Spotlight on Economics: Are Farm Policy and Trade Important for N.D. Agriculture?

(Click an image below to view a high-resolution image that can be downloaded)

By Saleem Shaik, Associate Professor NDSU Agribusiness and Applied Economics Department

I recently became the director of the Center for Agricultural Policy and Trade Studies that is housed in the Department of Agribusiness and Applied Economics at North Dakota State University. We are engaged in studies related to evaluating the importance of farm policy and trade.

I want to draw your attention to the importance of farm policy and trade (exports) to North Dakota agriculture.

What drives Supply and Demand?

As economists, we try to understand the two main arteries of any sector, including agriculture: the supply of agriculture commodity production and the demand for these products.

What is driving the supply of agriculture commodity production? It is the technological innovations related to input resources, including the recent seed technology, and the use of global positioning systems to enhance efficient production.

The technological innovations help to increase production or supply of agriculture commodities efficiently, while farm policy helps farmers when they are faced with random and unknown risks. Farm policy and associated farm programs are introduced as part of omnibus farm bills approximately every five years. These bills including commodity and conservation programs and, most importantly, crop insurance to support growth in the supply of agriculture commodity production.

Discussions about the next farm bill are round the corner. The primary concern includes: are current farm programs including crop insurance really providing protection to producers against unknown and random risk in the short and long run? The discussions should revolve around an integrated approach involving production risk, price/marketing risk, financial risk, institutional or policy risk, trade risk and household risk rather than a piece meal approach of addressing one or two risks independently.

An integrated farm policy along with technological innovations will not only increase the supply or production of agriculture but also reduce the risk or variability in the supply or production of agriculture.

Does a demand for our agriculture commodities exist? If yes, is it domestic demand, or do we have international demand for our agricultural products (exports and/or trade)? Trade is mostly accomplished via the World Trade Organization; however, we have seen an increase in bilateral trade agreements and regional trade agreements, including the North American Free Trade Agreement, Central America Free Trade Agreement and, more recently, the Trans-Pacific Partnership, Transatlantic Trade and Investment Partnership and Trade in Services Agreement.

With increased emphasis on trade, evaluating the demand for agricultural commodity production, especially the importance of trade (exports) to North Dakota agriculture, is a good idea.

So let us take a look at the importance of farm policy, along with associated farm programs and trade to North Dakota agriculture production.

What is Farm Policy?

A farm bill refers to a multiyear, multicommodity federal support law for farm products. Two permanent laws, the Agricultural Adjustment Act of 1938 and the Agricultural Act of 1949, provide some standing authority for these programs. However, Congress usually amends these provisions, reauthorizes or amends provisions of preceding temporary agricultural acts, and/or puts forth new provisions for a limited time into the future during the farm bill authorization process. Fifteen versions of the farm bills have been enacted since 1938. If you are interested to look at the evolution of farm payments across farm bill periods, take a look at the appendix of a recent paper: Role of Public Policy on Farm Real Estate Values.

Before we look at the importance of farm programs and trade (exports) to our state, let us look at the growth in value of agricultural sector production.

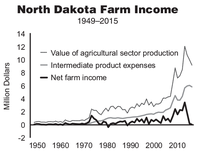

The value of North Dakota’s agricultural sector production grew from 494 million in 1949 to $9.167 billion in 2015, with a peak of $12.02 billion in 2012. The value of North Dakota crop production showed a negative growth rate of minus 20.74, minus 10.91 and minus 8.34 in 2013, 2014 and 2015, respectively. However, the rate of the value of North Dakota livestock production showed a growth of minus 2.29, 20 and 0.09, respectively, in the last three years.

To stabilize the value of agricultural production, are commodity and crop insurance programs contributing to North Dakota agriculture?

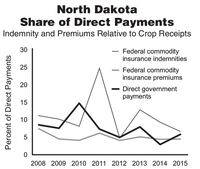

Based on the share of commodity payments and crop insurance indemnities relative to crop receipts, it ranged from 8.51 percent for commodity payments and 11.05 percent for crop insurance in 2008 to 5.88 percent for commodity payments and 6.68 percent for crop insurance in 2015. However, in 2011, the share of commodity payments was 7.35 percent and crop insurance indemnities was 24.17. Because we do not have the payments by commodity, stating the neutrality of farm policy is difficult.

What is Agricultural Trade?

According to economists, trade is the ability to undertake economic transactions between countries free from any restraints imposed by governments or other regulators. Trade is measured by the volume of imports and exports. The primary driver of trade, according to economists, is explained by the theory of comparative advantage. However, trade also has attracted critics based on the trade patterns and the efficient or inefficient use of resources.

Prior to looking at the importance of trade (exports) to North Dakota agriculture, let us take a look at global and U.S. total exports of agricultural commodities.

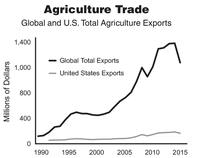

The global agricultural commodity trade increased from $152 billion in 1991 to $1.11 trillion in 2015. In contrast, the U.S. agricultural commodity trade increased from $40 billion in 1991 to $137 billion in 2015. If you compare the share of U.S. trade relative to the world, it was 29.2 percent in 1991 and reduced to 13.7 percent in 2015. Individual commodities such as corn, soybeans and wheat show similar trends. Comparison between U.S. and North Dakota total agricultural commodity trade in 2015 indicates the exports from North Dakota amounted to $903 million, compared with $137 billion. With respect to corn and wheat exports of North Dakota relative to the U.S., the shares in 2015 are the same as in 2008. However, the share of soybeans exports has declined.

Let us take a look at the share of North Dakota exports relative to the crop receipts. The share of corn exports relative to corn cash receipts was 27.73 percent in 2008, and it fell to 19.22 percent in 2015. The soybean export share relative to soybean cash receipts declined marginally from 59.59 percent in 2008 to 53.65 percent in 2015. Wheat showed a steep decline from 77.28 percent in 2008 to 57.59 percent in 2015.

To summarize, farm policy and trade do play a role in North Dakota’s agricultural production supply and demand.

Now, let’s talk about the real-world application of linking commodity and crop insurance payments to land values.

A recent paper I wrote, Role of Public Policy on Farm Real Estate Values, shows the results of an investigation on the contribution of commodity and crop insurance payments to agriculture land values. The paper also evaluates the importance of the U.S. president, Senate, House of Representatives and state governors on land values, commodity programs and crop insurance in the lower 48 states from 1948 to 2014.

The investigation found that the majority in the Senate and House played a statistically significant role in explaining expected farm program and crop insurance program payments and farm real estate values in the U.S. from 1948 to 2010.

However, governors did not play a statistically significant role in explaining expected farm and crop insurance program payments and farm real estate values, but the president played a significant role in explaining expected farm program payments and farm real estate values.

The results of the study suggest a positive contribution of expected farm crop returns, and farm and crop insurance program payments to farm real estate values. Based on the data, the average contribution of farm and crop insurance program payments was 15 and 8.88 percent, respectively.

Given the results of this study, the substantial cost reductions in the farm and crop insurance program payments likely will lead to disproportionate effects on farm real estate values. The study also indicates a negative and positive sign on the expected farm crop returns variable in the farm and crop insurance program payments equations, respectively.

This suggests the perceived counter-cyclic nature of expected crop insurance program payments (expected farm program payments) and farm returns is not consistent with the intent of the federal programs. This could be due to the intent of the different types of farm programs and crop insurance programs and the overlapping of the two programs to cover similar risks.

Finally, the results do not quantify changes in the share of contribution of farm and crop insurance program payments to the value of land through time and across regions. This would be a potentially valuable and fruitful research topic.

NDSU Agriculture Communication - Oct. 6, 2016

| Source: | Saleem Shaik, 701- 231-7459, saleem.shaik@ndsu.edu |

|---|---|

| Editor: | Kelli Armbruster, 701-231-6136, kelli.armbruster@ndsu.edu |