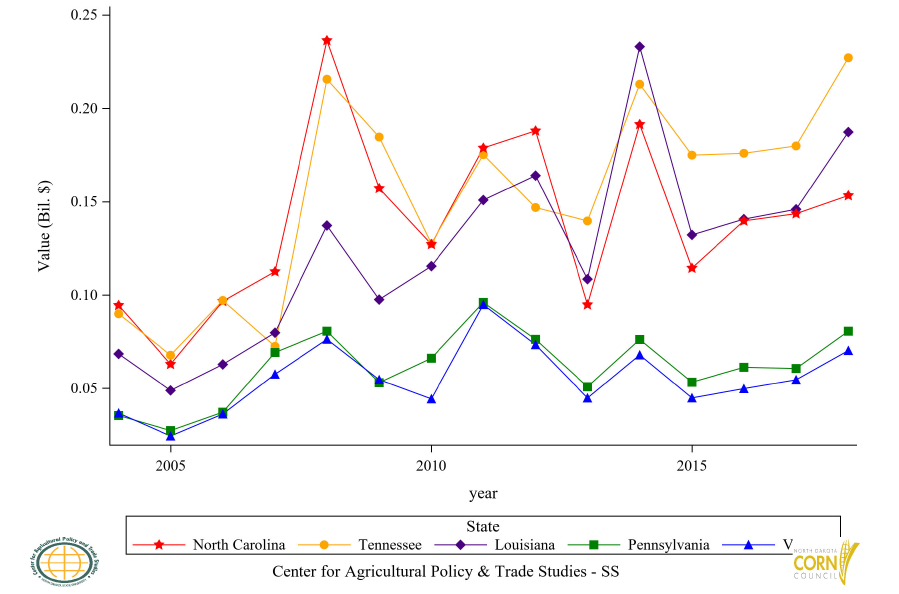

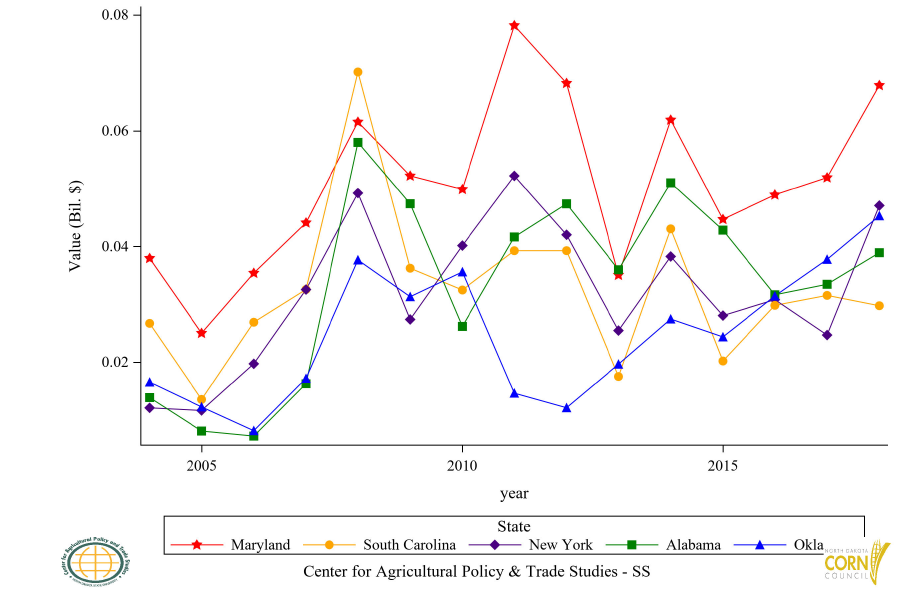

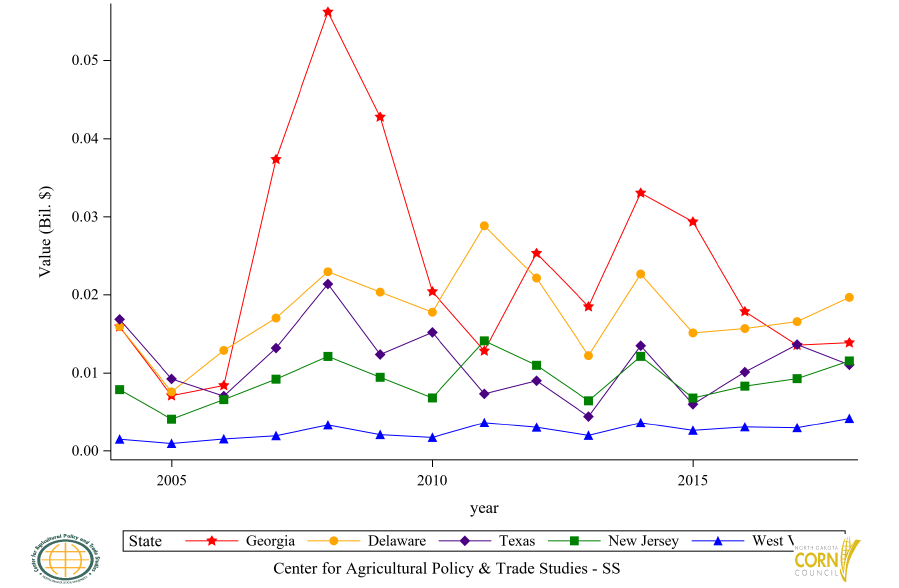

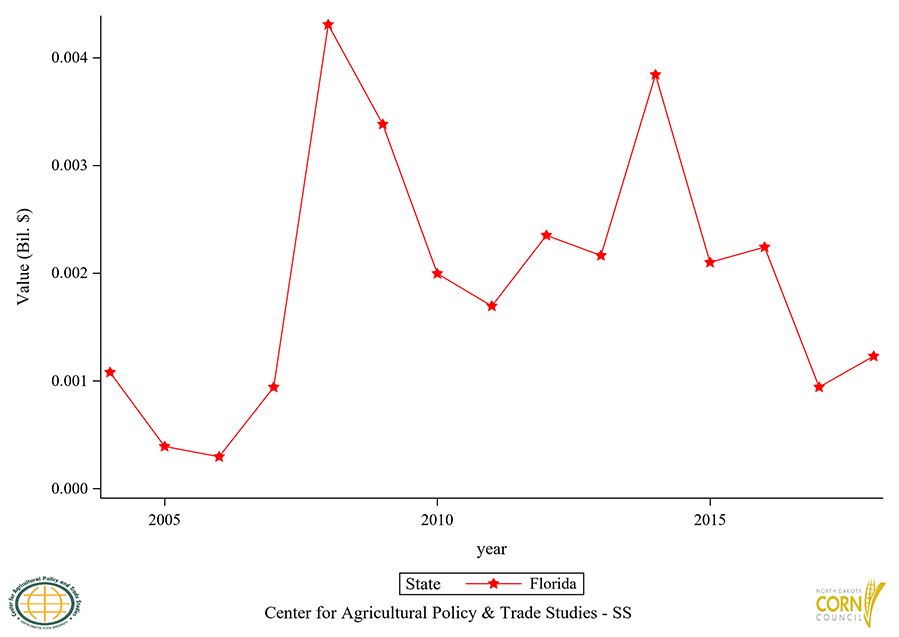

The trends of the indicators for all the exporting states are presented from Figure 66 to Figure 72. The details for other indicators at the global level can be found in the appendix.

- The trends of the indicators for all the exporting states are presented from Figure 66 to Figure 72. The details for other indicators at the global level can be found in the appendix.

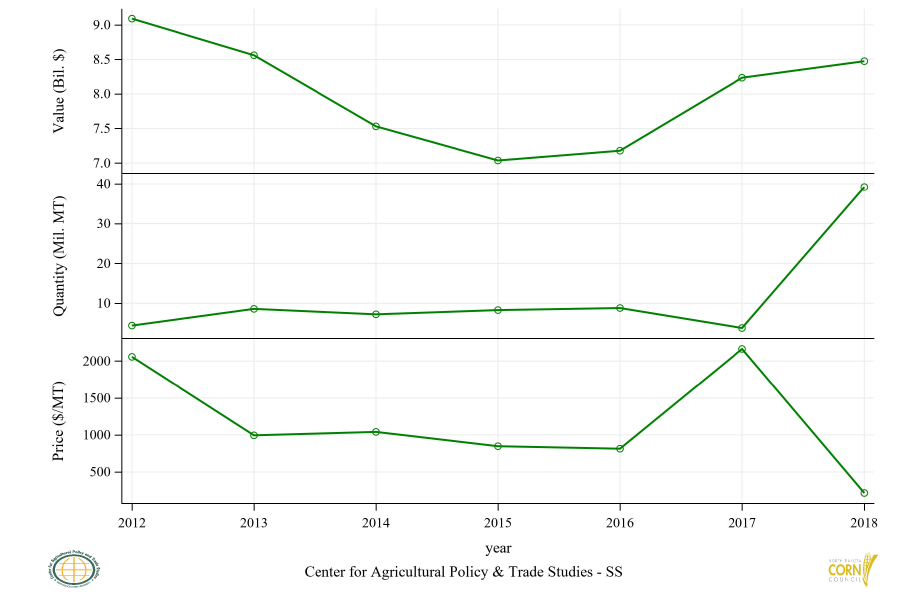

North Dakota Corn Excluding Seed Exports

The USDA FAS reports state export values based on reported port values. Hence, the data obtained from the USDA FAS website do not reflect the actual performance of the individual states in terms of their export and production. To that effect, state representatives have difficulty in negotiating for incentives and farm programs for domestic farmers.

To solve this problem, this report employs a production accounts method to estimate North Dakota corn exports. For consistency, the cash receipts-based method employed by the USDA ERS to estimate state level exports also is obtained. The export value for these three methods are presented in Tables 1, 2 and 3.

A comparison of the three data types is shown in Table 4 for the total export value during the period. We can see that the production accounts method and cash-receipts method yield similar results.

The data from USDA FAS underestimates North Dakota corn exports by about five times relative to the production accounts method. For instance, the production adjusted export value predicts a value of $652,594,412 in 2018, while the FAS method presents a value of $134,183,209. On the other hand, the ERS method predicted $337,701,587 for North Dakota, which is two times less than the production adjusted estimate.

Future Research Proposal

Exports are particularly important for every economy. Furthermore, in the case of North Dakota, where production mostly exceeds domestic consumption, the need to explore foreign market potentials is essential. From this report, we can observe that the current trends of corn trade for North Dakota have been increasing. Evaluating the determinants of North Dakota corn exports is essential.

- The next stage of this research seeks to evaluate the efficiency of U.S. state agricultural exports and their determinants. Of particular interest are the impact of genetically modified restrictive index, tariffs and other transportation costs. The expected outcome of the estimation is to provide the requisite knowledge that will give North Dakota corn farmers a comparative advantage on the international markets, given that these variables have become very instrumental drivers of international trade in recent years.

- The second objective will be to examine the determinants of commodity price volatilities and their impact on North Dakota production and exports.

Section I: Global Temporal Corn Trade

Figure 1: Global Corn and Seed Exports, Annual Trends

Figure 2: Global Ethyl Alcohol Exports, Annual Trends

Figure 3: Global Corn Residue (BWC) Exports, Annual Trends

Figure 4: Global Corn Flour (GHS) Exports, Annual Trends

Figure 5: Global Glucose and Fructose Exports, Annual Trends

Figure 6: Global Corn Oil (CR) Exports, Annual Trends

Figure 7: Global Export Share of Corn Products, 2014-2018

Figure 8: Global Export Value of Corn Products, Annual Trends

Figure 9: Global Export Quantity of Corn Products, Annual Trends

Figure 10: Global Export Price of Corn Products, Annual Trends

Section II: Global Spatial Corn Export

Figure 11: Top 5 Countries Corn and Seed Export Value, Annual Trends

Figure 12: Top 6 to 10 Countries Corn and Seed Export Value, Annual Trends

Figure 13: Top 11 to 15 Countries Corn and Seed Export Value, Annual Trends

Figure 14: Top 5 Countries Ethyl Alcohol Export Value, Annual Trends

Figure 15: Top 6 to 10 Countries Ethyl Alcohol Export Value, Annual Trends

Figure 16: Top 11 to 15 Countries Ethyl Alcohol Export Value, Annual Trends

Figure 17: Top 5 Countries Corn Residue (BWC) Export Value, Annual Trends

Figure 18: Top 6 to 10 Countries Corn Residue (BWC) Export Value, Annual Trends

Figure 19: Top 11 to 15 Countries Corn Residue (BWC) Export Value, Annual Trends

Figure 20: Top 5 Countries Corn Flour (GHS) Export Value, Annual Trends

Figure 21: Top 6 to 10 Countries Corn Flour (GHS) Export Value, Annual Trends

Figure 22: Top 11 to 15 Countries Corn Flour (GHS) Export Value, Annual Trends

Figure 23: Top 5 Countries Glucose and Fructose Export Value, Annual Trends

Figure 24: Top 6 to 10 Countries Glucose and Fructose Export Value, Annual Trends

Figure 25: Top 11 to 15 Countries Glucose and Fructose Export Value, Annual Trends

Figure 26: Top 5 Countries Corn Oil (CR) Export Value, Annual Trends

Figure 27: Top 6 to 10 Countries Corn Oil (CR) Export Value, Annual Trends

Figure 28: Top 11 to 15 Countries Corn Oil (CR) Export Value, Annual Trends

Section III: Global Spatial Corn Import

Figure 29: Top 5 Countries Corn and Seed Import Value, Annual Trends

Figure 30: Top 6 to 10 Countries Corn and Seed Import Value, Annual Trends

Figure 31: Top 11 to 15 Countries Corn and Seed Import Value, Annual Trends

Figure 32: Top 5 Countries Ethyl Alcohol Import Value, Annual Trends

Figure 33: Top 6 to 10 Countries Ethyl Alcohol Import Value, Annual Trends

Figure 34: Top 11 to 15 Countries Ethyl Alcohol Import Value, Annual Trends

Figure 35: Top 5 Countries Corn Residue (BWC) Import Value, Annual Trends

Figure 36: Top 6 to 10 Countries Corn Residue (BWC) Import Value, Annual Trends

Figure 37: Top 11 to 15 Countries Corn Residue (BWC) Import Value, Annual Trends

Figure 38: Top 5 Countries Corn Flour (GHS) Import Value, Annual Trends

Figure 39: Top 6 to 10 Countries Corn Flour (GHS) Import Value, Annual Trends

Figure 40: Top 11 to 15 Countries Corn Flour (GHS) Import Value, Annual Trends

Figure 41: Top 5 Countries Glucose and Fructose Import Value, Annual Trends

Figure 42: Top 6 to 10 Countries Glucose and Fructose Import Value, Annual Trends

Figure 43: Top 11 to 15 Countries Glucose and Fructose Import Value, Annual Trends

Figure 44: Top 5 Countries Corn Oil (CR) Import Value, Annual Trends

Figure 45: Top 6 to 10 Countries Corn Oil (CR) Import Value, Annual Trends

Figure 46: Top 11 to 15 Countries Corn Oil (CR) Import Value, Annual Trends

Section IV: U.S. Temporal Corn Export

Figure 47: U.S. Share of Exports Relative to the World, Annual Trends

Section V: U.S. Spatial Corn Export

Figure 48: U.S. Corn and Seed Export Value to Top 5 Countries, Annual Trends

Figure 49: U.S. Corn and Seed Export Value to Top 6 to 10 Countries, Annual Trends

Figure 50: U.S. Corn and Seed Export Value to Top 11 to 15 Countries, Annual Trends

Figure 51: U.S. Ethyl Alcohol Export Value to Top 5 Countries, Annual Trends

Figure 52: U.S. Ethyl Alcohol Export Value to Top 6 to 10 Countries, Annual Trends

Figure 53: U.S. Ethyl Alcohol Export Value to Top 11 to 15 Countries, Annual Trends

Figure 54: U.S. Corn Residue (BWC) Export Value to Top 5 Countries, Annual Trends

Figure 55: U.S. Corn Residue (BWC) Export Value to Top 6 to 10 Countries, Annual Trends

Figure 56: U.S. Corn Residue (BWC) Export Value to Top 11 to 15 Countries, Annual Trends

Figure 57: U.S. Corn Flour (GHS) Export Value to Top 5 Countries, Annual Trends

Figure 58: U.S. Corn Flour (GHS) Export Value to Top 6 to 10 Countries, Annual Trends

Figure 59: U.S. Corn Flour (GHS) Export Value to Top 11 to 15 Countries, Annual Trends

Figure 60: U.S. Glucose and Fructose Export Value to Top 5 Countries, Annual Trends

Figure 61: U.S. Glucose and Fructose Export Value to Top 6 to 10 Countries, Annual Trends

Figure 62: U.S. Glucose and Fructose Export Value to Top 11 to 15 Countries, Annual Trends

Figure 63: U.S. Corn Oil (CR) Export Value to Top 5 Countries, Annual Trends

Figure 64: U.S. Corn Oil (CR) Export Value to Top 6 to 10 Countries, Annual Trends

Figure 65: U.S. Corn Oil (CR) Export Value to Top 11 to 15 Countries, Annual Trends

Section VI: U.S. State Level Corn Export

Figure 66: U.S. Corn Excluding Seed Export Value of Top 5 States, Annual Trends

Figure 67: U.S. Corn Excluding Seed Export Value of Top 6 to 10 States, Annual Trends

Figure 68: U.S. Corn Excluding Seed Export Value of Top 11 to 15 States, Annual Trends

Figure 69: U.S. Corn Excluding Seed Export Value of Top 16 to 20 States, Annual Trends

Figure 70: U.S. Corn Excluding Seed Export Value of Top 21 to 25 States, Annual Trends

Figure 71: U.S. Corn Excluding Seed Export Value of Top 26 to 30 States, Annual Trends

Figure 72. U.S. Corn Excluding Seed Export Value of Top 31 to 35 States, Annual Trends

Table 1: NDSU Estimate of U.S. State Corn Grain Export Value, Annual Trends.

|

Reporter |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

|

Alabama |

26,173,819 |

41,624,953 |

47,364,118 |

35,959,929 |

50,999,370 |

42,810,036 |

31,639,862 |

33,447,903 |

38,908,101 |

|

Arkansas |

315,905,196 |

553,447,252 |

421,672,458 |

275,154,152 |

455,478,630 |

349,854,895 |

350,231,958 |

389,774,431 |

487,852,592 |

|

Delaware |

17,754,412 |

28,847,069 |

22,125,851 |

12,200,251 |

22,638,566 |

15,108,248 |

15,667,092 |

16,550,961 |

19,648,420 |

|

Florida |

1,995,232 |

1,693,218 |

2,349,968 |

2,163,006 |

3,841,229 |

2,099,003 |

2,241,065 |

941,612 |

1,228,389 |

|

Georgia |

20,391,589 |

12,804,964 |

25,333,170 |

18,463,191 |

33,041,081 |

29,357,229 |

17,840,202 |

13,545,536 |

13,857,638 |

|

Illinois |

1,445,737,642 |

1,930,268,992 |

1,206,457,554 |

932,444,046 |

1,513,873,985 |

1,190,998,563 |

1,422,665,547 |

1,312,901,813 |

1,990,631,034 |

|

Indiana |

781,481,199 |

1,089,199,446 |

712,654,856 |

525,798,116 |

835,408,747 |

599,749,072 |

769,565,993 |

688,944,458 |

1,021,985,329 |

|

Iowa |

1,461,008,397 |

2,134,106,193 |

1,298,266,837 |

821,665,347 |

1,346,266,454 |

1,174,609,867 |

1,297,824,615 |

1,171,341,511 |

1,590,846,365 |

|

Kansas |

423,986,846 |

445,802,459 |

270,374,988 |

249,853,515 |

367,245,651 |

302,874,948 |

437,262,800 |

385,456,381 |

546,299,461 |

|

Kentucky |

141,628,365 |

255,026,058 |

183,478,257 |

162,039,127 |

236,770,815 |

195,113,920 |

215,502,864 |

222,910,176 |

295,551,266 |

|

Louisiana |

115,431,676 |

150,850,368 |

164,016,994 |

108,476,351 |

233,055,186 |

132,159,791 |

140,599,531 |

145,885,057 |

187,367,273 |

|

Maryland |

49,872,919 |

78,188,066 |

68,221,158 |

35,037,291 |

61,882,582 |

44,681,425 |

48,920,718 |

51,909,132 |

67,855,182 |

|

Michigan |

258,936,979 |

372,206,251 |

257,803,521 |

164,256,081 |

237,545,843 |

207,853,648 |

242,708,435 |

202,470,065 |

319,720,746 |

|

Minnesota |

942,557,952 |

1,213,096,926 |

937,049,668 |

534,524,354 |

815,171,220 |

786,441,506 |

881,927,125 |

787,575,250 |

1,075,605,748 |

|

Mississippi |

208,406,343 |

300,161,446 |

273,813,215 |

180,075,797 |

339,818,569 |

241,652,448 |

236,442,040 |

250,365,779 |

357,517,627 |

|

Missouri |

647,133,197 |

846,987,972 |

493,331,843 |

394,282,194 |

704,429,072 |

394,820,361 |

639,326,879 |

619,842,915 |

752,104,187 |

|

Nebraska |

774,236,850 |

1,117,524,153 |

628,357,938 |

482,999,250 |

759,697,740 |

630,228,420 |

707,498,676 |

661,633,237 |

656,075,987 |

|

New Jersey |

6,791,150 |

14,089,843 |

10,965,871 |

6,423,444 |

12,109,638 |

6,780,093 |

8,300,404 |

9,260,117 |

11,522,469 |

|

New York |

40,133,084 |

52,202,223 |

42,003,953 |

25,454,584 |

38,251,969 |

28,042,495 |

30,802,806 |

24,680,383 |

47,058,648 |

|

North Carolina |

127,127,049 |

178,838,356 |

188,027,553 |

94,832,009 |

191,475,508 |

114,408,266 |

139,684,460 |

143,532,703 |

153,266,833 |

|

North Dakota |

396,507,583 |

486,941,396 |

491,640,383 |

260,959,447 |

521,351,099 |

375,775,531 |

547,032,540 |

482,727,166 |

652,594,412 |

|

Ohio |

666,044,791 |

1,009,431,826 |

648,959,108 |

430,591,447 |

687,980,961 |

516,874,655 |

625,122,183 |

541,724,649 |

834,502,937 |

|

Oklahoma |

35,586,899 |

14,607,572 |

12,085,549 |

19,643,798 |

27,446,884 |

24,356,622 |

31,431,825 |

37,748,520 |

45,279,602 |

|

Pennsylvania |

66,128,936 |

96,027,433 |

76,273,241 |

50,788,305 |

76,205,266 |

53,256,241 |

61,272,211 |

60,621,223 |

80,636,100 |

|

South Carolina |

32,461,824 |

39,251,881 |

39,254,362 |

17,511,790 |

43,029,362 |

20,193,139 |

29,815,118 |

31,532,941 |

29,748,813 |

|

South Dakota |

450,777,374 |

654,624,891 |

439,915,697 |

345,542,142 |

584,494,016 |

478,880,468 |

566,929,811 |

482,002,574 |

683,630,369 |

|

Tennessee |

127,542,657 |

175,273,761 |

146,852,330 |

139,636,357 |

212,959,264 |

175,002,208 |

175,988,731 |

179,941,107 |

227,118,441 |

|

Texas |

15,173,228 |

7,311,625 |

8,985,829 |

4,405,294 |

13,466,275 |

5,979,872 |

10,101,106 |

13,615,939 |

11,026,809 |

|

Virginia |

44,289,423 |

94,851,587 |

73,391,303 |

44,753,380 |

67,892,098 |

44,816,184 |

49,811,256 |

54,539,745 |

70,257,988 |

|

West Virginia |

1,703,439 |

3,609,848 |

3,015,792 |

1,966,734 |

3,597,083 |

2,614,706 |

3,057,760 |

2,949,774 |

4,155,208 |

|

Wisconsin |

233,697,685 |

334,335,098 |

215,112,439 |

115,312,605 |

213,654,808 |

192,398,740 |

246,274,267 |

212,194,841 |

303,474,308 |

Table 2: FAS Estimate of U.S. State Corn Grain Export Value, Annual Trends.

|

Reporter |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

|

Alabama |

34,716,607 |

. |

9,754,265 |

6,419,243 |

23,848,117 |

46,955 |

21,780 |

11,000 |

24,945 |

|

Alaska |

. |

. |

. |

. |

. |

. |

978,670 |

. |

. |

|

Arizona |

. |

26,034 |

25,501 |

9,912 |

23,961 |

. |

34,164 |

25,907 |

33,574 |

|

Arkansas |

. |

4,596,593 |

4,706,259 |

5,963,638 |

10,594,436 |

184,999 |

. |

. |

3,707,450 |

|

California |

38,608,040 |

31,562,613 |

22,223,909 |

37,129,983 |

19,354,187 |

13,409,608 |

15,081,212 |

12,092,151 |

11,733,298 |

|

Colorado |

3,979,586 |

12,416,909 |

1,438,190 |

2,864,276 |

5,260,694 |

3,384,282 |

9,583,554 |

1,269,494 |

19,473,166 |

|

Connecticut |

169,032,653 |

127,085,742 |

39,305 |

. |

4,958 |

12,902 |

2,206,640 |

65,018 |

2,495,242 |

|

Delaware |

. |

. |

. |

. |

30,720 |

4,536 |

. |

6,737,278 |

1,550,223 |

|

Florida |

3,377,652 |

7,266,910 |

2,121,445 |

15,910,852 |

1,873,905 |

2,949,063 |

3,752,378 |

1,733,719 |

5,010,728 |

|

Georgia |

7,627,334 |

1,768,181 |

2,886,409 |

1,240,654 |

532,492 |

54,470 |

92,167 |

917,449 |

2,346,296 |

|

Hawaii |

9,865 |

. |

. |

84,087 |

274,766 |

. |

. |

28,092 |

. |

|

Idaho |

2,658,367 |

401,556 |

101,489 |

603,057 |

2,141,683 |

91,812 |

68,299 |

26,237 |

3,260,095 |

|

Illinois |

447,832,696 |

733,550,745 |

511,974,466 |

657,771,692 |

1,008,456,636 |

708,896,992 |

504,743,230 |

433,249,827 |

829,134,925 |

|

Indiana |

41,767,638 |

35,116,977 |

38,787,756 |

46,659,489 |

61,681,087 |

79,216,473 |

55,823,850 |

67,394,533 |

44,161,064 |

|

Iowa |

401,253,223 |

733,890,595 |

887,916,560 |

539,960,724 |

1,145,681,143 |

966,229,035 |

1,176,124,824 |

1,184,048,710 |

1,441,396,092 |

|

Kansas |

215,900,047 |

249,707,330 |

106,868,939 |

255,179,408 |

281,136,247 |

212,769,600 |

304,939,213 |

217,675,627 |

194,918,897 |

|

Kentucky |

7,519,770 |

8,764,309 |

7,422,900 |

1,331,335 |

2,321,019 |

14,061,614 |

2,903,478 |

3,405,043 |

3,129,965 |

|

Louisiana |

4,989,696,005 |

7,190,836,624 |

4,710,476,567 |

3,283,377,169 |

5,404,078,218 |

4,020,538,238 |

4,493,936,202 |

4,185,334,437 |

4,894,774,277 |

|

Maine |

. |

. |

4,726 |

6,484,895 |

635,223 |

183,740 |

45,925 |

. |

45,421 |

|

Maryland |

926,645 |

52,632 |

4,682,812 |

1,090,127 |

208,922 |

548,214 |

466,758 |

1,029,238 |

247,719 |

|

Massachusetts |

20,703 |

. |

23,895 |

23,947 |

9,186 |

. |

. |

32,181 |

. |

|

Michigan |

35,890,132 |

43,210,268 |

4,006,943 |

2,467,592 |

39,773,447 |

25,422,504 |

16,773,037 |

18,586,688 |

33,350,754 |

|

Minnesota |

189,294,729 |

392,579,176 |

185,872,238 |

112,108,491 |

195,564,309 |

126,468,052 |

169,817,962 |

195,471,804 |

135,332,694 |

|

Mississippi |

. |

3,346,921 |

10,512,100 |

8,700,824 |

. |

. |

562,982 |

194,064 |

. |

|

Missouri |

134,462,425 |

177,689,176 |

262,892,377 |

109,883,441 |

167,811,191 |

231,982,780 |

231,742,083 |

247,670,341 |

263,937,162 |

|

Montana |

982,941 |

519,192 |

788,697 |

714,944 |

628,472 |

1,528,062 |

2,600,857 |

2,569,082 |

19,973,642 |

|

Nebraska |

438,284,353 |

646,853,697 |

574,637,247 |

144,176,236 |

194,659,736 |

229,580,529 |

343,966,130 |

429,565,846 |

447,420,498 |

|

Nevada |

57,400 |

40,654 |

. |

. |

69,750 |

. |

. |

. |

. |

|

New Jersey |

411,124 |

1,039,736 |

2,092,023 |

1,108,810 |

926,434 |

918,590 |

225,282 |

349,435 |

226,330 |

|

New Mexico |

3,365,531 |

3,342,966 |

5,754,203 |

5,784,317 |

3,278,652 |

3,495,337 |

3,943,659 |

4,222,355 |

7,073,855 |

|

New York |

130,492,731 |

46,305,410 |

54,802,562 |

4,827,621 |

4,862,019 |

4,174,000 |

7,285,873 |

1,523,473 |

3,471,391 |

|

North Carolina |

630,530 |

552,510 |

17,117 |

6,261,191 |

3,187,624 |

1,294,031 |

842,911 |

19,224 |

939,198 |

|

North Dakota |

82,289,805 |

59,113,932 |

84,033,573 |

75,667,677 |

27,735,598 |

82,134,314 |

89,292,071 |

69,436,021 |

134,183,209 |

|

Ohio |

34,274,110 |

33,769,085 |

32,877,932 |

96,459,078 |

87,965,749 |

65,688,228 |

97,358,974 |

54,807,083 |

47,377,789 |

|

Oklahoma |

. |

861,596 |

. |

283,284 |

. |

. |

. |

5,421,991 |

2,691,606 |

|

Oregon |

77,072,958 |

96,191,789 |

75,234,342 |

57,863,558 |

22,377,766 |

12,094,924 |

56,731,521 |

72,723,213 |

149,612,067 |

|

Pennsylvania |

991,163 |

1,145,742 |

1,248,835 |

2,532,065 |

2,339,283 |

606,763 |

346,061 |

749,611 |

1,124,755 |

|

Puerto Rico |

26,815 |

15,820 |

19,579 |

56,937 |

5,339 |

31,074 |

15,091 |

10,551 |

66,150 |

|

South Carolina |

385,804 |

16,962 |

. |

667,534 |

590,036 |

1,562,763 |

14,647,217 |

60,225 |

168,295 |

|

South Dakota |

4,230,703 |

23,807 |

357,281 |

18,420,405 |

172,819 |

6,719,014 |

7,429,689 |

14,121,965 |

8,915,985 |

|

Tennessee |

20,334 |

189,952 |

16,343 |

552,998 |

. |

4,874,654 |

. |

133,063 |

16,813 |

|

Texas |

326,451,305 |

343,512,660 |

88,331,351 |

84,988,821 |

73,342,649 |

62,671,607 |

172,194,405 |

112,711,758 |

95,493,871 |

|

Utah |

230,557 |

20,999 |

28,008 |

123,968 |

52,784 |

107,629 |

110,677 |

25,748 |

. |

|

Vermont |

69,468 |

58,525 |

202,243 |

79,116 |

162,562 |

479,712 |

80,367 |

50,746 |

. |

|

Virgin Islands |

490,474 |

. |

. |

. |

. |

. |

. |

. |

. |

|

Virginia |

108,866,765 |

103,838,847 |

46,113,415 |

57,835,210 |

145,630,111 |

58,718,198 |

51,190,704 |

10,763,586 |

24,687,480 |

|

Washington |

1,944,958,439 |

2,599,445,013 |

1,649,271,071 |

834,818,481 |

1,751,248,565 |

1,418,342,789 |

2,103,228,076 |

1,880,065,016 |

3,713,992,731 |

|

West Virginia |

. |

. |

. |

. |

. |

. |

12,029,211 |

. |

. |

|

Wisconsin |

39,906,647 |

54,045,107 |

18,302,810 |

8,185,282 |

12,315,858 |

25,241,992 |

42,361,311 |

13,459,499 |

24,022,254 |

|

Wyoming |

. |

. |

224,474 |

. |

. |

. |

. |

. |

. |

Table 3: ERS Estimate of U.S. State Corn Grain Export Value, Annual Trends.

|

Reporter |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

|

Alabama |

27,024,048 |

33,465,421 |

25,542,396 |

20,488,604 |

37,042,412 |

26,234,117 |

28,648,344 |

27,960,699 |

41,445,189 |

|

Arizona |

3,967,449 |

6,374,915 |

5,457,336 |

4,549,638 |

8,375,551 |

5,379,481 |

8,365,372 |

7,682,691 |

6,137,702 |

|

Arkansas |

49,090,535 |

68,768,877 |

81,832,625 |

82,648,534 |

125,816,844 |

64,286,419 |

84,418,410 |

82,827,320 |

112,105,289 |

|

California |

30,774,195 |

35,553,039 |

24,445,317 |

19,131,040 |

26,477,543 |

10,302,699 |

12,605,373 |

14,502,037 |

13,873,032 |

|

Colorado |

134,275,543 |

189,940,571 |

125,561,917 |

69,902,496 |

106,002,056 |

87,452,804 |

104,535,901 |

100,295,455 |

151,867,083 |

|

Delaware |

18,714,486 |

24,776,806 |

19,397,123 |

14,235,354 |

23,392,682 |

19,015,509 |

22,509,019 |

20,752,688 |

27,271,843 |

|

Florida |

2,696,596 |

3,298,976 |

3,399,730 |

3,859,034 |

6,667,417 |

3,535,254 |

4,558,462 |

4,117,492 |

8,106,369 |

|

Georgia |

42,486,634 |

49,519,449 |

46,018,107 |

41,116,308 |

64,315,258 |

34,221,725 |

41,318,553 |

36,993,417 |

51,109,338 |

|

Idaho |

15,130,558 |

24,859,493 |

20,874,637 |

14,594,609 |

16,546,546 |

10,480,701 |

14,302,983 |

16,028,094 |

26,468,806 |

|

Illinois |

1,670,923,501 |

2,290,903,223 |

1,459,146,653 |

806,865,745 |

1,820,489,328 |

1,336,373,673 |

1,565,070,870 |

1,413,486,544 |

2,002,812,469 |

|

Indiana |

725,770,816 |

1,110,404,375 |

630,353,015 |

399,500,134 |

895,922,307 |

640,048,512 |

642,046,825 |

664,564,484 |

875,156,364 |

|

Iowa |

1,720,966,660 |

2,489,273,252 |

1,728,165,656 |

1,090,663,768 |

1,587,676,202 |

1,414,348,888 |

1,790,825,953 |

1,587,508,590 |

2,127,909,904 |

|

Kansas |

517,672,344 |

481,251,584 |

312,863,253 |

210,789,938 |

381,054,651 |

328,070,084 |

439,366,277 |

407,907,151 |

575,274,821 |

|

Kentucky |

123,590,909 |

178,530,045 |

108,422,962 |

80,093,277 |

172,870,288 |

131,940,819 |

162,033,242 |

139,563,454 |

191,247,546 |

|

Louisiana |

68,331,899 |

83,088,229 |

72,164,000 |

60,747,621 |

90,845,057 |

48,019,574 |

62,796,547 |

63,606,089 |

82,553,118 |

|

Maryland |

45,306,196 |

50,812,188 |

38,559,545 |

31,097,326 |

53,705,709 |

40,400,108 |

46,315,825 |

44,469,073 |

60,094,745 |

|

Michigan |

234,848,164 |

371,839,222 |

244,990,716 |

163,535,729 |

251,429,326 |

210,344,330 |

220,921,598 |

193,148,860 |

257,504,272 |

|

Minnesota |

885,222,212 |

1,221,042,237 |

933,955,362 |

800,128,092 |

904,054,061 |

717,176,983 |

914,941,961 |

885,069,741 |

1,166,982,734 |

|

Mississippi |

78,155,567 |

101,277,746 |

96,914,750 |

83,172,665 |

113,730,524 |

62,003,165 |

81,771,138 |

75,972,368 |

88,936,507 |

|

Missouri |

319,344,193 |

433,472,686 |

252,011,429 |

167,657,414 |

394,614,633 |

324,338,887 |

345,841,750 |

351,493,070 |

461,030,916 |

|

Montana |

3,963,329 |

5,461,011 |

4,302,325 |

3,903,555 |

6,172,052 |

4,134,342 |

4,359,079 |

3,657,015 |

4,227,092 |

|

Nebraska |

1,131,439,252 |

1,780,512,900 |

1,093,752,645 |

769,433,157 |

1,183,510,547 |

1,009,979,840 |

1,142,887,072 |

1,036,755,432 |

1,476,573,551 |

|

New Jersey |

7,399,574 |

9,832,301 |

7,917,101 |

5,675,013 |

8,784,081 |

6,828,831 |

7,673,149 |

7,130,398 |

9,280,180 |

|

New Mexico |

9,262,392 |

11,040,395 |

6,732,736 |

4,249,816 |

6,995,717 |

5,833,634 |

5,725,940 |

4,213,708 |

6,194,439 |

|

New York |

70,358,466 |

97,987,909 |

65,464,368 |

49,088,507 |

78,157,306 |

58,498,517 |

61,099,572 |

50,499,487 |

82,986,964 |

|

North Carolina |

73,179,676 |

93,806,799 |

83,858,032 |

60,327,443 |

97,399,608 |

66,335,737 |

99,124,184 |

96,182,364 |

115,582,651 |

|

North Dakota |

145,901,268 |

244,165,538 |

211,819,714 |

188,068,586 |

252,243,472 |

154,252,368 |

249,378,399 |

251,331,038 |

337,701,587 |

|

Ohio |

395,285,758 |

532,541,178 |

389,027,894 |

291,136,919 |

438,183,234 |

349,886,146 |

371,141,487 |

336,596,567 |

507,306,728 |

|

Oklahoma |

30,720,230 |

28,087,532 |

18,851,169 |

20,071,621 |

36,467,789 |

25,106,826 |

27,550,151 |

24,434,706 |

34,779,958 |

|

Oregon |

6,613,170 |

10,977,727 |

9,438,968 |

5,673,628 |

6,437,606 |

4,662,370 |

5,419,768 |

6,689,724 |

8,809,125 |

|

Pennsylvania |

118,367,643 |

113,871,124 |

102,234,370 |

69,218,388 |

109,900,480 |

87,414,811 |

115,186,436 |

80,540,135 |

132,728,790 |

|

South Carolina |

32,508,280 |

31,133,661 |

27,473,147 |

24,617,851 |

33,345,436 |

19,583,992 |

27,078,923 |

33,736,870 |

48,226,270 |

|

South Dakota |

400,942,802 |

642,687,491 |

441,765,029 |

302,477,359 |

546,556,048 |

413,516,664 |

487,981,462 |

438,953,969 |

581,696,212 |

|

Tennessee |

55,989,389 |

90,852,278 |

68,739,959 |

60,981,728 |

94,613,521 |

69,838,802 |

88,230,406 |

76,420,443 |

101,668,979 |

|

Texas |

255,994,777 |

177,625,498 |

191,104,260 |

124,699,352 |

254,132,658 |

187,737,634 |

248,083,790 |

202,104,965 |

249,160,924 |

|

Utah |

2,987,842 |

5,279,754 |

4,660,389 |

3,544,726 |

4,737,436 |

2,707,858 |

3,082,905 |

3,154,730 |

3,770,815 |

|

Virginia |

26,513,235 |

30,892,129 |

30,035,844 |

22,847,459 |

42,559,417 |

29,424,623 |

37,938,164 |

34,109,932 |

46,266,312 |

|

Washington |

23,478,019 |

28,604,105 |

19,790,359 |

13,959,922 |

22,506,659 |

16,940,863 |

16,482,417 |

16,845,031 |

19,591,403 |

|

West Virginia |

2,629,655 |

3,281,350 |

2,973,907 |

2,606,808 |

4,178,937 |

3,102,207 |

3,788,901 |

3,422,775 |

4,800,803 |

|

Wisconsin |

278,715,846 |

457,147,150 |

295,830,851 |

193,495,433 |

267,739,262 |

236,248,123 |

276,702,259 |

261,658,973 |

358,823,588 |

|

Wyoming |

5,444,892 |

7,956,839 |

7,206,404 |

4,817,402 |

6,250,339 |

4,984,076 |

6,471,134 |

6,076,421 |

8,784,582 |

Table 4: NDSU, FAS and ERS Corn Excluding Seed Export Value for North Dakota.

|

Year |

NDSU |

FAS |

ERS |

|

2004 |

157,304,687 |

12,171,791 |

71,136,990 |

|

2005 |

160,848,513 |

4,134,773 |

49,821,539 |

|

2006 |

254,917,151 |

14,886,252 |

94,574,977 |

|

2007 |

383,898,233 |

73,701,411 |

145,898,482 |

|

2008 |

469,903,563 |

182,966,287 |

275,387,915 |

|

2009 |

296,128,345 |

80,522,948 |

168,867,945 |

|

2010 |

396,507,583 |

82,289,805 |

145,901,268 |

|

2011 |

486,941,396 |

59,113,932 |

244,165,538 |

|

2012 |

491,640,383 |

84,033,573 |

211,819,714 |

|

2013 |

260,959,447 |

75,667,677 |

188,068,586 |

|

2014 |

521,351,099 |

27,735,598 |

252,243,472 |

|

2015 |

375,775,531 |

82,134,314 |

154,252,368 |

|

2016 |

547,032,540 |

89,292,071 |

249,378,399 |

|

2017 |

482,727,166 |

69,436,021 |

251,331,038 |

|

2018 |

652,594,412 |

134,183,209 |

337,701,587 |

1 The efficiency concept allows producers to evaluate input resources (cost) to produce output (revenue). The producers’ efficiency will improve through time with adoption of innovative technologies to minimize cost and maximize revenue.