N.D. Cropland Values Down 1 Percent

(Click an image below to view a high-resolution image that can be downloaded)

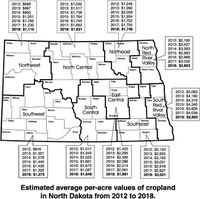

North Dakota land values declined approximately 1 percent, based on the 2018 County Rents and Prices Report survey funded by the North Dakota Department of Trust Lands.

“The survey, conducted in February and March of 2018, contains observations from 2017,” says Bryon Parman, North Dakota State University Extension agricultural finance specialist. He used the county averages to develop the NDSU crop budget regional averages.

Parman notes, “Looking at the central Plains and Corn Belt for reference, Federal Reserve Bank data shows that land values are a bit mixed.”

The Kansas City Federal Reserve Agricultural Credit Survey reports land values down approximately 3 percent in the first quarter of 2018, for irrigated and non-irrigated farmland in Nebraska, Kansas, Oklahoma and parts of Missouri.

However, according to AgLetter, published by the 7th Federal Reserve District in Chicago, in the Corn Belt states of Illinois, Iowa and Indiana, quality farmland values edged up slightly, showing a 1 percent gain in 2017.

In North Dakota, the 1 percent decline continues a slow downward trend for land values statewide that first was seen in the 2015 report and continued through 2017. Values declined 0.57 percent, 3.95 percent and 0.91 percent, respectively, to $1,996 per acre.

“While any single year movement as small as 1 percent could be explained by a slight sampling error or random variation rather than an actual decline, the persistence of negative values indicates that land prices are indeed falling statewide from the nominal peak of $2,123 per acre in 2014,” Parman says.

He continues, “However, while the statewide average change in land values from a year ago may be modest, regional movements are of much greater magnitude.”

The regional average shows that after three consecutive years of declines, the southeastern region had the greatest increase of nearly 7 percent, up to $3,021 per acre. The south-central ($1,648 per acre) and southwestern regions ($1,373 per acre) report land values edging higher at 3.17 and 3.53 percent growth, respectively, after both experienced losses in the 2017 survey. The only other region reporting an appreciation of farmland is the northeastern region, with an increase of 2.4 percent to $1,746 per acre following three consecutive years of declines.

Regions that experienced declining land values are the northwest, north-central, northern Red River valley, southern Red River valley and east-central.

The survey data indicate that for the first time since 2003, the northwestern region experienced a decline in farmland values, falling 9.81 percent from $1,230 to $1,110 per acre. This represents the greatest decline of any region in the state.

Sales data from the 2017 North Dakota Agricultural Land Price and Cash Rent Survey generated by the North Dakota Chapter of the American Society of Farm Managers and Rural Appraisers yields an average decline of 3.1 percent to $1,192 per acre, based on actual sales from 2017 for the northwestern region. Reconciliation of the two numbers may lie in when the actual sales took place, and a relatively lower number of sales and returned surveys in counties representing the northwestern region.

The northern Red River valley also experienced a relatively steep decline, with land values in the region off approximately 6 percent, falling below $3,000 per acre to $2,853 per acre. This marks the fourth year out of the last five in which a decline occurred.

The southern Red River valley declined more modestly, falling 2.18 percent, from $4,038 to $3,950 per acre. Similarly, the north-central region experienced a land value decline of approximately 3 percent, to $1,631 per acre, while the east-central region declined approximately 4 percent to $1,981 per acre.

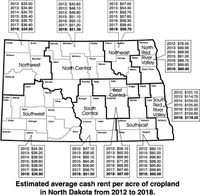

Cash Rents

Relative to land values, cash rents across North Dakota declined much more sharply, with a statewide weighted average rental rate decline of 4.63 percent from $64 to $61 per acre.

Eight out of the nine regions reported declines in rental rates for farmland, with the north-central region steady at $51 per acre.

The south-central region declined 12 percent from $58.70 to $51.50 per acre, which was the greatest decline statewide. However, rents in the neighboring east-central region remained mostly flat, declining from $67.60 to $67 per acre.

Rents in the Red River Valley counties declined 5 percent, with the southern Red River Valley counties falling from $124.60 to $118.20 per acre. Northern Red River valley counties fell 10 percent, from $89.60 to $80.80 per acre.

Rents in the northwestern and southeastern regions declined approximately 5 percent, from $36.40 to $34.50 per acre in the northwest and from $99.80 to $95 per acre in the southeast.

Rental rates in the northeastern region declined less than the statewide average, at 2.93 percent, from $58.40 to $56.70 per acre.

Analysis

“Margins remain slim or negative for farmers across most of North Dakota as production costs resist coming down fast enough to cash flow a significant share of farms across the state,” says Parman.

The 2018 North Dakota enterprise budgets project slim returns for wheat, negative returns for corn and modest returns for soybeans in most regions of the state.

He adds, “Should yields remain at or below average for the state and prices hold, it will likely be a tough year for farmers financially mitigating available funding for new land purchases, and pushing rents and sales values downward.

“Another issue facing farmland values statewide and nationally are interest rates,” he adds. “The Federal Reserve conducted three separate interest rate increases in 2017, one in March of 2018, and it is expected there will be a rate increase in June of 2018. Insiders also anticipate one or two more rate increases before the end of 2018.”

Other outlets, as well as NDSU, have highlighted how interest rates affect borrowing power and production costs (profitability), putting downward pressure on farmland. The direct impact on farmland values from rate hikes comes from higher rates paid on operating loans and higher rates on funds borrowed for new land purchases. These two factors reduce credit worthiness and limit potential buyers from entering the land market.

Rising interest rates put additional downward pressure on farmland as outside investment opportunities begin to look more favorable. While the bulk of farmland is purchased by farmers, a sizable share is purchased by investors.

Parman concludes, “The exact proportions of land purchased by investors versus traditional farmers is difficult to discern. However, even if as little as 10 to 15 percent is investor-purchased, should they look to sell, or at least no longer view farmland as a favorable investment, it’s likely to have a significant impact on land moving forward. Especially if bond yields rise much faster than capitalization on farmland, investors will most likely look at investments in other markets yielding better returns.”

NDSU Agriculture Communication – June 8, 2018

| Source: | Bryon Parman, 701-231-8248, bryon.parman@ndsu.edu |

|---|---|

| Editor: | Kelli Anderson, 701-231-6136, kelli.c.anderson@ndsu.edu |

Attachments

- PDF - Estimated average cash rent per acre of cropland in North Dakota from 2012 to 2018 - (405.689453125 kb)

- EPS - Estimated average cash rent per acre of cropland in North Dakota from 2012 to 2018 - (1302.912109375 kb)

- EPS - Estimated average per-acre values of cropland in North Dakota from 2012 to 2018. - (1300.833984375 kb)

- PDF - Estimated average per-acre values of cropland in North Dakota from 2012 to 2018. - (405.9208984375 kb)