Spotlight on Economics: Genetically Modified Wheat Status, Outlook and Implications

(Click an image below to view a high-resolution image that can be downloaded)

By William W. Wilson, University Distinguished Professor

NDSU Agribusiness and Applied Economics Department

Wheat is one of the world's largest acreage food crops, but it has not been a recipient of the new genetically modified (GM) technologies that have benefited corn, soybeans, canola and cotton.

Compared with these crops, wheat has been losing its competitiveness for a number of reasons. The areas planted to wheat in the U.S. have declined by 30 to 40 percent since the mid-1980s.

Similar pressures exist in Canada which during the same period, canola acreage has increased, so it now exceeds wheat acres. There also have been important geographical shifts in the composition of crops planted in these countries. Generally, the smaller wheat acreage has been matched with a gradual shift to more northern and western dry areas.

Since 1996, a number of GM traits have been introduced in competing crops. For corn, Roundup Ready (RR), Bacillus thuringiensis (BT) and several other traits have been developed and widely adopted. Some of these are now stacked in multiples of three or four traits in a single variety.

Looking forward, a large number of traits are under development and expected to be commercialized in the next 10 or more years. For corn, there are at least 21 new GM traits under development that are a mix of producer-, consumer- and processor-wanted traits. Some of these traits are developed individually and some through joint initiatives. A comparable number and composition of traits is under development for soybeans.

Following a number of years in which wheat acres declined in North America and mostly shifted to corn, soybeans, canola and cotton, a number of events unfolded that helped spawn the recent interest in GM wheat.

One was an international trilateral agreement among grower groups supporting the development of GM wheat. The other was the sharp escalation of crop prices during 2008. This precipitated concerns by end users about the longer-term supplies and competitiveness of wheat.

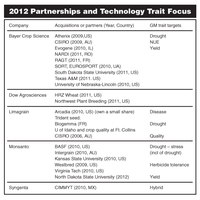

In 2009, Monsanto was the first to announce its intent to expand into GM wheat. This was followed within months by announcements to do the same by BASF, Bayer Crops Sciences, Limagrain and Dow AgroSciences. Each of these companies is following work that already had been initiated in Australia by the Victoria Agrobiosciences Center and CSIRO.

Indeed, much of the initial and early work was done in Australia, where the initial focus was on drought. This is in addition to the almost simultaneous development of initiatives on GM wheat in China. These firms and organizations have been pursuing varying strategies, including acquiring germplasm and creating public-private partnerships. In addition, to varying degrees, each has made claims about the traits it intends to develop using genetic modification.

Each of the major firms has sought varying forms of alliances, acquisitions or partnerships to achieve technology improvement goals. The GM traits that are most commonly being developed are yield, drought tolerance and nitrogen use efficiency.

The criteria for selecting these traits are not exactly clear. Most likely, these choices are a result of experiences with other crops, evidence related to current plant stressors, anticipated changing geography of production and concerns of future water availability and cost.

Against this acceleration of research in wheat breeding technology, there are a number of important issues. One is consumer acceptance. Generally, consumers in North America are less averse to GM content than other countries. In part, this is due to greater confidence in the underlying regulatory mechanisms. In some other countries, notably the European Union and Japan, there is a greater aversion to GM content as reflected partly in their regulatory regimes.

Looking forward, one would expect a more highly differentiated market for wheat products for those that are nonaverse to GM content, averse to GM content and those seeking organic produce.

Ultimately, this means that the commercialization of GM wheat will require fairly elaborate segregation systems. While achievable, segregation will need to be initiated by buyers through contractual requirements. If so, the markets can be effective at segregation and at reasonable costs, although the costs will vary across market segments and participants.

Another major issue confronting wheat is that most of the germplasm is or has been under the control of the public sector. Therefore, as biotechnology companies seek to expand and pursue “seeds and traits” strategies, they will need to develop varying forms of public-private partnerships

The values of these traits provide encouragement for further development. However, the values in wheat traits are not as great as in other crops, which means that any variety of wheat likely would need a combination of stacked traits to be commercially acceptable.

NDSU Agriculture Communication – Dec. 19, 2012

| Source: | Bill Wilson, (701) 231-7472, william.wilson@ndsu.edu |

|---|---|

| Editor: | Rich Mattern, (701) 231-6136, richard.mattern@ndsu.edu |