N.D. Cropland Values Leveling Off

(Click an image below to view a high-resolution image that can be downloaded)

A recent survey indicates that North Dakota cropland values increased about 5 percent from January 2009 to January 2010.

“This indicates a noticeable slowdown or leveling of land values when compared with the average annual increase of more than 12 percent during the previous six years,” says Andrew Swenson, North Dakota State University Extension Service farm management specialist.

Swenson bases his calculations on surveys conducted in January by the North Dakota Agricultural Statistics Service. When reporting the land survey results last year, Swenson observed that these were historic times for land values.

“There only were two periods during the past 100 years that have had longer periods of continuous, strong increases in land values,” Swenson says. “There was an eight-year period (1942 through 1949) with an average annual increase of 10 percent and a nine-year period (1973 through 1981) that averaged a whopping 18 percent annual increase.”

Swenson expects a further leveling of land values next year.

The biggest negative is that projected crop profitability for 2010 is the most challenging in several years. Some other important factors include interest rates, farm balance sheets (ability to purchase land) and the general economy. However, the largest wild card remains grain prices that affect crop profitability.

“Low interest rates are a positive factor,” Swenson says. “Interest rates to finance land purchases are attractive, while returns and confidence on alternative investments have been weak. If there is a general rise in interest rates, it will make it more difficult for producers to cash flow land purchases with debt capital and make the returns on certain fixed return investments more competitive with investments in land.”

Although there was a substantial decrease in farm profit for 2009, most crop producers had two outstanding years in 2007 and 2008. Therefore, many producers have the financial wherewithal to bid on land, which will tend to underpin land values. After the strong run in land prices the past several years, any softening could be seen as a buying opportunity.

“Similar to last year, the timing may be opportune for those who have a desire or need to sell their land,” Swenson says. “Prices are at historic highs, the rent-to-land value ratio is historically low and capital gains tax rates are attractive.”

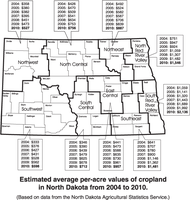

The largest increase in cropland values was in the northwestern region at 11 percent ($527 per acre), followed by increases around 9 percent in the southeastern part of the state ($1,481 per acre) and 7 percent in the southern Red River Valley ($2,136 per acre). Increases in the southwestern, northeastern, south-central and northern Red River Valley regions ranged from 6.5 percent to 4 percent at $598, $887, $712 and $1,546 per acre, respectively. Cropland values were flat in the north-central and east-central regions at $756 and $957 per acre, respectively.

“The big increase in the northwestern region was not surprising because the region had very strong yields in 2009 and land values had been lagging compared with other regions,” Swenson says. “This region had the smallest total increase (60 percent) from the 2003 survey.”

During this same seven-year period, land values in the southeastern region nearly tripled and those in the east-central region increased 2 1/2 times. The total increase in values for the north-central region was 84 percent and about 100 percent to 125 percent higher for the other five regions.

“Land rents tend to be stickier than land values and are slower to move up and slower to move down,” Swenson says. “For example, during the six years prior to the current survey, cropland values increased by an average annual rate of 12 percent, while rents increased by 5 percent. During the last land crash, from the 1981-82 peak to the 1987-88 trough, the total drop in cropland values was about 40 percent, but land rents only declined 15 percent.”

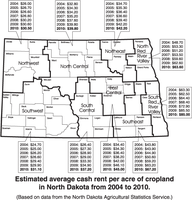

Cropland rents (January 2009 to January 2010) increased less than 2 percent on average. This was down from the prior year’s strong increase of 7 percent. The rate increases in cropland rents per acre were the highest, 6 percent to 7 percent, in the southeastern region to $67.20 and the south-central region to $37.20.

Cropland rents increased 4 percent in the southwestern region to $31.10 and 2 percent in the northern Red River Valley to $63.60 per acre. Cash rents were flat in the southern Red River Valley and the northeastern, north-central and northwestern regions at $85, $42.20, $39.80 and $30.50, respectively. The survey indicated a 2 percent decline to $45 for cropland rent in the east-central region.

Swenson cautions that the values and rents are averages for large multicounty regions. Prices can vary considerably within a region.

NDSU Agriculture Communication

| Source: | Andrew Swenson, (701) 231-7379, andrew.swenson@ndsu.edu |

|---|---|

| Editor: | Rich Mattern, (701) 231-6136, richard.mattern@ndsu.edu |

Attachments

- PDF - Estimated average cash rent per acre of cropland in North Dakota from 2004 to 2010 - (26.484375 kb)

- EPS - Estimated average cash rent per acre of cropland in North Dakota from 2004 to 2010 - (3104.8681640625 kb)

- PDF - Estimated average per-acre values of cropland in North Dakota from 2004 to 2010 - (26.5947265625 kb)

- EPS - Estimated average per-acre values of cropland in North Dakota from 2004 to 2010 - (2859.1357421875 kb)