N.D. Sees Very Large Increase in Land Values

(Click an image below to view a high-resolution image that can be downloaded)

North Dakota cropland values increased by about 42 percent during 2012, according to Andrew Swenson, North Dakota State University Extension Service farm management specialist.

His estimate is derived from the published results of a January 2013 county-level survey commissioned by the North Dakota Department of Trust Lands. The 42 percent increase is similar to the 46 percent increase reported by the North Dakota Chapter of the American Society of Farm Managers and Rural Appraisers.

“The question is whether this huge increase has capped a 10-year rise in land values, which has been the largest in the past 100 years, even exceeding what occurred from 1973 to 1981,” Swenson says. “North Dakota cropland values are now the highest ever, even when adjusting for inflation.”

The drivers that have pushed land values have been well-documented. Grain prices from 2007 to the present have been much higher than any year prior to 2007. Also, yields generally have been strong. For example, the three highest wheat yields ever have occurred within the past four years. This combination has provided several years of strong profit for crop producers, which has fueled their financial ability and desire to buy land.

Swenson believes 2012 was the apex in North Dakota crop production profit because stored soil moisture provided much better yields than expected. At the same time, prices soared due to a drought in the Corn Belt.

A factor that has been just as important in driving land values has been low interest rates. Interest rates to finance land purchases are attractive, while returns and confidence on alternative investments have been weak.

Ten years ago, an acceptable return on land investment (cash rent minus real estate taxes divided by land value) was about 6 percent. Now it is about 3 percent. If buyers insisted on a return of just one percentage point more, to 4 percent, land values would have to drop by one-fourth, assuming constant cash rents and real estate taxes.

If a general rise in interest rates occurs, being able to cash flow land purchases with debt capital becomes more difficult. Also, certain fixed-return investments may become more attractive relative to investing in land.

“This perfect storm of high crop prices and yields and low interest rates driving land values higher will not continue indefinitely,” Swenson says. “In fact, there are strong indications that 2013 crop prices will be significantly lower than in 2012. In addition, government subsidies for agriculture are expected to diminish, if not in 2013, then most certainly in 2014.”

For example, direct payments average about $10 per cropland acre in North Dakota. If they are eliminated, the eventual impact on average land values could be a reduction of $200 to $300 per acre.

However, Swenson does not expect an immediate sharp drop in land values, even if crop prices, yields and/or interest rates turn somewhat less favorable.

“Obviously there has been very strong interest in land,” Swenson says. “Many producers and investors have the financial wherewithal to bid on land, which will tend to underpin land values. After the strong increase in land prices, any softening could be seen as a buying opportunity.”

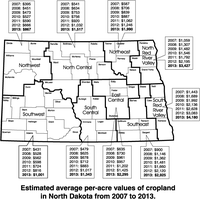

The largest increase in cropland values (January 2012 to January 2013) was about 60 percent in the east-central region (to $2,295 per acre) and the northeastern region (to $1,990), followed by increases of 56 percent (to $3,427) in the northern Red River Valley and 47 percent in the north- central region (to $1,517). There was a 30 to 40 percent increase for the northwestern region (to $867), south-central (to $1,343), southern Red River Valley (to $4,180) and southeastern region (to $2,925). The smallest increase per acre, about 23 percent, occurred in the southwestern region (to $1,001).

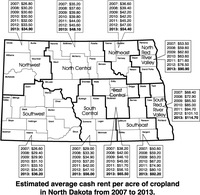

“The survey indicates that land rents, as typical, did not change as much in percentage as land values,” Swenson says. “On average, cropland rents increased about 12 percent, which was a very strong increase from a historical perspective.”

The largest increases in land rent, nearly 19 percent, occurred in the south-central region (to $56 per acre) and the northern Red River Valley region (to $90.90). The average rent increased 17 percent (to $65.50 per acre) in the east-central region. Cropland rents increased about 15 percent in the northeastern region (to $54.40) and the southeastern region (to $92.20) and increased 14 percent in the southern Red River Valley (to $114.70). The smallest increase in land rent rates, 4 to 5 percent, occurred in the northwestern region (to $34.90), north-central region (to $48.10) and southwestern region (to $36.20).

Swenson cautions that the values and rents are averages for large multicounty regions. Prices can vary considerably within a region because of soil types, drainage and location.

NDSU Agriculture Communication – April 3, 2013

| Source: | Andrew Swenson, (701) 231-7379, andrew.swenson@ndsu.edu |

|---|---|

| Editor: | Rich Mattern, (701) 231-6136, richard.mattern@ndsu.edu |

Attachments

- PDF - Estimated average cash rent per acre of cropland in North Dakota from 2007 to 2013 - (55.630859375 kb)

- EPS - Estimated average cash rent per acre of cropland in North Dakota from 2007 to 2013 - (2877.8603515625 kb)

- PDF - Estimated average per-acre values of cropland in North Dakota from 2007 to 2013 - (55.7763671875 kb)

- EPS - Estimated average per-acre values of cropland in North Dakota from 2007 to 2013 - (2742.896484375 kb)